Top 15 Most Active Crypto VC Funds for 2025 Investors

Curious about which venture capital firms are leading the charge in the crypto space for 2025? In this article, we’ll explore the 15 most active crypto VC funds, including the MOS active crypto VC funds, that are pivotal in driving blockchain innovation. Learn about these key players, their investment strategies, and how they are shaping the future of the cryptocurrency market.

Key Takeaways

- Crypto venture capital firms play a crucial role in supporting early-stage blockchain startups through various funding stages, from initial seed funding to growth and late-stage investments.

- In 2025, the crypto VC landscape is marked by significant investments in decentralized finance (DeFi) and non-fungible tokens (NFTs), with emphasis on regulatory compliance and increased institutional participation.

- The rigorous evaluation process conducted by VC firms involves comprehensive due diligence and relies on strong networks and partnerships to foster innovation and support growth in the crypto ecosystem.

Understanding Crypto Venture Capital Firms

Crypto venture capital firms are a group of investors pooling together funds to invest early in promising blockchain projects. Unlike traditional hedge funds, these venture funds focus specifically on the cryptocurrency space, seeking to multiply their investments by backing innovative startups and technologies. A crypto vc firm plays a crucial role in investing in early-stage blockchain projects, helping to nurture innovation and financial inclusion within the digital asset ecosystem. The process involves meticulous due diligence, funding stages, and strategic exit strategies, ensuring that the capital is deployed effectively and yields substantial returns.

These firms are pivotal in the crypto ecosystem, providing the necessary capital to early-stage companies and driving innovation in the blockchain sector. Crypto venture capital firms gather funds from private and institutional investors to support a range of projects, from initial concepts to fully operational businesses. For example, a company in its early development phase may receive funding to accelerate its growth and market entry. This support plays a vital role in the growth of early-stage blockchain startups. This support is crucial for their overall success.

Understanding the various stages of funding helps in grasping how venture capital firms operate. These stages include early-stage funding, growth stage investments, and late-stage funding, each with its unique characteristics and focus areas. The early stages are particularly important for nurturing startups from inception to growth. These stages contribute significantly to the development of the crypto industry.

By supporting innovation and collaboration among developers, entrepreneurs, and users, these firms contribute to the growth and strength of the blockchain community.

Early Stage Funding

The journey of a crypto startup often begins in the pre-seed phase, where entrepreneurs seek initial support from personal connections, such as family and friends. This earliest stages is vital for forming ideas and validating concepts, laying the foundation for future growth.

Venture capital firms step in during the seed funding round, where the focus shifts to presenting a minimum viable product (MVP) to attract potential investors. The MVP demonstrates the project’s fund feasibility and potential.

During the seed round, detailed analyses presented to investors to secure funding include:

- Competitor analysis

- Market analysis

- Pitch decks

- Cash flow projections

Early-stage companies often rely heavily on the continued support of crypto VC firms to navigate the initial hurdles and achieve sustainable growth. Notably, a substantial portion of deals in Q1 2025 involved early-stage companies, underscoring the importance of this phase in the investment landscape.

Firms like Kenetic Capital are known for their focus on pre-seed and early-stage projects, provide capital and strategic guidance needed to transform innovative ideas into viable businesses. Investing early helps these firms not only aid startups in gaining traction but also positions them to reap significant returns as the projects mature.

Growth Stage Investments

As startups progress, they enter the growth stage, where the focus is on scaling operations and expanding the business. Series A funding typically centers on enhancing marketing efforts and brand development to reach a broader audience. This stage is crucial for startups to establish a strong market presence, gain traction, and build a loyal customer base.

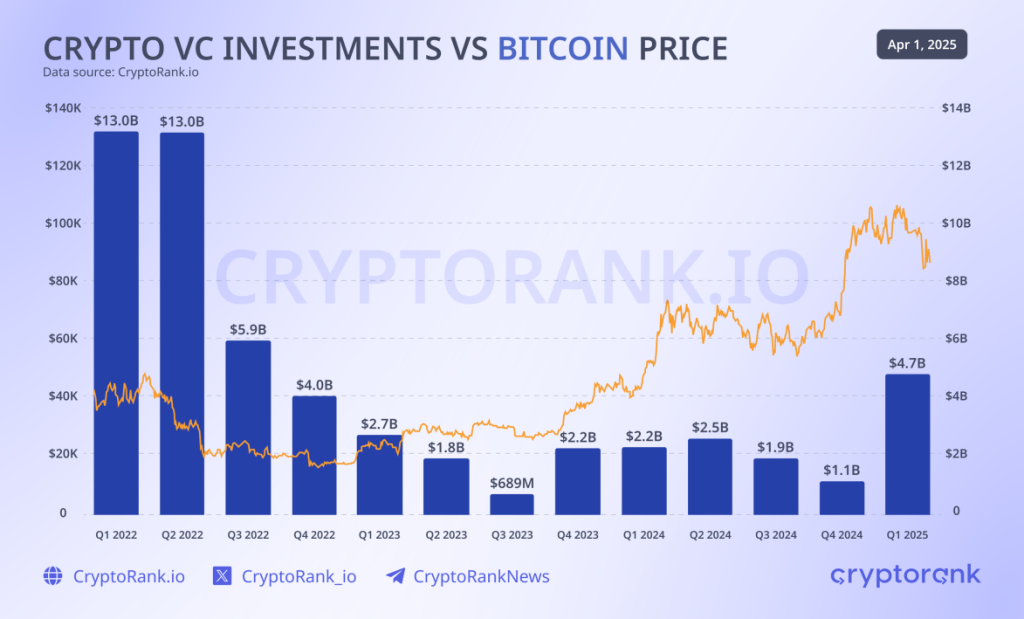

Series B funding, on the other hand, is geared towards significant growth in areas like sales, human resources, and product development. In Q1 2025, blockchain and crypto startups raised an impressive $4.8 billion, marking a significant recovery in funding and highlighting the potential for substantial growth in this sector. These investments are vital for startups to transition from promising ventures to established market players.

Late Stage Funding

Late-stage funding, including Series C and beyond, signals a company’s commercial success and its need for further expansion or diversification. At this stage, the focus is on scaling operations to new heights, entering new markets, and possibly preparing for an Initial Public Offering (IPO). In Q1 2025, most crypto VC investments for later-stage companies focused on DeFi, trading platforms, and mining operations, reflecting the high-growth potential of these sectors.

Startups that reach this stage benefit immensely from the mentorship and strategic guidance provided by venture capital firms. Such support can be a game-changer, helping companies navigate complex market dynamics and achieve long-term success.

The collaboration between VC firms and startups at this stage is crucial for driving innovation and maintaining a competitive edge in the fast-evolving crypto industry.

Investment Strategies of Crypto VC Funds

Crypto VC funds utilize a range of investment strategies to navigate the ever-evolving crypto market. One of the most common approaches is diversification—spreading investments across various asset classes, including cryptocurrencies, tokens, and equity stakes in blockchain companies. This helps manage risk and capture opportunities in different segments of the crypto ecosystem.

Many crypto VC funds specialize in seed funding and early-stage investments, backing startups with innovative ideas and strong growth potential. By investing early, these funds can support projects from inception and benefit from their long-term success. Others focus on later-stage investments, providing capital to companies that have already demonstrated product-market fit and are ready to scale.

Active participation is another hallmark of leading crypto VC funds. Rather than being passive investors, these firms often engage directly with the projects they back—offering strategic guidance, leveraging their networks, and sometimes participating in project governance. This hands-on approach can accelerate growth and ensure that investments align with the fund’s vision for the future of decentralized finance and blockchain infrastructure.

Additionally, many crypto VC funds prioritize projects that are building the foundational layers of the crypto ecosystem, such as DeFi protocols and blockchain infrastructure solutions. By supporting these critical areas, funds help drive the overall maturity and resilience of the crypto industry, positioning themselves and their portfolio companies for long-term success.

Blockchain Infrastructure: The Foundation of Crypto Investments

Blockchain infrastructure forms the essential backbone of the crypto industry, enabling the secure creation, transfer, and storage of digital assets. Recognizing its pivotal role, crypto VC funds are increasingly directing investments toward companies that build and enhance this infrastructure—such as exchanges, wallets, payment processors, and security solutions.

A robust blockchain infrastructure is vital for the continued growth and adoption of cryptocurrencies. It not only supports the seamless operation of digital assets but also instills confidence among institutional investors and everyday users. By investing in projects that focus on scalability, security, and user experience, crypto VC funds help lay the groundwork for a more reliable and accessible crypto ecosystem.

These infrastructure investments are crucial for the expansion of the crypto sector, as they enable new applications and services to flourish. As the industry matures, the demand for advanced infrastructure will only increase, making this a key area of focus for both funds and investors looking to capitalize on the long-term potential of the crypto market.

Top 15 Most Active Crypto VC Funds in 2025

In 2025, the crypto market continues to thrive, and a total capital of $1.9 billion has been allocated to crypto-focused venture funds. These funds are instrumental in fostering innovation and supporting the growth of blockchain projects. Despite various challenges, the investment levels in new blockchain projects have remained elevated, indicating resilience and ongoing confidence in the cryptocurrency market.

The top crypto VC funds for 2025 include notable firms such as Pantera Capital, Andreessen Horowitz (a16z), Digital Currency Group, and Ribbit Capital. Ribbit Capital is recognized for its influence on large fundraises in the crypto venture capital space. These firms invest in a diverse array of projects, including blockchain infrastructures, exchanges, decentralized finance (DeFi) platforms, and non-fungible tokens (NFTs) through a crypto fund.

Several of these firms have a long standing reputation for successful investments in the crypto industry, which underscores their reliability and expertise.

Here’s an overview of each of these leading venture capital firms and their contributions to the crypto ecosystem.

Pantera Capital

Pantera Capital, based in Menlo Park, California, is recognized as the first institutional asset manager in the US focusing solely on blockchain. They invest in a wide range of blockchain projects and tokens, aiming to drive industry adoption through strategic funding and support.

With a strong emphasis on institutional investors, Pantera Capital has positioned itself as a key player in the crypto venture capital landscape.

Andreessen Horowitz (a16z)

Andreessen Horowitz, also known as a16z, has been actively funding blockchain firms for over five years, establishing itself as a powerhouse in the crypto venture capital space. Their investment arm focuses on identifying and nurturing high-potential crypto startups, providing the necessary capital and strategic guidance to ensure their success.

Paradigm

Paradigm, founded by Matt Huang and Fred Ehrsam, invests in a variety of blockchain-related projects, leveraging their deep industry knowledge and strategic insights. Their diverse portfolio includes innovative projects that span across different sectors of the blockchain industry, driving growth and innovation.

Coinbase Ventures

Coinbase Ventures focuses on early-stage crypto projects and startups, aiming to provide funding and promote the blockchain industry. By investing in promising blockchain-based projects, they help foster innovation and drive the growth of the crypto ecosystem.

Digital Currency Group

Digital Currency Group (DCG), headquartered in New York, has a significant global footprint, having invested in more than 30 countries. They focus on early-stage companies in the blockchain sector, believing that blockchain technology will drive social and economic change. Their investments span a wide range of projects, from blockchain infrastructure to decentralized finance.

Blockchain Capital

Blockchain Capital is recognized as a significant investor in the cryptocurrency industry, with over 90 crypto companies in its portfolio since its inception. Their extensive investment history highlights their commitment to fostering innovation and growth in the crypto space.

Polychain Capital

Polychain Capital, a leading venture capital firm in the cryptocurrency industry, focuses on identifying and investing in high-potential cryptocurrency projects. Their investment focus positions them to capitalize on innovative blockchain technologies and emerging trends in the crypto market.

Binance Labs

Binance Labs is dedicated to supporting crypto projects and promoting crypto adoption by providing funding and strategic support to entrepreneurs. In Q1 2025, over 40% of Binance Labs’ capital was tied to significant strategic deals, highlighting their impactful role in the crypto ecosystem.

Draper VC

Draper VC specializes in recognizing and investing in transformative blockchain technologies and startups. Their portfolio includes a significant number of blockchain and crypto-based projects, reflecting their commitment to driving innovation in the industry, including delphi ventures.

Three Arrows Capital

Founded by Kyle Davies and Su Zhu in 2012, Three Arrows Capital primarily invests in DeFi and GameFi projects. Notable investments include Aave and Axie Infinity, as well as significant blockchain projects like Polkadot, Ethereum, Avalanche, and Solana.

NGC Ventures

NGC Ventures focuses on investing in blockchain technologies and big data, operating across multiple global locations, primarily in Asia and North America. Their global investment strategy targets innovative sectors in the blockchain industry, helping companies grow based on regional specificities.

Animoca Brands

Animoca Brands focuses on investing in emerging technologies within the gaming industry, leading investments in areas such as NFTs, GameFi, and the Metaverse. Their strategic investments in these sectors highlight their role in driving innovation and growth in the crypto market.

Sequoia Capital

Sequoia Capital, located in Menlo Park, California, is a prominent venture capital firm known for its investments in promising blockchain startups. Their investment arm provides the necessary capital and strategic guidance to foster the growth of innovative crypto projects.

Multicoin Capital

Multicoin Capital supports innovations in decentralized institutions through its investments, focusing on seed funding and bringing cutting-edge technologies to the masses. Based in Austin, Texas, they play a crucial role in driving the growth and adoption of blockchain technologies.

Key Trends in Crypto VC Investments

The landscape of crypto VC investments in 2025 is shaped by several key trends that are driving innovation and growth:

- Significant focus on decentralized finance (DeFi) and non-fungible tokens (NFTs), seen as transformative technologies with the potential to disrupt traditional financial systems.

- Growing emphasis on regulatory compliance.

- Increased institutional investment.

- Expansion into new markets, indicating a maturing industry adapting to new challenges and opportunities. Regulatory support and governmental policies in these regions are fostering blockchain adoption, especially in emerging markets, by encouraging financial inclusion and technological development.

In Q1 2025, 65% of capital investment went to later-stage deals, reflecting a strong interest in established projects that are poised for significant growth. Major investors are also focusing on sectors like trading, infrastructure, tokenization, payments, and artificial intelligence, which are expected to drive the next wave of innovation in the crypto space through recent investments.

These key trends significantly impact the crypto VC landscape.

Regulatory Compliance

Regulatory compliance has become a critical focus for crypto venture capital firms, as it reduces investment risks and enhances the legitimacy of blockchain projects. Emphasizing regulatory compliance helps these firms mitigate risks and build trust with institutional investors and the broader market.

Clearer regulatory frameworks positively influence investment activity and foster institutional confidence, contributing to the long-term success of blockchain technology.

Institutional Investment

Institutional investors are increasingly participating in the crypto market, reshaping its landscape and driving significant growth. In Q1 2025, over 40% of capital invested in the crypto market was attributed to a significant strategic investment in Binance, highlighting the growing influence of institutional asset managers.

Despite challenges, the total capital invested in crypto startups is showing signs of recovery, indicating a strong asset management performance and potential for future growth.

Focus on DeFi and NFTs

In 2025, decentralized finance (DeFi) has become a significant interest for venture capital firms. This is largely because of its potential to disrupt traditional financial systems and develop innovative products. In the last quarter, investment in DeFi protocols projects remained robust, with protocols raising $763 million.

Alongside DeFi, NFTs and Web3 projects are gaining traction as they provide decentralized, user-centric solutions in the digital economy. These sectors represent significant investment opportunities for crypto funds looking to capitalize on the next wave of innovation.

Expansion into New Markets

Crypto VC firms are increasingly focusing on emerging markets to leverage growth opportunities and enhance financial inclusion. By investing in developing markets, these firms help areas that have been previously underserved by traditional financial systems.

NGC Ventures, for example, operates across multiple global locations, focusing on blockchain project growth and expanding their global presence. This trend is crucial for fostering a dynamic and inclusive crypto ecosystem.

Market Analysis: The State of Crypto VC in 2025

The crypto VC landscape in 2025 is marked by both significant growth and evolving challenges. Despite ongoing volatility in the crypto market, venture capital investment in crypto startups has surged, with more funding rounds and a higher number of deals than in previous years. This growth is particularly evident in the increased capital flowing into later-stage projects, as investors seek out companies with proven track records and scalable business models.

A major trend shaping the market is the strong interest in DeFi protocols and blockchain infrastructure projects. These areas continue to attract substantial investment, reflecting the industry’s commitment to building a solid foundation for the broader crypto ecosystem. At the same time, competition from other high-growth sectors, such as artificial intelligence startups, is intensifying, making it more challenging for crypto VC funds to attract and retain capital.

Additionally, the current high-interest rate environment is prompting investors to be more selective, favoring projects with clear value propositions and sustainable growth strategies. Despite these headwinds, the overall outlook for crypto VC remains positive, with significant growth opportunities for funds, startups, and investors who can navigate the shifting landscape and focus on projects that drive innovation and infrastructure development.

How Crypto VC Firms Evaluate Projects

Evaluating potential investments is a critical aspect of the venture capital process. Crypto VC firms employ a rigorous due diligence process to assess the technical and economic viability of projects. This process includes:

- Analyzing business plans

- Reviewing project milestones

- Evaluating timelines

- Assessing the future value of the cryptocurrency

- Projecting the user base

Strong relationships within the crypto ecosystem facilitate knowledge sharing and lead to informed decisions about better investment.

Collaboration among projects can enhance technical capabilities and address common challenges effectively, further supporting the growth and success of blockchain startups. Key components of the evaluation process include due diligence, investment track record, and industry expertise.

Due Diligence Process

During due diligence, venture capitalists assess the feasibility of a startup’s technology and its economic viability. This comprehensive evaluation includes an analysis of the future value of the cryptocurrency, its projected user base, and potential market impact.

Collaborations with technology providers can enhance due diligence, resulting in more informed investment choices and better outcomes for both investors and startups.

Investment Track Record

A firm’s historical investment performance is a critical factor in evaluating its potential as a venture capital partner. For instance, Blockchain Capital has realized more than $300 million from its investments, showcasing its ability to yield substantial returns over time. Polychain Capital’s focus on maximizing returns for investors further underscores the importance of a strong investment track record.

Industry Expertise

Expertise in the blockchain sector allows investment groups to identify innovative projects and provide better support. A well-versed industry background enables crypto VC firms to make informed investment choices by understanding market trends and the potential of cutting-edge technologies.

This deep expertise is crucial for driving innovation and achieving long-term success in the crypto industry.

The Role of Networks and Partnerships

Networks and partnerships play a pivotal role in the success of crypto venture capital firms:

- The support provided by these firms is crucial for the growth and development of early-stage companies.

- Strong networks enhance a firm’s ability to leverage resources and connections, which can be instrumental in driving project success.

- Strategic alliances provide financial support and business development.

- These partnerships foster meaningful innovation in the blockchain sector.

Leveraging resources and collaboration opportunities significantly contribute to the success of crypto VC investments.

Leveraging Resources

Venture capital firms often collaborate with established players to boost their resource availability and market knowledge. Binance Labs functions as both a funding source and a support system for emerging crypto projects, leveraging resources strategically to enhance their investment capabilities.

This strategic leverage is crucial for driving innovation and supporting new projects, ensuring they have the necessary infrastructure and funding to succeed.

Collaboration Opportunities

Strategic partnerships enable venture capital firms to share assets and expertise, providing comprehensive support to startups. These collaborations are essential for fostering a dynamic crypto ecosystem that promotes the success of emerging technologies.

Leveraging partnerships allows VC firms to enhance the resources available to startups, accelerating their growth and innovation in the crypto market.

Investment Tips for 2025 Crypto VC Investors

For those considering crypto VC investments in 2025, a strategic and informed approach is essential to maximize returns and manage risks in the dynamic crypto market. Start by conducting thorough research into each project’s growth potential, competitive positioning, and the expertise of its founding team. Understanding the unique value proposition and market fit can help identify projects with the highest likelihood of success.

Diversification remains a key principle—spreading investments across multiple projects, sectors, and stages can help mitigate the inherent volatility of the crypto market. It’s also important to stay informed about the regulatory environment, as changes in policy can significantly impact the prospects of crypto projects and funds.

Keeping a close eye on emerging trends and being ready to adapt your investment strategy as the market evolves will position you to seize new opportunities. Finally, consider partnering with established crypto VC funds, as their experience, networks, and access to exclusive investment opportunities can provide a significant advantage.

By following these tips and maintaining a disciplined approach, investors can tap into the vast potential of the crypto VC space while navigating its unique challenges.

Future Outlook for Crypto VC Investments

The future outlook for crypto VC investments is promising, with total capital invested in crypto startups reaching $4.9 billion in Q1 2025. This significant increase highlights the resilience and ongoing confidence in the crypto market. Venture capital firms are poised to continue driving innovation and growth in the industry, supporting a wide range of blockchain projects and startups.

Multicoin Capital, for example, aims to bring cutting-edge technologies to the masses through its investments, reflecting the broader trend of VC firms focusing on transformative technologies.

The long-term prospects for Web3 and the resilience of crypto VC funding are promising.

Long-Term Prospects for Web3

The long-term prospects for Web3 projects are promising due to the integration of decentralized solutions and AI, which improve functionality and user adoption. Web3 projects are poised to thrive by offering decentralized applications that enhance user engagement and drive innovation in the digital economy.

The combination of AI and blockchain will reshape investment strategies in the crypto sector, creating new opportunities for growth and development.

Resilience of Crypto VC Funding

Despite economic headwinds and a high-interest rate environment, interest in crypto VC funding is projected to remain strong. This resilience is evident in the continued investment activity and the persistence of interest from potential investors.

The crypto VC sector has demonstrated its ability to adapt to market volatility and maintain a steady flow of funding, ensuring the ongoing support and growth of innovative blockchain projects.

Summary

In summary, crypto venture capital firms are the driving force behind the innovation and growth of the blockchain industry. They provide crucial funding and strategic support to early-stage, growth-stage, and late-stage startups, ensuring their success and long-term viability. The top 15 most active crypto VC funds in 2025, including Pantera Capital, Andreessen Horowitz, and Digital Currency Group, are leading the charge in fostering innovation and supporting the growth of the crypto ecosystem.

Key trends such as regulatory compliance, institutional investment, focus on DeFi and NFTs, and expansion into new markets are shaping the future of crypto VC investments. By leveraging resources and forging strategic partnerships, these firms are well-positioned to drive the next wave of innovation in the crypto world. The future outlook for crypto VC investments remains positive, with promising prospects for Web3 projects and a resilient funding environment.

Frequently Asked Questions

What are crypto venture capital firms?

Crypto venture capital firms are investor groups that combine funds to invest in early-stage blockchain projects, offering essential capital and strategic guidance for their development and expansion.

What is the importance of early-stage funding for crypto startups?

Early-stage funding is vital for crypto startups as it facilitates idea development, concept validation, and the creation of a minimum viable product, enabling them to attract subsequent investment and foster growth. This initial capital is essential for laying a strong foundation for future success.

How do crypto VC firms evaluate potential investments?

Crypto VC firms evaluate potential investments through a comprehensive due diligence process focusing on the technical and economic viability of projects, including detailed analysis of business plans, project milestones, and projected future value of the cryptocurrency. This thorough approach ensures informed investment decisions.

What are the key trends in crypto VC investments for 2025?

The key trends in crypto VC investments for 2025 highlight a focus on regulatory compliance, the growing involvement of institutional investors, significant investments in DeFi and NFTs, and expansion into emerging markets. These developments indicate a maturing landscape for cryptocurrency investments.

How do networks and partnerships benefit crypto VC firms?

Networks and partnerships significantly enhance crypto VC firms by allowing them to leverage resources and share expertise, which supports innovation and growth in the crypto ecosystem. This collaborative approach ultimately leads to more effective support for startups.