Pumpfun Risks: Assessing the $1 Billion Token Sale and its Impact on DeFi and Meme Coins

When diving into the world of Pump.fun, the risks are both significant and varied. Users searching for ‘pumpfun risks’ are likely concerned with potential financial losses, market manipulation tactics, and security vulnerabilities. This article provides a comprehensive overview of these risks to help you navigate this high-stakes trading environment. You’ll learn about the speculative nature of Pump.fun, the prevalence of scams, and the impact of market manipulation.

Key Takeaways

- Pump.fun operates as a high-risk trading platform dominated by speculative meme coin investments, akin to gambling with a low probability of success.

- Financial losses are widespread, with over 60% of users facing monetary setbacks, highlighting the platform’s vulnerabilities to scams and market manipulation.

- Security concerns are prevalent, as 98% of tokens traded are associated with fraud, necessitating thorough research and vigilance against fraudulent schemes for anyone investing on Pump.fun.

Understanding Pump.fun’s Trading Environment

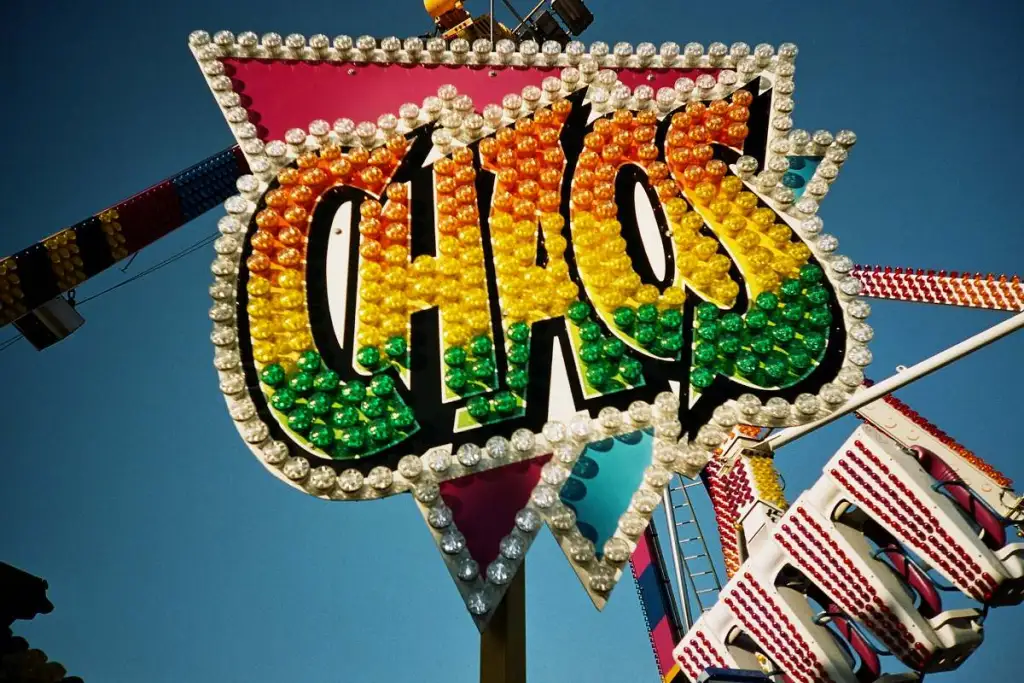

Pump.fun is a high-risk trading environment that attracts speculative traders seeking quick profits. The platform is characterized by high volatility and speculative investments, making it a zero-sum game where one trader’s gain is another’s loss. One notable feature of Pump.fun is its easy-to-use token creation tool, which attracts speculative traders looking to launch and trade new meme coins. The allure of rapid gains drives many users to approach Pump.fun with a speculative mindset, much like stepping into an unfair betting game.

For many, Pump.fun’s trading environment is reminiscent of a roller coaster ride, filled with thrilling highs and gut-wrenching lows. Pump.fun’s dominance in the meme coin sector has led to a concentration of activity, which can impact liquidity and market stability within the ecosystem. Grasping the dynamics of this fun Pump environment is necessary for anyone venturing into this speculative playground.

The Speculative Playground for Meme Coins

Pump.fun is now closely associated with meme coin trading, dominated by speculative activities. Investors are often driven by the volatile nature of these crypto assets, leading to unpredictable market behavior. The platform’s environment fosters a blend of excitement and caution, as users navigate the potential for rapid gains and devastating losses.

While Pump.fun is recognized for fostering innovation in meme coin creation and the broader crypto ecosystem, this same innovative environment can also contribute to instability and increased risk for participants.

Market manipulation tactics, such as wash trading, are suspected to be in play, raising ethical concerns about the impact on the broader crypto market. Diversified investments can help some users mitigate the impact of losses from individual tokens, even amidst these risks.

As one trader put it, “It’s a game of memes and dreams, where the stakes are as high as the risks.”

Odds of Success vs. American Roulette

The likelihood of profiting from meme coins on Pump.fun is strikingly similar to the odds of winning at American Roulette. With only a 0.12% chance of finding a successful meme coin, compared to a 2.6% chance of winning at American Roulette, the extreme risks involved are evident.

This comparison underscores the need for caution and a well-thought-out strategy when engaging in such long speculative trading, noting this serves as a warning.

Financial Risks Associated with Pump.fun

The financial risks on Pump.fun are substantial and undeniable. Over 60% of users have reported experiencing financial losses, with some individuals losing amounts exceeding $100,000. Pump.fun’s high-risk environment is similar to the uncertainties in games of chance like American Roulette, where participants often face unfavorable odds. Billions of dollars are traded on Pump.fun and similar platforms, underscoring the massive scale of the memecoin market.

Scams are rampant on Pump.fun, despite its claims of providing a fair launch environment. The total transaction cost has increased due to additional fees imposed to compensate creators, leading to criticism of the platform’s efficiency. Frequent trading activities can become prohibitively expensive due to these cumulative fees. A recent Bloomberg report has also raised concerns about liquidity and large-scale token sales on Pump.fun.

High Rate of Financial Losses

The reality of financial losses on Pump.fun is stark:

- Around 62.5% of users encounter financial setbacks.

- The majority of traders endure monetary losses.

- Over 2.4 million wallets have reported losses exceeding $1,000, highlighting the widespread impact of these financial risks.

Interestingly, only a handful of wallets—just five—achieved profits ranging from $50,000 to $100,000, indicating a very low success rate among users. This disparity in potential earnings further underscores the high risks involved in trading on Pump.fun.

Market Manipulation and Rug Pulls

Market manipulation is a significant concern on Pump.fun, with common scam tactics like wash trading and the use of volume bots to generate artificial trading activity. These practices create a false impression of high demand, misleading potential investors and inflating token prices artificially.

Rug pulls, a particularly devastating scam, involve:

- Developers orchestrating rapid price drops after hyping a token through misleading promotions.

- Using bundled transactions to execute multiple sell orders at once.

- Causing significant market drops when they cash out.

Such tactics underscore the need for vigilance and skepticism while trading on Pump.fun.

Security Concerns on Pump.fun

Security concerns on Pump.fun are a significant issue for users. A recent breach of Pump.fun’s X account led to the promotion of a fraudulent governance token, highlighting the platform’s vulnerabilities. Such breaches can lead to potential financial losses and a loss of trust among users, making security a paramount concern.

These security vulnerabilities have significant implications for traders. The fear of hacks or scams can overshadow potential gains, fostering an environment of caution and mistrust.

Vulnerability to Scams

Research indicates that a staggering 98% of tokens traded on Pump.fun have been linked to fraudulent or suspicious activities. Hackers connected to past exploits in the crypto space have targeted the platform, using phishing tactics that have previously compromised other crypto accounts.

Avoiding these scams requires caution in the following ways:

- Be wary of unrealistic promises or guarantees of returns, which are often indicative of fraudulent schemes.

- Assess the credibility of a token’s creators.

- Gather community feedback to help identify potential scams.

While not all projects on the platform are scams, the prevalence of fraud necessitates a high degree of vigilance.

Developer Strategies for Coin Crashes

Developers on Pump.fun employ various strategies to crash coins, often selling off simultaneously at specific market cap levels, causing a 90% drop in market value. The headquarters wallet is used by ruggers to launch or take over a coin and inflate the market cap, further manipulating the market.

The entire process of a rug pull typically takes about ten minutes, with the team’s profit usually ranging from 10 to 20 SOL during the final rug pull. These rapid and coordinated sell-offs can devastate investors, emphasizing the need for caution and awareness of such tactics.

Impact of Pump.fun Fees and Revenue Model

Pump.fun’s fee structure and revenue model have significant implications for users and the platform’s sustainability. Since its launch, Pump.fun has generated over $700 million in revenue. Recently, the platform held a major token offering, raising substantial funds and drawing attention to the scale and impact of such events. However, the high transaction fees have been criticized, as they may affect the platform’s competitiveness with other trading platforms.

The revenue-sharing program, intended to provide creators with passive income, has raised concerns that it might encourage creators to abandon their projects, negatively impacting community-led initiatives. Revenue trends are tracked month by month, highlighting how each month is crucial for platform sustainability. The platform’s plans for future growth, including potential adjustments to the fee structure, could further influence its position in the memecoin ecosystem. These issues illustrate the delicate balance between generating revenue and ensuring user satisfaction that was created.

Fee Structure and Its Implications

Launching a memecoin on Pump.fun costs less than $2, a minimal fee that might encourage more token launches, potentially oversaturating the market and increasing risks for investors. Users can create any type of meme coin on Pump.fun, regardless of its functionality. The platform also allows users to upload an image to quickly generate a new token. This low barrier to entry can result in a flood of new tokens, complicating the investment landscape.

Revenue Trends and User Impact

In May, Pump.fun generated $46.6 million in revenue, marking a 66% drop from January revenue of $137 million. This sharp decline raises questions about the platform’s sustainability and its capacity to keep users engaged.

Tokens automatically migrate to Raydium after reaching a market cap threshold of $69,000, significantly boosting their liquidity and visibility. Tokens that secure liquidity on Raydium tend to exhibit more stable market performance, providing a more reliable investment environment for users.

Case Study: Notable Tokens and Market Cap

Analyzing notable tokens and their market caps offers valuable insights into Pump.fun’s market dynamics. Notable tokens like $GOAT and Fartcoin have made headlines with their significant market capitalization. $GOAT, for instance, achieved a market cap surge to over $850 million within weeks of its launch.

The launch of the trump memecoin on Pump.fun is another example of a high-profile token that drew significant trading volume and attention. Dylan Kerler, one of the founders of Pump.fun, has played a key role in the platform’s rapid growth and development. Wired magazine has recognized Pump.fun as one of the fastest-growing crypto applications, further highlighting its impact in the industry.

The current total market capitalization for meme tokens stands at $64 billion, reflecting the substantial interest and investment in this space. However, not all tokens achieve such success, emphasizing the need to understand market trends and dynamics.

Successful Tokens vs. Failures

Of the 16,357 tokens launched in a recent 24-hour period, only 175 graduated to Raydium, resulting in a success rate of just 0.12%. Tokens must reach a market cap of $69,000 to graduate to Raydium, a threshold that many fail to achieve.

The success of certain tokens often depends on the collective efforts of people within the community, as active participation and engagement can drive growth and credibility. Sometimes, a single person can make a significant profit by identifying a promising token early and acting quickly.

Cloned token contracts can deceive investors by mimicking legitimate tokens during their transition from Pump.fun to Raydium, adding another layer of complexity to the investment process.

Despite these challenges, a total of 310 wallets managed to cross the $1 million dollars profit mark, demonstrating that money success is possible, albeit rare.

Celebrity Involvement and Market Influence

Celebrity endorsements have become a significant factor in the meme coin market. Notable celebrities such as Iggy Azalea, Caitlyn Jenner, and Jason Derulo have released meme coins on Pump.fun, driving significant initial market caps due to hype and speculator interest.

However, influencer promotions can lead to drastic market fluctuations. For instance, a recent sell-off reduced a token’s market cap from $2.5 million to $139,000, demonstrating the volatile nature of celebrity-driven investments. These endorsements can attract attention and investment, but they also introduce additional risks.

Mitigating Risks When Using Pump.fun

Navigating Pump.fun’s high-risk environment demands more than luck. It demands a proactive approach to mitigate risks effectively and ensure access to thorough research. Conducting thorough research and staying vigilant against fraud are two fundamental strategies that can help protect your investments and respond to potential threats. There are several important things to consider when trying to mitigate risks on Pump.fun.

Comprehending the platform’s dynamics and common pitfalls can greatly impact your trading experience.

Read more about advanced risk mitigation strategies in our related articles to stay informed and further enhance your understanding.

Conducting Thorough Research

Conducting comprehensive research before investing in any tokens on Pump.fun is crucial. This involves understanding the projects and the creators behind the tokens. Successful tokens that transition to established platforms often have strong backing and transparent projects, making them more reliable investments.

Reading whitepapers, analyzing market trends, and engaging with the community can provide valuable insights into the underlying value and potential risks associated with a token. Investing time in research allows you to make informed decisions and steer clear of fraudulent schemes.

Staying Vigilant Against Fraud

Remaining vigilant against fraud is critical when trading on Pump.fun. The platform is vulnerable to scams that can deceive users into investing in fraudulent projects. Identifying red flags, such as unrealistic promises or a lack of transparency, is critical for avoiding scams.

Educating yourself on market manipulation tactics, including rug pulls, can help you recognize and avoid these schemes. Being aware of the signs of fraud and staying informed about the latest security concerns can significantly reduce your risk of financial losses.

Summary

Pump.fun offers a speculative playground for meme coins, attracting traders with the promise of quick profits. However, the platform’s high volatility, significant financial risks, and security concerns make it a challenging environment to navigate. Understanding the dynamics of Pump.fun, including its fee structure and revenue model, is essential for making informed investment decisions.

By conducting thorough research and staying vigilant against fraud, you can mitigate some of the risks associated with trading on Pump.fun. While the potential for significant gains exists, it’s crucial to approach this platform with caution and a well-thought-out strategy. In the end, knowledge and vigilance are your best allies in the high-stakes world of Pump.fun.

Frequently Asked Questions

What are the odds of finding a successful meme coin on Pump.fun?

The odds of finding a successful meme coin on Pump.fun are just 0.12%, which is quite low and similar to the 2.6% odds of winning at American Roulette. It’s important to approach such investments with caution.

How significant are the financial losses on Pump.fun?

The financial losses on Pump.fun are significant, with around 62.5% of users affected and some reporting losses over $100,000. This highlights the considerable risk involved for users on the platform.

What security concerns should users be aware of on Pump.fun?

Users should be aware of security vulnerabilities, including recent breaches and a high prevalence of scams on Pump.fun, which can pose significant risks to their accounts and personal information. Exercise caution and stay informed to protect yourself.

How does Pump.fun’s fee structure impact users?

Pump.fun’s low creation fee encourages users to participate, but it may result in an oversaturated market. Additionally, high transaction fees could deter user engagement and impact the platform’s overall competitiveness.

How can investors mitigate risks when using Pump.fun?

To mitigate risks when using Pump.fun, conducting thorough research and remaining vigilant against potential fraud are essential strategies. This proactive approach helps protect your investments effectively.