The Rise of Modular Blockchains: Why Crypto is Moving Away from One-Size-Fits-All Design

The blockchain space is experiencing its most significant architectural transformation since Satoshi Nakamoto first introduced Bitcoin. After years of trying to optimize monolithic blockchains for every possible use case, the crypto industry is embracing a fundamentally different approach: modular design. This shift represents more than just a technical upgrade, it’s a complete reimagining of how blockchain networks should be built, scaled, and operated.

To understand this shift, it’s important to look at how modular blockchains decompose traditional blockchain functions into specialized, layered components, revolutionizing scalability, security, and interoperability.

The numbers tell a compelling story. When Ethereum gas fees regularly spiked above $100 per transaction during peak usage periods, it became clear that traditional blockchain architecture had reached its limits. Today, modular systems are delivering cheaper transaction fees, often under $0.01, while maintaining the security guarantees that make blockchain technology valuable. This dramatic improvement isn’t just theoretical, it’s happening right now across production networks processing billions of dollars in value.

Understanding this transition from monolithic to modular systems is crucial for anyone building, investing in, or using blockchain technology. The changes happening today will determine which projects thrive and which become obsolete over the next decade.

The End of the Monolithic Era

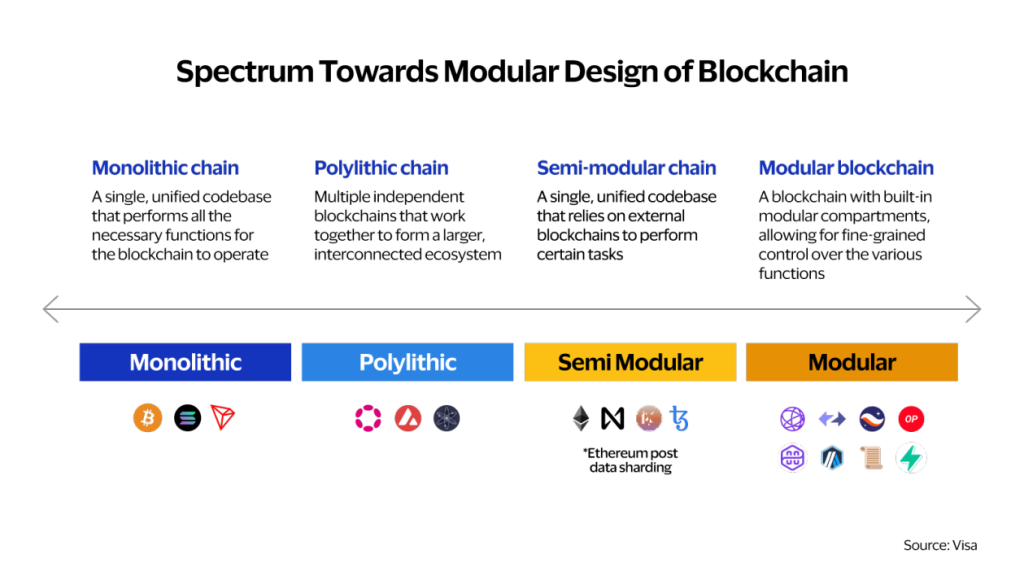

Crypto is moving from monolithic blockchains to modular designs due to fundamental scalability limitations and performance bottlenecks that have plagued the industry since its inception. The traditional approach of handling every blockchain function within a single system, known as the monolithic framework, has proven inadequate for the demands of modern decentralized applications.

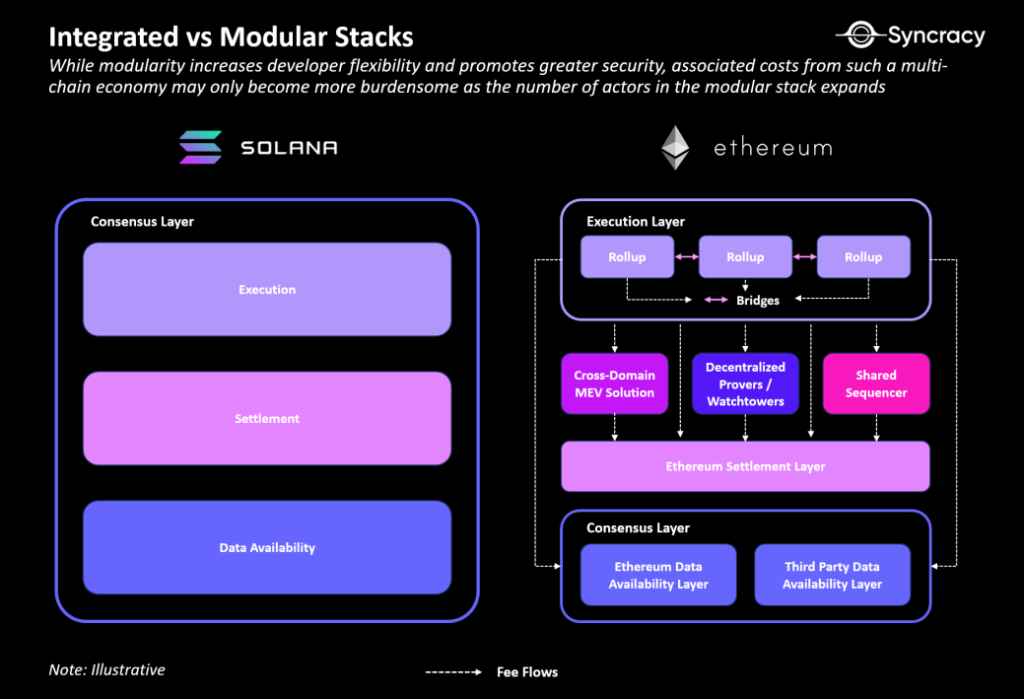

Ethereum’s transition to a rollup-centric roadmap in 2023-2024 exemplifies this shift away from one-size-fits-all architecture. Rather than continuing to scale Ethereum as a monolithic system, the network’s core developers explicitly reoriented their development efforts toward enabling specialized layer-2 solutions that handle execution while Ethereum focuses on security and data availability.

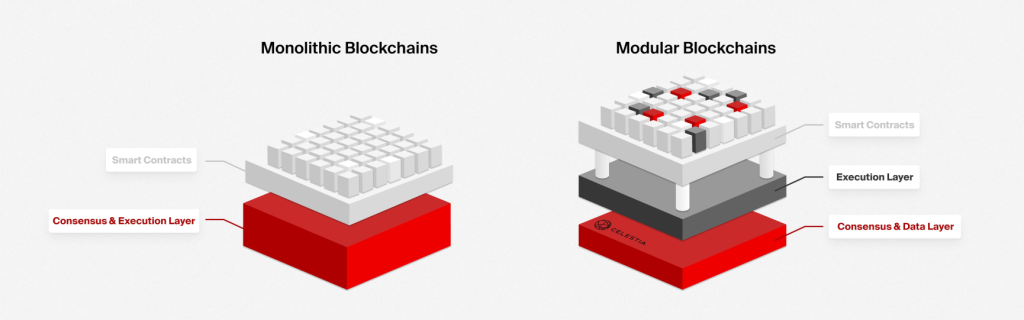

Traditional blockchains like Bitcoin and early Ethereum handle execution, consensus, data availability, and settlement within one unified system, operating as a single layer. Every node in the network must process every transaction, store all state data, and participate in the same consensus mechanism. This creates an inherent bottleneck where the entire network can only operate as fast as its slowest participants.

This unified approach creates what’s known as the blockchain trilemma, where only two of three critical properties, security, decentralization, and scalability, can be optimized simultaneously. Attempts to increase throughput by raising block sizes or reducing block times typically compromise decentralization by making it harder for average users to run full nodes.

The real-world consequences of these limitations became painfully apparent during periods of high network congestion. High transaction fees of $50-100 during peak periods on Ethereum and slow throughput of 7-15 transactions per second demonstrate how monolithic limitations directly impact user experience and application viability. Gaming applications, micropayments, and mass-market financial services became economically infeasible on these networks.

Even newer monolithic chains that achieve higher throughput often do so by requiring more powerful hardware or accepting greater centralization. Solana, for example, can process thousands of transactions per second but requires validators to run high-performance servers that cost tens of thousands of dollars, effectively limiting validator participation to well-funded entities.

The fundamental issue isn’t that monolithic blockchains are poorly designed, it’s that they’re trying to optimize for too many different requirements simultaneously. A system optimized for maximum security and decentralization will inevitably sacrifice performance, while a system optimized for performance will typically compromise on decentralization or security guarantees.

Understanding Modular Blockchain Architecture

Modular blockchains represent a fundamental reimagining of how blockchain systems should be structured, introducing a modular framework that separates core functions into distinct, specialized components. Instead of forcing all core functions through a single protocol layer, modular systems separate these responsibilities into specialized components that can be independently optimized and composed.

The core insight behind modular design is that different blockchain functions have dramatically different optimization requirements. Data availability requires high throughput and efficient storage, consensus needs robust security and finality guarantees, execution demands flexibility and performance, and settlement requires strong dispute resolution and cross-chain coordination.

Modular blockchains separate core functions into specialized, separate layers: execution, consensus, data availability, and settlement. Each layer focuses entirely on its specific responsibility rather than attempting to handle multiple functions efficiently. This separation allows each component to be engineered specifically for its task without compromising other requirements.

Transitioning from a monolithic chain to a modular setup can be complex, involving the migration and reconnection of settlement, bridging, custody, and execution components to fit the new architecture.

Data availability layers like Celestia, which launched its mainnet in October 2023, focus solely on storing and making transaction data accessible to network participants. These systems use advanced techniques like data availability sampling and erasure coding to ensure data remains available even if some validators go offline or attempt to withhold information. Celestia can process megabytes of data per second while allowing light clients to verify availability by downloading only small samples.

Execution layers like Arbitrum and Optimism process transactions and smart contract logic while relying on other layers for security and data storage. These rollups can implement custom virtual machines, gas mechanisms, and transaction processing logic without being constrained by the limitations of their underlying settlement layer. This flexibility enables domain-specific optimizations that would be impossible in monolithic systems.

Consensus layers provide the ordering and finality guarantees that ensure all network participants agree on the state of the system. In modular architectures, data availability and consensus often focus purely on ordering data blobs and ensuring transaction data is reliably published and agreed upon, rather than executing complex transaction logic, allowing for more efficient and specialized consensus algorithms.

Settlement layers handle dispute resolution, asset custody, and cross-chain communication. For Ethereum-based rollups, Ethereum itself serves as the settlement layer, providing final arbitration for disputes and enabling secure bridging of assets between different execution environments.

This separation allows independent scaling and upgrading of each component without affecting the entire system. A rollup can migrate from optimistic to zero-knowledge proof systems, switch data availability providers, or upgrade its execution environment without requiring changes to other layers in the stack.

The modularity extends beyond just technical architecture. Different layers can have entirely different economic models, governance structures, and upgrade mechanisms. Modular systems enable the deployment of custom blockchains, allowing developers to create individualized, application-specific chains within the ecosystem. Projects can also deploy their own execution layers, such as rollups or application-specific chains, which operate independently but leverage shared data availability and security features. A gaming-focused execution layer might prioritize low latency and high throughput while accepting different security trade-offs than a DeFi-focused layer handling billions in assets.

Key Drivers Behind the Modular Revolution

The transition to modular blockchain architecture is being driven by concrete benefits that address the most pressing limitations of traditional blockchain systems. These advantages go beyond theoretical improvements to deliver measurable enhancements in performance, cost-effectiveness, and developer experience.

Modular blockchains introduce advanced scaling solutions, such as rollups and specialized data availability layers, which significantly improve throughput and efficiency compared to monolithic designs. These scaling solutions enable networks to handle higher transaction volumes while maintaining decentralization and low costs.

Additionally, modular systems often leverage shared security models, where security guarantees are inherited from robust main networks like Ethereum. Shared security mechanisms, such as restaking or unified security frameworks, enhance the economic security and trustworthiness of layered blockchain ecosystems.

When it comes to upgradeability and integration of new components, modular blockchains emphasize maintaining compatibility between execution environments, data availability layers, and settlement layers. This ensures seamless integration and interoperability without requiring extensive reconfiguration, supporting ecosystem growth.

Finally, modular architectures focus on maintaining security during upgrades and component changes. By upholding strict security standards and implementing robust safeguards, these systems reduce risks and ensure the integrity and reliability of the blockchain throughout its evolution.

Massive Scalability Improvements

The scalability improvements enabled by modular architecture are not incremental—they represent order-of-magnitude enhancements over monolithic systems. Rollups routinely achieve 100x throughput improvements over Ethereum mainnet, scaling from the base layer’s 15 transactions per second to over 1,500 transactions per second on optimized rollup solutions.

Celestia’s data availability sampling demonstrates how specialized layers can achieve seemingly impossible performance characteristics. The network can process blocks containing 1 megabyte of data while light nodes only need to download 100 kilobytes to verify availability with high confidence. This sampling approach scales data throughput independently of the number of network participants, breaking the traditional trade-off between throughput and decentralization.

EigenDA, which launched in June 2024, promises even more dramatic improvements with throughput of 15 megabytes per second compared to Ethereum’s current 83 kilobytes per second for data availability. These improvements compound across the stack, when multiple rollups can share high-capacity data availability, the total throughput of the modular ecosystem can exceed any individual monolithic chain by several orders of magnitude.

Transaction costs provide another compelling measure of modular blockchain advantages. Where users might pay $10-50 for a simple token transfer on Ethereum during periods of high congestion, the same transaction on an optimized rollup solution costs under $0.01. This dramatic cost reduction makes entirely new categories of applications economically viable, from micropayments to high-frequency trading strategies.

Specialized Performance Optimization

Modular systems excel because each layer can be optimized for its specific use case rather than trying to serve all applications adequately. Trading platforms benefit from execution layers that prioritize transaction ordering, MEV protection, and sub-second finality, while gaming applications need execution environments optimized for frequent state updates and minimal transaction costs.

DeFi protocols can leverage settlement layers specifically engineered for financial applications, with features like atomic cross-chain transactions, sophisticated dispute resolution mechanisms, and integration with traditional financial systems. Each vertical gets purpose-built infrastructure instead of compromised general-purpose solutions that fail to excel at any specific task.

This specialization extends to consensus mechanisms, data structures, and even governance models. A privacy-focused rollup might implement zero-knowledge proof systems and encrypted state transitions, while a high-frequency trading rollup might prioritize deterministic transaction ordering and minimal latency. These optimizations would be impossible to implement simultaneously in a monolithic system without creating conflicts and trade-offs.

Upgradable Infrastructure

Perhaps the most underappreciated advantage of modular systems is their upgradeability. Modular components can be upgraded independently without requiring hard forks or network-wide coordination. New data availability solutions can be integrated without affecting existing execution layers, and consensus mechanisms can evolve while maintaining full compatibility with deployed applications.

This flexibility future-proofs applications against technological obsolescence. A DeFi protocol deployed on a rollup today could seamlessly benefit from advances in zero-knowledge proofs, improved data availability, or more efficient consensus algorithms without requiring any changes to the application itself.

The upgrade path also reduces the risks associated with adopting new blockchain technologies. Rather than betting everything on a single monolithic chain, developers can begin with proven components and gradually adopt new technologies as they mature.

Execution and Settlement in Modular Blockchains

Modular blockchains have fundamentally changed blockchain design by breaking down the core functions of execution, consensus, and data availability into distinct, specialized layers. This modular architecture stands in stark contrast to the traditional monolithic blockchains, where all these responsibilities are bundled into a single, tightly coupled system. By separating execution and settlement, modular blockchains unlock new levels of scalability, flexibility, and security that were previously unattainable.

The execution layer in a modular blockchain is dedicated to processing transactions and running smart contracts. Unlike monolithic blockchains, where every node must handle all aspects of transaction processing, modular systems allow execution environments to focus solely on efficiently executing user actions. This separation enables the creation of custom execution layers tailored to specific use cases, whether it’s high-frequency trading, gaming, or decentralized finance, without being constrained by the requirements of consensus or data storage. Developers can implement unique virtual machines, optimize transaction ordering, and experiment with new features, all while relying on other layers for security and data availability.

The settlement layer serves as the backbone of trust and finality in modular blockchains. Its primary role is to finalize the results of transaction execution, resolve disputes, and anchor the state of the execution layer to a secure, widely trusted base. Settlement layers leverage robust consensus mechanisms and data availability solutions to ensure that all the data required to verify transactions is accessible and that the network’s security guarantees are upheld. In many modular stacks, the settlement layer also facilitates cross-chain communication and asset transfers, acting as a bridge between different execution environments.

The interaction between execution and settlement layers is a defining feature of modular blockchain design. After transactions are processed in the execution layer, the resulting data, such as state changes and proofs, are submitted to the settlement layer. Here, consensus and data availability mechanisms come into play, ensuring that transaction data is both ordered correctly and made available to all network participants. This process not only maintains the integrity of the entire system but also allows for parallel transaction processing across multiple execution layers, all anchored to a single, secure settlement layer.

By decoupling execution and settlement, modular blockchains overcome the bottlenecks of monolithic systems. Each layer can be independently upgraded, optimized, or replaced without disrupting the rest of the stack. This modular approach enables blockchain networks to scale more efficiently, maintain robust security, and support a diverse range of applications, all while ensuring that consensus and data availability remain at the core of the network’s trust model.

In summary, the separation of execution and settlement in modular blockchains represents a structural shift in blockchain design. It allows for the creation of specialized, high-performance execution environments that can interact seamlessly with secure, consensus-driven settlement layers. This innovation is at the heart of the rise of modular blockchains, paving the way for a more scalable, secure, and adaptable blockchain ecosystem.

Leading Modular Blockchain Projects

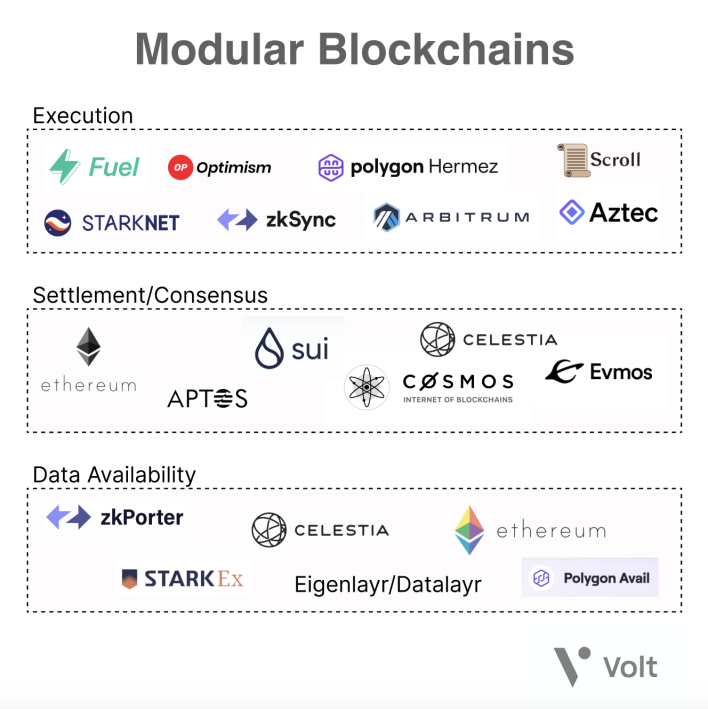

The modular blockchain thesis isn’t just theoretical, several projects are demonstrating its viability in production environments, processing billions of dollars in value and supporting hundreds of thousands of daily active users. These projects are building specialized modular data availability layers, which separate data publishing, verification, and security functions to enable scalable and cost-effective blockchain infrastructure.

Celestia and EigenDA are leading examples of modular data availability solutions. Their core function is to provide modular data availability, decoupling data publishing and verification from execution and settlement layers. This approach leverages advanced techniques like data availability sampling and cryptographic commitments, allowing efficient verification by light nodes and supporting high-throughput blockchain systems. Both Celestia and EigenDA rely on a robust security layer, which serves as the foundational component ensuring system security, finality, and decentralization.

By integrating with existing blockchains, these modular data availability layers can inherit the network’s security, maintaining strong security guarantees while enabling greater scalability and flexibility.

Celestia – Pure Data Availability

Celestia launched its mainnet in October 2023 as the first production-grade data availability network designed specifically for modular blockchain architectures. The network focuses exclusively on data availability, implementing sophisticated data availability sampling and erasure coding techniques to scale data storage without the computational overhead of transaction execution.

The network currently supports over 50 rollups and modular projects, including major implementations like Manta Pacific and Eclipse. These connected chains represent a combined total value locked exceeding $2 billion, demonstrating that pure data availability can serve as a viable foundation for significant economic activity.

Celestia’s technical architecture showcases the power of specialization. By eliminating execution complexity, the network can dedicate its resources entirely to data throughput and availability guarantees. The system can process blocks containing megabytes of data while maintaining light client accessibility through probabilistic sampling schemes.

Arbitrum – Battle-Tested Execution Layer

Arbitrum has emerged as one of the most successful demonstrations of modular execution layers, handling over $2.5 billion in total value locked across its execution environment as of late 2024. The rollup consistently processes more than 50 transactions per second with sub-second confirmation times, proving that modular execution layers can deliver real-world performance at scale.

The network hosts major DeFi protocols including Uniswap, Aave, and GMX, with minimal downtime or performance degradation over more than 18 months of continuous operation. This track record demonstrates that modular execution layer maturity can match or exceed that of established monolithic chains.

Arbitrum’s success stems from its specialized focus on transaction execution while leveraging Ethereum for settlement and security. This division of labor allows the rollup to optimize its execution environment for throughput and cost while inheriting Ethereum’s robust security guarantees and established economic infrastructure.

EigenDA – Ethereum-Secured Data Availability

EigenDA represents a new category of modular infrastructure that leverages existing blockchain security through restaking mechanisms. Launched in June 2024, the system utilizes Ethereum’s $40+ billion in staked ETH to provide data availability services, creating a powerful synergy between established blockchain security and modular architecture benefits.

The network achieves 15 megabytes per second in data throughput using advanced erasure coding and leverages over 200 operators who stake substantial ETH amounts to secure the network. This approach provides data availability services at costs that are 95%+ lower than posting data directly to Ethereum while maintaining strong security guarantees.

EigenDA demonstrates how modular architectures can bootstrap security from existing blockchain networks rather than requiring entirely new validator sets. This approach reduces the cold start problem that affects new blockchain networks and provides immediate access to significant economic security.

Challenges in the Modular Transition

While modular blockchain architecture offers compelling advantages, the transition from monolithic to a modular framework introduces new complexities and risks that must be carefully managed. Understanding these challenges is crucial for making informed decisions about modular blockchain adoption.

Increased Complexity and Coordination

Modular systems require sophisticated bridging protocols and cross-layer communication mechanisms that don’t exist in monolithic designs. Developers must understand and integrate multiple components instead of deploying to a single chain, significantly increasing the learning curve and operational overhead.

The complexity manifests in multiple ways. Instead of running a single node and understanding one consensus mechanism, operating modular infrastructure requires coordination across data availability layers, execution environments, and settlement protocols. Each component has its own API, upgrade schedule, and failure modes.

Debugging becomes substantially more complex when problems span multiple layers. A transaction that fails might encounter issues in the execution layer, data availability layer, or during cross-layer communication. Identifying the root cause requires expertise across the entire modular stack rather than deep knowledge of a single system.

Multiple potential points of failure exist across the modular stack. Where a monolithic blockchain has one point of failure (the blockchain itself), modular systems can fail at the data availability layer, execution layer, settlement layer, or any of the bridges connecting these components.

Security Model Complications

The security of modular systems depends on the security of every component in the stack, creating complex interdependencies that can be difficult to analyze and manage. The overall system security becomes equivalent to the weakest link across all modular components, which may include data availability networks, rollup operators, bridge protocols, and settlement mechanisms.

Cross-chain bridges, which are essential for asset movement between modular components, have historically represented some of the largest security vulnerabilities in the blockchain space. Billions of dollars have been lost to bridge exploits, and modular architectures typically require more sophisticated bridging infrastructure than monolithic systems.

Economic security models become complex when value flows across multiple tokens, layers, and validator sets. Understanding whether a particular modular stack provides adequate security for a given application requires analysis of validator incentives across multiple networks, token economics of different layers, and potential attack vectors that span multiple components.

Many modular components lack the extensive battle-testing that established monolithic chains have undergone. While systems like Ethereum and Bitcoin have operated securely for years, newer modular components may have undiscovered vulnerabilities or edge cases that only emerge under stress or adversarial conditions.

Liquidity Fragmentation

One of the most significant practical challenges facing modular architectures is liquidity fragmentation. As assets and trading activity spread across multiple execution layers, the depth and efficiency of markets can be reduced compared to the concentrated liquidity found on monolithic chains.

Cross-rollup arbitrage opportunities can create price inefficiencies and increase costs for traders and applications. When the same asset trades at different prices on different rollups, arbitrageurs must use bridge protocols to equalize prices, introducing latency and additional costs that reduce overall market efficiency.

The user experience suffers from complex bridging requirements and layer-switching procedures. Users must understand which rollup their assets are on, how to bridge between different execution environments, and which applications are available on which layers. This complexity can create significant barriers to adoption for mainstream users.

Network effects become diluted as activity spreads across numerous modular chains rather than concentrating on a single platform. Applications that benefit from composability and shared liquidity may find their effectiveness reduced in a highly fragmented modular ecosystem.

Real-World Impact and Enterprise Adoption

The theoretical advantages of modular blockchain architecture are being validated through significant real-world implementations that demonstrate practical benefits for enterprises and major crypto protocols adopting a modular framework.

Major crypto exchanges have embraced modular solutions to reduce operational costs and improve user experience. Coinbase’s decision to deploy Base, an Optimism rollup, represents one of the largest enterprise endorsements of modular architecture. Base allows Coinbase to offer users significantly reduced transaction costs while maintaining the security guarantees of Ethereum settlement.

Gaming companies are increasingly choosing custom blockchains and custom rollups for their specialized game logic and high transaction throughput requirements. Games that require frequent microtransactions, item transfers, and state updates benefit enormously from execution environments optimized specifically for gaming use cases rather than general-purpose blockchain infrastructure.

DeFi protocols have achieved dramatic cost reductions by migrating to rollup solutions while maintaining Ethereum’s security model. Protocols report 90%+ reductions in transaction costs after migrating from Ethereum mainnet to rollup solutions, making previously uneconomical use cases viable and improving user adoption.

Traditional financial institutions are exploring modular chains specifically for their ability to implement regulatory compliance layers without compromising on blockchain benefits. Modular architectures enable the separation of compliance requirements from core blockchain functionality, allowing financial institutions to meet regulatory requirements while accessing blockchain efficiency and transparency.

StarkWare’s StarkEx provides compelling evidence of modular architecture success at scale, having processed over $1 trillion in trading volume using its modular approach to zero-knowledge proof systems. Major applications including dYdX, Immutable X, and Sorare rely on StarkEx’s specialized execution environment for high-performance trading and NFT operations.

Polygon zkEVM demonstrates that modular systems can achieve production-ready performance while maintaining full compatibility with existing development tools and applications. The zero-knowledge rollup provides EVM compatibility with significant performance improvements, allowing developers to migrate existing applications without modification while gaining modular benefits.

The enterprise adoption patterns reveal that modular blockchains excel in scenarios where specific performance characteristics, compliance requirements, or cost structures are more important than the simplicity of monolithic systems. Organizations that require specialized blockchain functionality are increasingly choosing modular solutions built on a modular framework over general-purpose alternatives.

The Future of Blockchain Architecture

The blockchain space continues to evolve rapidly, with several major developments shaping the future relationship between monolithic and modular architectures. The emergence of the modular framework, an architecture that separates execution, settlement, and data availability layers—has improved flexibility, scalability, and customization for various use cases. Understanding these trends is essential for making strategic decisions about blockchain technology adoption over the next several years.

Ethereum’s implementation of proto-danksharding through EIP-4844 in March 2024 reduced rollup costs by over 90%, dramatically accelerating the adoption of modular designs. This upgrade introduced dedicated blob space for rollup data, creating a more efficient and cost-effective foundation for modular blockchain ecosystems. The success of proto-danksharding validates the modular approach and sets the stage for even more aggressive scaling through future danksharding implementations.

Rollup-as-a-Service platforms like Caldera and AltLayer are democratizing access to modular blockchain deployment, making it possible for teams to launch custom execution environments without deep blockchain infrastructure expertise. These platforms provide templates, tooling, and managed services that reduce the complexity barriers associated with modular blockchain adoption.

Interoperability protocols are advancing rapidly to address the fragmentation concerns associated with modular architectures. Projects focused on seamless cross-layer asset movement, unified user interfaces, and shared sequencer networks aim to create user experiences that feel like single chains while maintaining the performance benefits of modular design.

Zero-knowledge proofs represent a particularly promising direction for modular blockchain evolution. ZK proofs may enable instant cross-layer verification without trust assumptions, allowing modular components to interact with the security guarantees of monolithic systems but without the performance limitations.

The relationship between modular and monolithic approaches will likely be complementary rather than competitive over the long term. High-performance monolithic chains may continue serving use cases that prioritize simplicity and require maximum composability, while modular designs will dominate applications that need specialized performance characteristics or cost structures.

Market segmentation appears to be the most likely outcome, with different blockchain architectures optimizing for different types of applications and user requirements. Gaming, DeFi, enterprise applications, and public goods infrastructure may each gravitate toward different architectural approaches based on their specific needs.

The next 2-3 years will be critical in determining whether modular or integrated approaches dominate specific market segments. The success of major modular implementations, the evolution of user experience abstractions, and the development of robust cross-layer infrastructure will largely determine the future balance between these architectural approaches.

Investment and development activity strongly favor modular approaches, suggesting that the ecosystem will continue moving away from one-size-fits-all solutions toward specialized, composable blockchain infrastructure. The rise of modular blockchains represents more than a technical evolution, it represents a fundamental shift toward a more diverse, flexible, and capable blockchain ecosystem that can support the full range of applications that will define the future of decentralized technology.

The transition away from monolithic blockchain design to a modular setup reflects a broader maturation of the blockchain industry. As the technology moves beyond the experimental phase toward mainstream adoption, the limitations of one-size-fits-all approaches become increasingly apparent. Modular blockchain architecture provides a path toward blockchain infrastructure that can truly support the diversity of applications and use cases that will drive the next decade of blockchain adoption.