The 5 Trading Mistakes That Cost Me The Most And How I Fixed Them

Introduction: The Year I Gave Back 38 Percent Of My Account

Between March and October 2019, I gave back 38 percent of my trading account. That was roughly 9,500 dollars on a 25,000 dollar account, and the worst part was that my strategy actually had an edge. The setups worked. The backtests looked solid. The problem was me.

After reviewing six months of trades, I realized the damage came from five repeating behavioral mistakes that quietly drained capital while I blamed the market, bad luck, and “volatility.” Like many traders, I also found myself blaming my trading system for failures instead of recognizing my own mistakes. These were not complicated issues. They were simple, preventable errors that compounded into serious losses because I never tracked them or built rules to stop them.

This article lays out those five mistakes upfront so you get value immediately. Then I break down exactly what each one cost and how I fixed them through specific rules, tools, and behavioral changes, which will be discussed in detail below.

Here are the five biggest trading mistakes that nearly ended my journey as a trader:

- Increasing position size after a loss to “get it back”

- Holding losers and averaging down instead of exiting

- Taking random trades outside my plan

- Overtrading during news and high volatility

- Constantly changing strategies before they had a chance

The 5 Biggest Trading Mistakes At A Glance

Before diving into the details, here is a quick snapshot of each mistake with the approximate cost based on my 25,000 USD account during 2019 and early 2020:

- Increasing size after a loss: Roughly 4,800 USD lost between May and August 2019 from oversized revenge trades on EURUSD, ES futures, and crude oil. The pattern was doubling or tripling lot size after a losing trade to recover fast.

- Holding losers and averaging down: About 3,200 USD in extra losses during Q3 2019 from moving stops on trades like Apple stock and NASDAQ futures. What should have been 300 dollar losses turned into 1,000 plus dollar disasters. The potential loss from not cutting losers quickly can escalate and jeopardize overall profitability. Traders often take profits too early and let losses run too long, which is a common mistake.

- Taking random trades outside the plan: In July 2019 alone, 17 out of 48 trades did not match any documented setup. Those 17 trades accounted for over 65 percent of that month’s net loss, roughly 2,100 USD.

- Overtrading during news and volatility: Days with more than six trades had a negative expectation of about minus 1.8 percent on average. A single FOMC session in July 2019 cost 1,050 USD from five impulsive trades in 20 minutes.

- Constantly changing strategies: No single approach was traded for more than 50 trades in 2018 or early 2019, making it impossible to know if any method actually worked. The cost was not just money but months of wasted learning.

The rest of this article explains both the damage and the specific fixes for each mistake.

The Importance of a Trading Edge

If there’s one lesson that stands out from years of trading stocks and managing my own trading account, it’s this: having a trading edge is non-negotiable if you want to survive and thrive in the markets. A trading edge is what separates a good trader from the crowd—it’s your unique advantage, the reason your trades have a positive expectation over time, and the foundation of every winning trade you make.

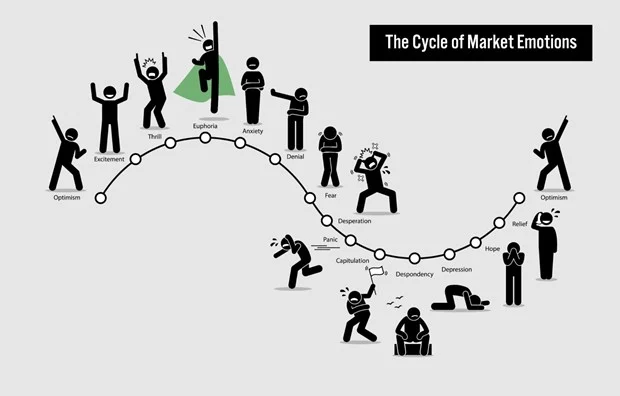

Without a trading edge, most traders fall into the same traps: emotional trading, chasing after every move, and making decisions based on fear or hope rather than a solid trading plan. This is where many traders fail. They jump from one strategy to another, take random trades, and let emotions dictate their actions. The result? A string of bad trades, mounting losses, and a trading account that never seems to grow.

Developing a trading edge isn’t about finding a magic indicator or copying what other traders are doing. It’s about doing your own research, understanding the market dynamics, and building a strategy that fits your personality, risk tolerance, and goals. For example, some traders find their edge in day trading volatile assets, while others focus on swing trading or even correlated trades to diversify risk. The key is to know exactly why you’re taking each trade and what gives you an advantage.

A true trading edge helps you manage risk on every single trade. It allows you to set stop loss orders with confidence, knowing that your plan is based on tested setups and not just gut feeling. When you have an edge, you’re less likely to make impulsive decisions or widen your stops out of fear. Instead, you stick to your plan, accept the occasional losing trade, and focus on the long-term profit potential.

Discipline is another major benefit. With a clear edge, you’re less tempted to overtrade or take positions outside your playbook. You know that not every day will bring good opportunities, and you’re willing to wait for the right setups. This patience is what keeps your account safe during bad days and allows your gains to compound over time.

Building a trading edge is an ongoing process. Markets change, and what worked last year might not work today. That’s why it’s crucial to keep learning, reviewing your trades, and refining your approach. Track your results, analyze your mistakes, and don’t be afraid to adapt when the data tells you something isn’t working. This continuous improvement is what keeps you ahead of the market and helps you realize your full potential as a trader.

Whether you’re trading stocks, forex, or any other asset, your edge is what keeps you focused, disciplined, and profitable. It’s not about making more money on one trade, but about building a sustainable approach that can weather the ups and downs of the market. As any good financial advisor would tell you, the right direction in trading comes from having a plan, managing your risk, and sticking to what works.

In the end, a trading edge is your best defense against common trading mistakes. It helps you avoid emotional trading, manage risk, and make decisions based on logic rather than fear. If you haven’t found your edge yet, start by reviewing your own research, tracking your trades, and focusing on what gives you consistent results. Over time, this discipline will save your account, improve your mental state, and put you on the path to long-term success.

Mistake 1: Increasing Size After A Loss To “Get It Back”

On a Wednesday in June 2019, I lost 600 dollars on ES futures during the morning session. Clean entry, reasonable stop, just wrong. Instead of walking away, I doubled my position size on the next trade because I wanted to “make it back before lunch.” That trade hit my stop within 40 minutes, costing another 1,400 dollars. I gave back nearly a full month of gains in one afternoon. Using leverage in these situations can amplify both gains and losses, so if not managed carefully, it can quickly lead to substantial losses.

This was not a one time event. It was a pattern of emotional trading where my position size depended on how the last trade felt instead of a predefined risk rule. Most traders do not track whether they slightly over-bet or under-bet on a trade, which can lead to unexpected losses.

The behavior looked like this:

- After a win, I felt confident and sized normally

- After a loss, I felt the urge to recover immediately

- I would increase lot size by 50 to 200 percent on the next trade

- If that trade also lost, the damage was catastrophic

The cost was real:

- Between May and August 2019, I lost approximately 4,800 USD purely from oversized revenge trades

- These losses came on EURUSD, ES futures, and crude oil positions

- The worst single day was the June afternoon described above, where 2,000 USD evaporated in two trades

The fix was implemented in September 2019:

- I created a hard rule: maximum 1 percent risk per single trade, no exceptions

- Lot size must be calculated from current account equity and stop distance before each entry

- No second attempt on the same setup if the first trade hits the stop

- Every position had to pass through a simple Excel calculator before order submission

- Using stop-loss orders is a common risk management technique that helps traders limit their losses

- Position sizing is a critical component of risk management in trading

The improvement was immediate. In October 2019:

- Maximum daily loss was capped at 2 percent

- No single day loss exceeded 500 dollars

- Average losing trade dropped from 1.8 percent to 0.9 percent of account

How I Now Size Every Single Trade

Here is the exact process I use for sizing every trade, using a real example:

Account size: 26,300 USD Risk per trade: 0.8 percent Stop distance on EURUSD: 30 pips

Step by step:

- Calculate dollar risk: 26,300 multiplied by 0.008 equals 210 dollars

- Determine pip value for EURUSD standard lot: 10 dollars per pip

- Calculate position size: 210 dollars divided by 30 pips equals 7 dollars per pip

- Convert to lots: 7 divided by 10 equals 0.7 lots

The formula in plain language: divide your dollar risk by your stop distance in pips to get your dollar per pip requirement, then divide by the standard pip value to get your lot size.

This process is written in my trading plan and must be completed before order submission, not after. If I cannot calculate the correct size, I do not take the trade.

Mistake 2: Holding Losers And Averaging Down Instead Of Exiting

In August 2019, I entered a long position on Apple stock as an intraday trade. The plan was simple: 300 dollar risk, tight stop, capture a bounce off support. When price dropped through my stop level, I did not exit. Instead, I moved the stop lower and told myself the support was “just below.”

Three days later, that day trade had become a “swing position.” A week later, I called it a “long term investment.” When I finally closed it, I had lost 1,250 dollars instead of the planned 300. The trade had consumed mental energy for nine days and tied up capital that could have been used elsewhere.

The psychological drivers were predictable:

- Refusal to admit the original analysis was wrong

- Anchoring to the entry price instead of current market structure

- Checking the profit and loss number instead of the chart

- Hope that price would return, despite no technical reason to believe it

- Not knowing when to sell to minimize losses can lead to even bigger drawdowns

- Holding losers can significantly reduce the overall reward from trading, as capital is locked in unproductive positions

This big mistake cost real money:

- Three trades in Q3 2019 where I moved or removed stops added approximately 3,200 USD to total losses compared to the original stop levels

- The Apple trade was the largest single example

- Other trades included a NASDAQ futures position and a crude oil swing trade

The fix started in November 2019:

- Every trade must have a predefined stop loss in the order ticket at entry

- Stops cannot be moved further away from entry under any condition

- Stops can be tightened to reduce risk or lock in profit, never widened

- Server side stop orders are mandatory so I cannot “decide later”

- Setting profit and loss targets and sticking to them is essential to manage emotions and avoid impulsive decisions

- Practicing letting go of prior trades helps reduce emotional mistakes and prevents being anchored to past outcomes

The practical changes:

- I document the initial stop level in my trade journal before the trade is live

- If a stop is moved, I take a screenshot and compare “planned loss” versus “actual loss” in the weekly review

- Any rule violation triggers a mandatory 24 hour break from live trading

The before and after:

- In January 2020, the largest loss on a single position was 1.1 percent of equity

- In previous months, single bad trades had cost over 4 percent

- Total account drawdown in Q1 2020 was less than half of Q3 2019

The No Excuses Stop Loss Rule

Here are the three specific rules I follow for every losing trade:

- Every trade must have a stop loss order placed at the same time as entry

- Stops can be tightened but never widened under any circumstance

- If price hit the stop, there is no re entry unless a completely new setup forms according to the trading plan

This rule saved me real money. In March 2020, crude oil was collapsing. I had a long position that looked bad within minutes of entry. Old me would have moved the stop, hoping for a bounce. New me let the stop hit and took the 250 dollar loss. Crude dropped another 8 percent that session. What would have been a 2,000 dollar disaster became a manageable small loss.

Copy these rules into your own trading plan. They work precisely because they remove decision making in the moment when your mental state is compromised.

Mistake 3: Taking Random Trades Outside My Plan

On a Thursday morning in July 2019, I watched a clean NASDAQ breakout setup form perfectly according to my plan. I hesitated, waited for “more confirmation,” and missed the entry by three points. Frustrated, I spent the next two hours taking five impulsive scalp trades on USDJPY and gold. Neither market was in my playbook. I had no tested edge on either. I lost 700 dollars by noon on trades I should never have taken.

Random trades are any trade that was not predefined in your written trading plan. This includes:

- Markets you do not normally trade

- Time sessions outside your tested window

- Patterns you have not backtested

- Setups driven by boredom, fear, or greed rather than rules

Lacking discipline is a key reason traders fall into the trap of taking random trades, as it leads to poor decision-making and deviation from a structured trading plan. Many traders make this mistake because missing a good setup feels like a failure. The impulse is to “make up” for the missed opportunity by trading something, anything. Trading based on short-term fluctuations, known as trading the noise, is especially dangerous and often results in losses rather than gains. Chasing the market after significant moves can also lead to buying at peaks just before reversals, which is a common outcome of random, undisciplined trades.

The cost was significant:

- In July 2019, I reviewed 48 total trades

- 17 of those trades did not match any documented setup

- Those 17 random trades accounted for over 65 percent of the month’s net loss

- Total damage from non plan trades in Q3 2019: approximately 3,400 USD

The fix began in January 2020:

- I created a very short written playbook with only two primary setups

- One setup for EURUSD during the London session

- One setup for NASDAQ futures during the US session

- Each setup had screenshots, specific entry criteria, stop placement rules, and profit targets

The practical filter:

- Before any order, the trade idea must match one of the two documented setups

- If it does not match, the idea gets logged in my journal as a “non qualified idea” instead of a trade

- A simple checklist on paper sits at my desk with a yes or no box: “Is this one of my documented setups?”

This approach dramatically reduced random trading and helped me develop discipline over several months.

Building A Simple Two Setup Playbook

Creating the playbook started with reviewing my own research on past winning trades from 2018 and early 2019. I looked for recurring conditions rather than indicator signals.

The two setups I committed to:

- London session pullback on EURUSD: Price pulls back to a prior session high or low during the London session, shows rejection with a clear wick, and I enter in the right direction of the daily trend. Stop goes beyond the wick. Target is 1.5 to 2 times the stop distance.

- US session breakout on NASDAQ futures: Price consolidates for at least 30 minutes after the US open, then breaks the range with volume. Entry is on a close above the range. Stop goes below the consolidation low. Target is measured move equal to range height.

I stored screenshots, notes on typical volatility, and stop sizes in a folder. I reviewed this folder every Sunday to reinforce the patterns.

For new traders, I strongly recommend limiting yourself to one or two setups for at least three months. This constraint forces focused execution and generates clean data on what actually works.

Mistake 4: Overtrading During News And High Volatility

On July 31, 2019, the Federal Reserve announced its rate decision at 2:00 PM. I had promised myself I would wait for the dust to settle. Instead, I opened five trades within 20 minutes on EURUSD and gold. Three of them were direct reactions to the last candle rather than any planned setup. By 2:45 PM, I had lost 1,050 dollars.

The market was doing exactly what markets do during FOMC. I was the one making trading mistakes by expecting normal price action during abnormal conditions.

Overtrading means:

- Taking more trades than your plan allows on a daily basis

- Trading price action outside your tested conditions

- Entering positions during major news events or low liquidity periods

- Chasing moves because you fear missing out

The data was clear:

- I analyzed my 2019 trade history and found that days with more than six trades had a negative expectation of about minus 1.8 percent on average

- Many trades on high volatility days were essentially gambling, not trading

- Transaction costs alone on overtrade days added up to hundreds of dollars monthly

The fix was implemented in early 2020:

- Hard daily trade limit of five trades maximum

- No new positions within 15 minutes before or after scheduled high impact news (NFP, FOMC, CPI)

- Mandatory five minute break after two consecutive losses

- A log field in my journal where any extra trade beyond the limit must be justified in writing

Additional behavioral constraints:

- If I hit the daily trade limit, I close the platform

- If I hit 2 percent daily loss, I stop trading for the day regardless of trade count

- Both limits are pre committed before the session starts

In May 2020, these rules prevented me from trading a highly volatile NFP spike. I watched other traders blow up their accounts that day while my equity sat flat. The rules saved what would likely have been a 1,000 plus dollar loss based on my past behavior.

Daily Limits That Saved My Account

Here are the exact numeric limits I use:

- Maximum five trades per day

- Maximum 2 percent daily loss

- Mandatory stop for the day if either limit is hit

Example from a recent session:

- Trade 1: Small loss, minus 0.7 percent

- Trade 2: Small loss, minus 0.6 percent

- Trade 3: Winner, plus 0.4 percent

- Trade 4: Loss, minus 1.1 percent

- Daily total: minus 2.0 percent, session ends immediately

Without the limit, I would have taken three or four more money losing trades trying to recover. The rules prevented additional revenge trades that would have deepened the loss.

Place these limits at the top of your trading journal as a pre session checklist. Decide the numbers in advance when you are calm, not in the heat of the moment when emotions are running high.

Mistake 5: Constantly Changing Strategies Before They Had A Chance

Between January 2018 and March 2019, I cycled through at least four different trading approaches:

- A purely indicator based system with three moving averages

- A Fibonacci retracement strategy from a YouTube course

- A news trading experiment focused on forex

- A price action method I barely understood

Every time I hit three or four losing trades in a row, I abandoned the current method and went searching for something new. The cycle was predictable: lose money, feel frustrated, find a new “better” strategy, start over.

Assuming you have a sound trading strategy, it’s crucial to give it enough time to play out. A robust trading plan is the engine of any market move, and having one or several bad days doesn’t directly signal the strategy is poor. Overconfidence often leads to significant trading errors, especially when switching strategies too quickly. Many traders fail because they never give any single approach enough trades to prove itself. Most strategies need at least 100 trades before you can draw meaningful conclusions about their profit potential. Sticking to the trading plan through thick and thin can often be the best move for traders.

The cost was severe:

- No single method was traded for more than 50 trades

- I had no statistically valid data on what actually worked

- Months of learning were wasted starting over repeatedly

- The emotional cycle of hope and disappointment was exhausting

The fix began in December 2019:

- I committed to one primary price action approach on EURUSD and NASDAQ futures

- I wrote a contract with myself promising to trade this method for at least 100 trades before making any structural changes

- I signed and dated the document

The tracking process:

- Every trade was logged in a spreadsheet with columns for date, market, setup type, R multiple result, and whether the rules were followed

- I reviewed the data every 20 trades instead of after each bad day

- Minor execution tweaks were allowed, but no fundamental strategy changes until the 100 trade mark

The results from the first 100 trade sample between January and April 2020:

- Net gain of 6.4 percent

- Greatly reduced variance compared to previous boom and bust cycles

- A clear pattern emerged showing which conditions produced good opportunities and which produced bad trades

For the first time, I had actual data to improve discipline rather than assumptions driven by fear.

Setting A 100 Trade Commitment

Here is the exact commitment rule I followed:

- Pick one market, one timeframe, and one core setup

- Promise not to change it for 100 trades

- Only tiny execution tweaks allowed after 20 trade reviews

- No searching for new strategies until the sample is complete

The 100 trade log was structured with these columns:

| Date | Market | Setup Label | Risk Percent | Result in R | Rules Followed | Comments |

|---|---|---|---|---|---|---|

| 01/06 | EURUSD | London Pullback | 0.8% | +1.4R | Yes | Clean entry |

| 01/07 | NQ | US Breakout | 1.0% | -1.0R | Yes | Stopped out |

One concrete observation from that 100 trade sample: trades taken after 16:00 London time had a noticeably lower win rate. I removed those late session trades from my plan entirely based on the data.

View your first 100 trades as tuition for knowledge and data collection. The goal is learning, not necessarily making more money immediately. The gains come later when you have real evidence about what works.

How Tracking Every Mistake Changed My Results

In late 2019, I created a simple trading error journal in Google Sheets. This was separate from my regular trade log. The purpose was to track every mistake independently from trade outcomes.

I realized that a professional trader does not just track wins and losses. They track the behaviors that cause losses. Many traders focus on the wrong metrics.

Here is what I tracked for each mistake:

| Date | Market | Error Type | Extra Loss or Missed Profit | Rule Broken |

|---|---|---|---|---|

| 11/05 | EURUSD | Oversized position | +$420 extra loss | 1% risk cap |

| 11/12 | NQ | Moved stop | +$380 extra loss | No widening stops |

| 11/18 | Gold | Random trade | $210 loss | Not in playbook |

A concrete monthly snapshot:

- November 2019: approximately 1,900 USD lost purely from rule violations

- December 2020: the same category dropped below 300 USD

The difference was not better setups. It was fewer unforced errors.

This tracking changed my behavior because:

- The cost of holding losers became a visible dollar amount, not a vague feeling

- Oversizing after losses showed up as a pattern I could not ignore

- Random trades were quantified as a percentage of total losses

- I could see exactly which rule fixes had the highest payoff

The data revealed that fixing position sizing and stop loss discipline produced far more gains than searching for new indicators or strategies. My own research on my own trading proved more valuable than any YouTube tutorial.

If you do nothing else from this article, start an error journal. Track every time you break your rules and quantify what it costs. The numbers will save your account.

Conclusion: From Surviving To Compounding

The largest losses in my trading account came not from bad market conditions or flawed strategies. They came from five recurring behavioral mistakes that I repeated until I built specific rules to stop them.

Here is the recap:

- Oversizing after losses: Fixed with a hard 1 percent per trade risk cap and mandatory position size calculator

- Holding losers: Fixed with server side stop loss orders that cannot be widened

- Random trades: Fixed with a two setup playbook and a pre trade checklist

- Overtrading: Fixed with a five trade daily limit and news avoidance rules

- Strategy hopping: Fixed with a 100 trade commitment before any changes

Every fix was rule based and measurable. That is the key to improve discipline over time.

If you recognize one of these common trading mistakes in your own trading, pick that one and apply the fix for at least one month or 30 to 50 trades before making further changes. Do not try to fix everything at once. Focus on one mistake at a time.

Consistent execution of a simple edge with strict rules to manage risk turned a volatile 2019 into a more stable and modestly profitable 2020 on the same starting capital. No magic indicators. No expensive course. Just fewer unforced errors and the discipline to wait for setups that matched my plan.

Reducing trading errors now can lead to better results in the future, as each improvement compounds over time. Developing a mindset focused on long-term trading goals is essential to avoid emotional trading and stay disciplined. Many traders fail to recognize that their mistakes can lead to a cycle of blaming the trading system instead of their own errors, which prevents real progress.

That is the difference between a good trader and one who keeps giving back gains. Start tracking your mistakes today, and realize that the path to profitability is often about what you stop doing rather than what you add.