Solana RWA Gains Momentum: Tokenized Assets Surge 160% in 2025

Why is Solana becoming a key player in the world of real world asset (RWA) tokenization, particularly with Solana RWA? Alongside Solana, Aptos and ZKSync Era are emerging as strong competitors in the RWA space, while Ethereum’s RWA continues to lead in market share but now faces increasing competition from these newer blockchains. This article explains how Solana’s advanced technology has led to a 160% increase in tokenized assets as of June 2025. We’ll cover its advantages, key projects, and market trends.

Key Takeaways

- Solana offers a significant competitive advantage in real world asset tokenization with low transaction fees and fast settlement times, attracting institutional interest.

- The tokenized RWA market on Solana saw a 218% growth in 2025, largely driven by advances in real estate tokenization and increased investor demand for yield-generating assets.

- Institutional partnerships and technological advancements have enhanced Solana’s appeal, positioning it as a leader in the RWA space and facilitating broader market participation.

Solana’s Unique Edge in RWA Tokenization

Solana’s ascent in the RWA space is largely attributed to its technological prowess. With transaction fees averaging just $0.013, Solana offers a cost-effective solution for real world asset tokenization, a stark contrast to Ethereum’s often prohibitive costs. This affordability is complemented by Solana’s lightning-fast settlement times, averaging just 400 milliseconds, making it an appealing choice for sectors accustomed to the speed of traditional finance and near zero transaction costs.

The platform’s high throughput is another game-changer. Solana can handle extensive trading activities without delays, making it highly suitable for the frequent transactions required in the tokenized asset market. Compared to Ethereum, which faces scalability issues due to high transaction costs, Solana’s architecture avoids these bottlenecks by maintaining low fees and high speed at the base layer. This ensures that the platform remains scalable even as the volume of transactions increases.

Developers on Solana also benefit from a suite of advanced features tailored for RWA tokenization. Solana’s RWA protocol governs the secure and compliant tokenization of assets, providing a formal system for managing legal, compliance, and technical standards. The protocol includes robust verification processes to ensure asset legitimacy, security, and compliance during tokenization. Institutions can verify ownership and authenticity of tokenized assets through these protocols, ensuring adherence to regulatory requirements. Solana’s architecture supports sophisticated deployments, allowing developers to enforce transfer restrictions and automate compliance through single-shard execution and purpose-built token primitives. This is particularly valuable for institutions that require rigorous compliance and security measures.

Moreover, Solana’s infrastructure is continually evolving to meet the needs of institutional investors. Features like token extensions and permissioned environments enhance the flexibility and functionality of tokenized assets. By offering a robust and adaptable platform, Solana is well-positioned to cater to the diverse requirements of the RWA market, setting it apart from other blockchain network.

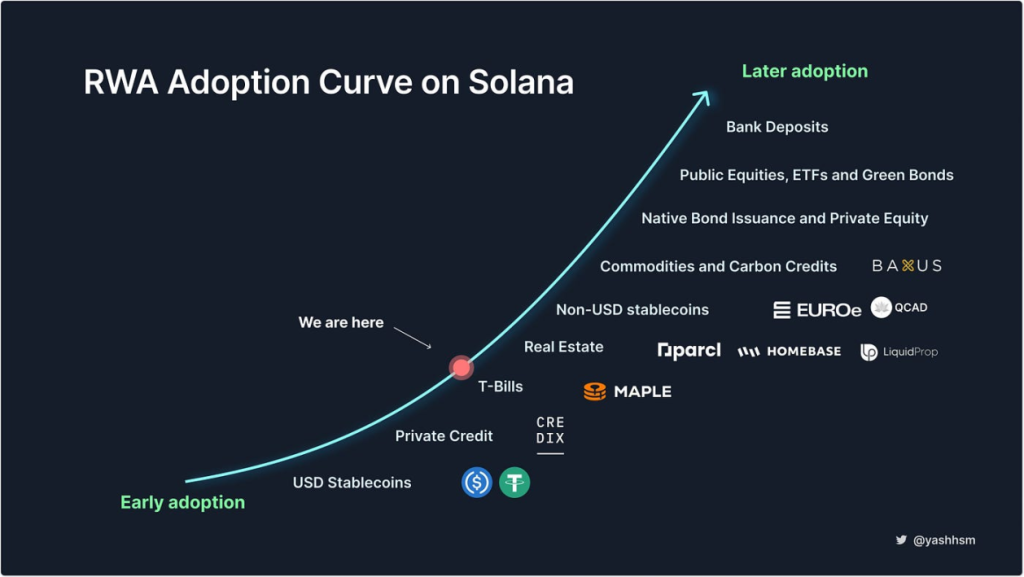

Surge in Tokenized Real World Assets on Solana

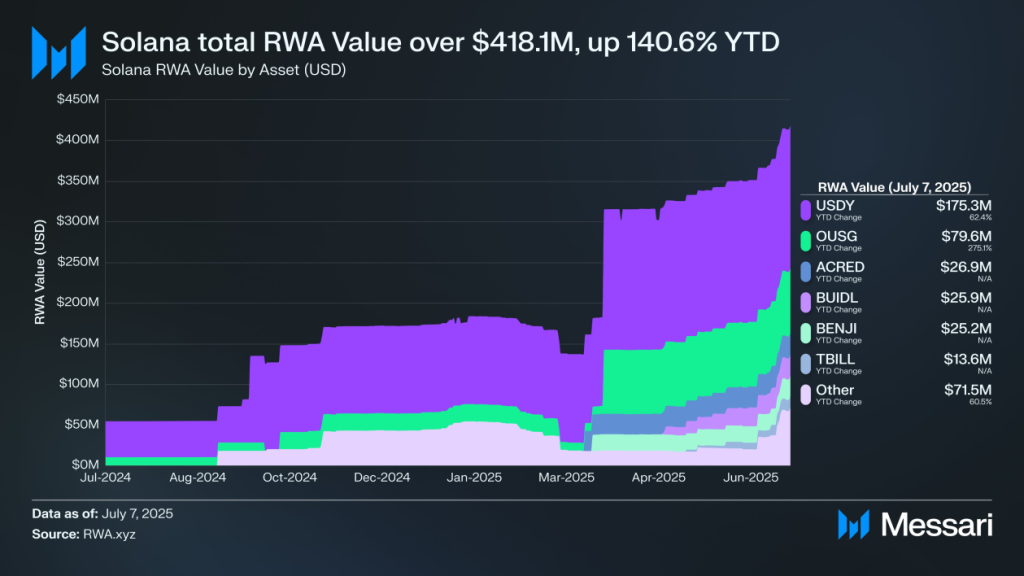

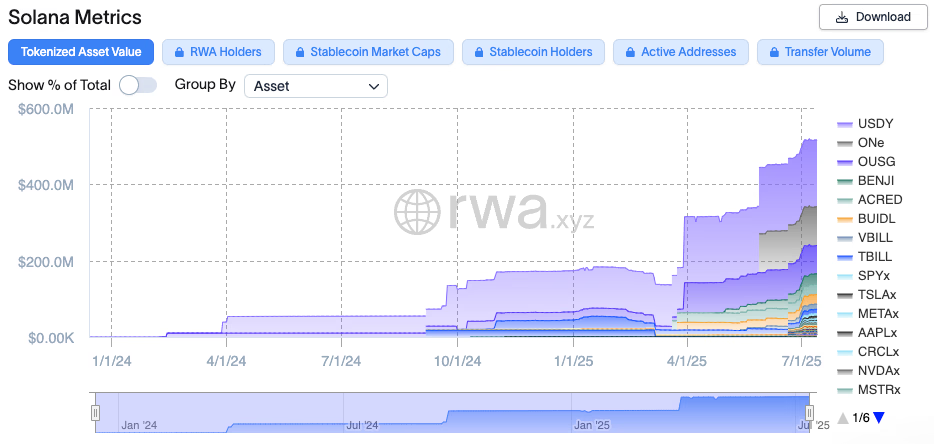

The year 2025 has seen a phenomenal increase in the market for tokenized real world assets on Solana. The platform has witnessed a staggering 218% expansion in this sector, significantly outpacing Ethereum’s 81% growth. This surge is a testament to the confidence and interest among investors in Solana’s capabilities for real world asset management, which grew significantly.

Valued at approximately $553.8 million, Solana’s tokenized RWA market ranks fourth among blockchains, showcasing its competitive edge. Despite this strong performance, there remains a gap between Solana and its leading competitors in the tokenized RWA space. Solana is actively working to close this gap through rapid growth in tokenized assets and increasing its market share. This growth has been driven by a combination of technological advancements and a strong demand for yield-generating assets. Yield-bearing RWAs, in particular, have seen a 22% growth in just one month, highlighting their appeal to investors seeking stable returns.

One of the key factors contributing to this growth is the tokenization of real estate physical assets. By enabling fractional ownership and improving liquidity, these projects have made high-value real estate investments accessible to a broader range of investors. This democratization of investment opportunities has significantly enhanced market dynamics, allowing for easier buying and selling of shares, which jumped in popularity.

Additionally, the tokenization of stocks and US treasuries on Solana has introduced unprecedented flexibility and liquidity to the market. Investors can now engage in real-time trading of these assets, which was previously limited by traditional market hours and settlement periods. This has not only attracted a diverse range of investors but also contributed to the overall growth and diversification of the tokenized asset market on Solana.

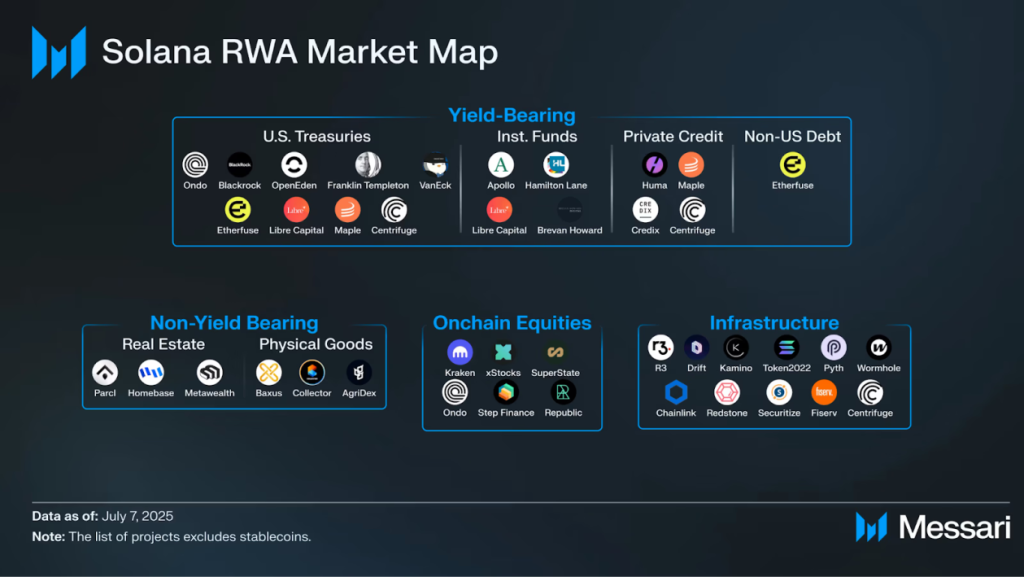

Institutional Adoption and Partnerships

Institutional adoption has played a crucial role in Solana’s rise in the RWA space. Major financial institutions like BlackRock are expanding their funds related to Solana, indicating a strong institutional interest in the ecosystem. This interest is further evidenced by the significant market share held by Ondo Finance, valued at $248 million. Ondo Finance’s contribution underscores its importance in Solana’s RWA landscape.

Partnerships have been instrumental in enhancing Solana’s attractiveness to institutional investors. Integrations with platforms like ONyc and sUSDe facilitate easier asset management, making Solana a more viable option for large-scale investments. Additionally, the partnership with R3 Corda allows institutions to leverage private enterprise assets while utilizing the liquidity of Solana’s public blockchain. This hybrid approach offers the best of both worlds, combining security with liquidity.

Security and custody options have also been bolstered through partnerships with entities like Anchorage Digital Bank. These collaborations ensure that institutional assets on Solana are well-protected, addressing one of the critical concerns for large investors. The involvement of qualified custodians is essential in this context, as they provide compliance and institutional-grade security standards for managing and safeguarding assets on Solana. Furthermore, the expansion of Solana’s ecosystem through new platforms like Maple Finance and Superstate aims to attract more diverse investment opportunities and broaden the platform’s appeal.

Looking ahead, predicted SEC approvals for ETFs are expected to facilitate even greater institutional engagement in RWA tokenization on Solana. This regulatory green light could pave the way for wider adoption, bringing more traditional finance players into the fold and solidifying Solana’s position as a leader in the RWA market.

Key Projects Leading the Charge

Several key projects are driving the growth of RWAs on Solana, breaking down traditional barriers to investment and allowing broader market participation. Ondo Finance and ONe are among the largest non-stablecoin RWA projects on Solana, managing approximately $277 million in tokenized assets. The total issuance of tokenized real world assets by these projects has reached new highs, with recent large-scale issuance events fueling market growth and increasing liquidity.

These projects are not only contributing significantly to the overall market value but are also setting the pace for innovation and adoption in the generation space during this xyz source period.

Real Estate Tokenization

Real estate tokenization on Solana is revolutionizing the way people invest in property. Several pioneering projects are making it possible for retail investors to participate in markets that were previously accessible only to institutional investors. This democratization of investment is a significant driver behind the overall 160% increase in tokenized assets seen in 2025.

By allowing fractional ownership, these projects enhance liquidity and enable more dynamic trading environments. Investors can now buy and sell smaller stakes in high-value real estate assets, facilitating easier and quicker transactions. This increased liquidity not only makes real estate a more attractive asset class but also aligns with the broader trend of real world asset tokenization.

Tokenized Stocks and Treasuries

Tokenized stocks and treasuries on Solana offer a modern evolution in the investment landscape. These tangible assets provide quicker settlement times and improved liquidity compared to traditional methods, appealing to a diverse range of investors. The ability to trade these assets in real-time removes the limitations imposed by traditional market hours and settlement periods.

Moreover, investing in tokenized stocks allows for diversification into different asset classes, making it an attractive option for retail investors and liquidity providers alike. This enhanced accessibility and efficiency represent a significant leap forward in the realm of real world asset tokenization, setting new standards for the industry.

Technical Analysis and Market Trends

Solana’s market performance in 2025 has been marked by significant milestones and trends. As of early April, the key support level for Solana is approximately $102.07, while its resistance level is noted at around $259.77. These levels provide critical insights into the market’s potential movements and investor sentiment. Recent technical analysis of SOL highlights its strong role in the growth of tokenized real-world assets, with increased institutional interest and notable price movements positioning Solana as a major contender in the blockchain space.

The 50-day moving average for Solana currently stands at $152.8, which is below the 200-day moving average of $164.9, indicating a bearish trend. However, the Moving Average Convergence Divergence (MACD) is positioned above its signal line, signaling bullish momentum. This suggests that while the market may be experiencing short-term bearish trends, the long-term outlook remains positive.

Additionally, the Relative Strength Index (RSI) for Solana is at 64, suggesting neutral market conditions, neither overbought nor oversold. This equilibrium indicates that the market is stable, with balanced buying and selling pressures. These technical indicators collectively provide a comprehensive view of Solana’s market dynamics, helping investors make informed decisions.

Tracking these trends and understanding the market cap, trading volume, and historical performance are crucial for anyone looking to invest in tokenized assets on Solana. By staying informed about these technical aspects, including the chart, investors can better navigate the complexities of the market and capitalize on emerging opportunities.

The Future of RWA on Solana

The future of real world asset tokenization on Solana looks incredibly promising. The platform’s ability to facilitate fractional ownership of high-value assets like real estate is a game-changer, making these assets accessible to a wider audience. This democratization aligns with the broader trend of increasing financial inclusion through blockchain technology.

Moreover, the quick transaction capabilities of Solana enhance accessibility for retail investors, allowing them to engage in markets that were previously out of reach. This ease of access is expected to drive further adoption and growth in the RWA space, solidifying Solana’s position as a leader in this evolving landscape.

As the market for RWAs continues to expand, Solana’s technological advantages and institutional partnerships will play a crucial role in maintaining its momentum. The platform’s ability to offer low fees, high speed, and a robust developer ecosystem makes it an attractive option for both investors and developers. This combination of factors positions Solana well for future growth and innovation in the RWA market.

In summary, the evolving landscape of RWA tokenization is moving towards a multi-chain future, with Solana emerging as a strong contender. The platform’s unique features and ongoing developments suggest that it will continue to play a pivotal role in shaping the future of real world asset tokenization.

Summary

Solana’s rise in the RWA space is a testament to its technological innovations and strategic partnerships. With low transaction fees, rapid settlement times, and a robust infrastructure, Solana has set itself apart from other blockchains, particularly Ethereum. The platform’s significant growth in tokenized assets and its appeal to institutional investors highlight its potential to transform the investment landscape.

As we look to the future, Solana’s role in the RWA market is poised to grow even further. The platform’s ability to democratize access to high-value assets and enhance market liquidity will continue to attract a diverse range of investors. With ongoing developments and increasing institutional adoption, Solana is set to lead the charge in the future of real world asset tokenization.

Frequently Asked Questions

What distinguishes Solana from Ethereum and Liquid in terms of transaction costs?

Solana distinguishes itself from Ethereum and Liquid by offering significantly lower transaction costs and higher speeds, effectively circumventing the scalability issues that lead to high fees on Ethereum.

How is the landscape of RWA tokenization evolving?

The landscape of RWA tokenization is increasingly favoring a multi-chain approach, with Solana emerging as a significant alternative to Ethereum and Liquid. This evolution indicates a diversification of platforms in the tokenization space.

What do Real World Assets (RWAs) represent in blockchain technology?

Real World Assets (RWAs) represent off-chain financial assets like real estate, credit, and commodities that have been tokenized and integrated into blockchain technology. This allows for increased liquidity and accessibility in the digital marketplace.

How has the total value locked in RWA protocols changed from the start of 2023 to now?

The total value locked in RWA protocols has significantly increased from around $2 billion at the beginning of 2023 to nearly $8 billion now. This remarkable growth underscores the rising interest and investment in RWA technologies.

What market preference exists within the non-stablecoin RWA sector?

The market preference within the non-stablecoin RWA sector leans heavily towards yield-bearing assets, which account for more than 90% of the total value locked. This indicates a strong demand for investments that generate returns.