Is DeFi in 2025 Still the Future? A Critical Analysis

Is DeFi in 2025 still the future? Absolutely, as decentralized finance keeps innovating and growing, reshaping the financial landscape. This article explores DeFi’s sustained popularity, technological drivers, emerging trends, real-world applications, and future challenges.

Introduction to DeFi

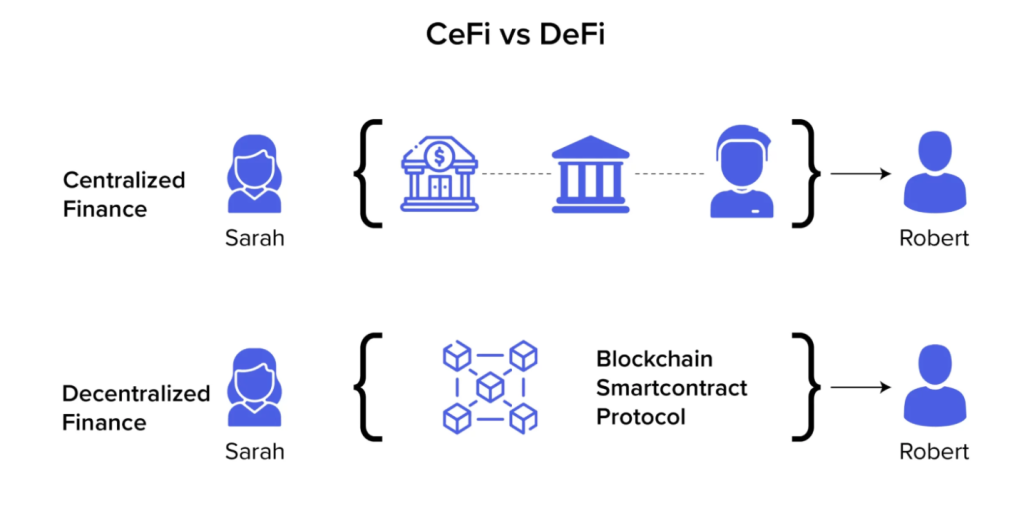

Decentralized finance, or DeFi, marks a transformative shift in the global financial system. By leveraging blockchain networks and smart contracts, DeFi platforms eliminate the need for traditional intermediaries like banks, allowing users to access a wide range of financial services directly. Whether it’s lending, borrowing, or trading, DeFi empowers investors and everyday users to interact with finance in a more transparent and secure environment.

One of the standout features of DeFi is its ability to create real value through fractional ownership, enabling users to invest in assets that were previously out of reach. This opens up new opportunities for both seasoned investors and newcomers, as DeFi platforms provide a level playing field for anyone interested in participating in the financial world. As the DeFi ecosystem continues to grow, it is redefining how value is created, shared, and secured, making finance more inclusive and accessible than ever before.

Key Takeaways

- DeFi maintains its appeal in 2025 due to higher interest rates and inclusivity, attracting both underbanked populations and investors seeking alternatives to traditional finance.

- Core technologies like blockchain, smart contracts, and AI are driving DeFi advancements, enhancing security, efficiency, and user experience across platforms.

- Key trends such as asset tokenization, mobile-first applications, and a focus on regulatory compliance are shaping the DeFi landscape, indicating a shift towards more robust and user-friendly financial systems.

DeFi’s Continued Popularity in 2025

DeFi continues to captivate the financial world in 2025, primarily due to the significantly higher interest rates it offers for lending and borrowing compared to conventional banks. This financial allure is coupled with the inclusivity that DeFi brings to the table, providing access to financial services for underbanked populations worldwide. DeFi overcomes the barriers of traditional financial systems, attracting a broader customer base and making it a compelling choice for many to borrow. As DeFi evolves, we can expect its continued growth and appeal in the coming years.

The potential for high returns from DeFi platforms further fuels its popularity among investors. As more people seek alternatives to the traditional financial system, the appeal of decentralized finance grows. Companies are increasingly leveraging DeFi solutions to enhance their financial operations and access new mechanisms outside traditional finance. This shift not only democratizes financial access but also fosters innovation within the financial sector, setting the stage for a more inclusive and efficient financial future.

Core Principles of DeFi

At the heart of DeFi are several core principles that distinguish it from traditional financial systems. Decentralization ensures that no single entity controls the network, while transparency means that all transactions are publicly recorded on the blockchain, making the system open and auditable. Security is paramount, with DeFi platforms relying on advanced technology and smart contracts to automate transactions and minimize counterparty risk.

Investor protection is a critical focus within DeFi, as platforms implement robust measures to safeguard user funds and assets. By creating a decentralized and transparent financial system, DeFi aims to provide equal access to financial services for users worldwide, regardless of their background or location. This commitment to security, transparency, and accessibility is what makes DeFi a compelling alternative to traditional finance, fostering trust and innovation in the financial sector.

Core Technologies Driving DeFi Forward

Blockchain technology is the core of decentralized finance, offering a decentralized and immutable ledger for transactions. Robust infrastructure is essential for supporting scalable and secure DeFi applications, as it provides the foundational layers and systems needed for growth. This technology forms the backbone of DeFi solutions, ensuring transparency and security in transactions and enabling trustless interactions. DeFi platforms operate on various blockchain networks, such as Ethereum, which support the deployment of financial applications without intermediaries.

Smart contracts are essential in automating financial processes and executing transactions within DeFi applications, thereby ensuring greater efficiency. Layer 2 solutions, like Optimistic Rollups and zk-Rollups, address scalability issues by reducing gas fees and congestion on main blockchains. This modularization of blockchain allows for flexibility and scalability, which are critical for the evolving DeFi applications.

Further enhancing DeFi platforms is the integration of AI, which:

- Transforms smart contracts by allowing them to follow complex rules and make adaptive decisions.

- Enhances security by identifying fraudulent activities through transaction pattern analysis.

- Improves the overall efficiency and user-friendliness of DeFi platforms.

Developers continue to build new layers and protocols on top of existing infrastructure to improve the DeFi ecosystem’s accessibility and interoperability.

Major Trends Shaping DeFi in 2025

Several key trends are shaping the landscape of decentralized finance in 2025, including:

- Asset tokenization

- Fractional ownership

- Enhanced mobile-first DeFi apps

- Regulatory compliance These trends are redefining how we interact with financial systems.

We invite readers to discuss how these trends might influence the future of DeFi.

Here’s a closer look at these trends and their impact on the DeFi ecosystem.

Asset Tokenization and Fractional Ownership

Tokenization of assets is revolutionizing ownership models, democratizing access to investments, and significantly improving liquidity. For example, tokenization has enabled new investment opportunities such as tokenized real estate or art, allowing investors to purchase fractions of high-value assets. Tokenization permits fractional ownership of assets like fine art and collectibles, opening new investment opportunities for a wider audience. This convergence of asset tokenization and fractional ownership is redefining investment opportunities within the DeFi landscape.

Real World Assets (RWAs) are helping to connect traditional finance with crypto, aiding in mainstream adoption. The ability to tokenize and fractionally own assets like real estate and stocks bridges the gap between traditional and decentralized finance, providing a seamless transition for investors and enhancing the overall value of the DeFi ecosystem.

Enhanced Mobile-First DeFi Apps

The rise of mobile-first DeFi applications is simplifying user onboarding and enhancing accessibility. These apps are designed with a primary focus on user experience, making it easier for individuals to engage with decentralized finance.

With intuitive interfaces and seamless interactions, mobile-first DeFi apps are now the preferred choice for users managing their finances on the go, all with one hand.

Regulatory Compliance and Investor Protection

With the growth of DeFi, regulatory frameworks are necessary to protect investors while fostering innovation. There are calls for stricter transparency and accountability standards in protocols managing synthetic stablecoins to enhance DeFi sustainability. These regulations aim to protect investors and maintain the integrity of the financial system as it evolves.

Decentralized autonomous organizations (DAOs) are set to redefine governance structures in finance. DAOs provide a new way of managing financial institutions, emphasizing transparency, community involvement, and decentralized decision-making. This shift towards more decentralized governance models is a critical step in the evolution of the financial landscape.

Comparison to Traditional Finance

When compared to traditional finance, DeFi stands out for its efficiency, accessibility, and inclusivity. Traditional financial institutions, such as banks, often impose strict requirements and high fees, limiting access to financial services for many individuals. In contrast, DeFi platforms offer a more open environment, allowing users to participate in financial activities without intermediaries and with fewer barriers to entry.

DeFi platforms typically provide lower transaction fees and faster processing times, making them an attractive option for users seeking more control over their finances. However, it’s important to acknowledge that DeFi also introduces unique risks, such as vulnerabilities in smart contracts and increased market volatility. Ensuring the security and stability of the financial system requires careful management of these risks. Despite these challenges, DeFi continues to gain traction as a forward-thinking alternative to traditional finance, offering new opportunities and greater access for users around the world.

Real World Applications of DeFi

The market for tokenized real-world assets is projected to climb from $1.1 trillion to $2 trillion by next year, showcasing the growing integration of DeFi with traditional finance. At this point in the evolution of DeFi’s real-world applications, the adoption of tokenized assets marks a significant milestone. Tokenization transforms traditional assets such as stocks and bonds into tradeable tokens on blockchain networks, creating a crucial link between traditional and decentralized finance. This integration is expected to enhance the stability of the financial ecosystem by combining the strengths of both systems.

DeFi-linked fundraising is expected to increase to $40 billion in the coming year as interest in traditional asset integration grows. Certain DeFi projects lead the way in integrating traditional and decentralized finance, setting the standard for innovation in the sector. Major banks are anticipated to adopt DeFi smart contracts for settlement, indicating a shift towards hybrid financial models and a new flow in financial transactions.

Stablecoins are anticipated to be integral in everyday transactions, further bridging the gap between traditional finance and crypto.

Security and Risk Management in DeFi

Security and risk management are paramount in the DeFi ecosystem. Users are exposed to liquidity risk due to the interconnected nature of various protocols. DeFi insurance products are growing in popularity, allowing users to pool funds and purchase secure coverage to hedge against potential losses and collateral risks. The collapse of Stream’s yield-generating stablecoin, xUSD, exemplifies the risks associated with algorithmic stablecoins, leading to significant financial losses and exposing systemic vulnerabilities, including counterparty risk.

Real-time monitoring and adaptive mitigation strategies are essential for effective risk management in DeFi platforms. AI-driven technologies significantly boost the security of DeFi platforms by:

- Enhancing risk detection and predictive measures.

- Streamlining the auditing process of smart contracts, identifying vulnerabilities that traditional audits may overlook.

- Using machine learning models to detect irregular transaction patterns, helping to prevent fraud in DeFi systems.

Educating users on DeFi risks is vital for reducing operational errors and fostering trust within the ecosystem. The decentralized nature of DeFi means that individual users are primarily responsible for monitoring and managing their own risks. A holistic approach to risk management requires an understanding of the interactions between:

- Technological risks

- Operational risks

- Financial risks

- Compliance risks

To further protect users from scams and low-quality content, DeFi platforms and communities implement spam detection and moderation policies. Automated systems help filter out spam, ensuring that discussions and shared information maintain high quality and security standards.

Cross-Chain Interoperability

Interoperability among blockchain networks is essential for enhancing liquidity and user experience in DeFi. Cross-chain technology is increasingly important for institutions, making blockchain systems more attractive and practical. Projects like Chainlink’s CCIP and LayerZero focus on enabling cross-chain messaging and transactions, promoting greater liquidity by allowing assets to be pooled across different chains.

Unified standards are being developed by initiatives like Polkadot and Cosmos to enhance reliable cross-chain interactions. However, challenges such as security risks and consensus mismatches still need to be addressed to improve cross-chain functionality.

As these challenges are overcome, cross-chain interoperability will play a crucial role in building a more seamless and efficient DeFi ecosystem.

The Role of AI in Automating DeFi

AI automates and optimizes complex tasks within DeFi, significantly enhancing efficiency. Integrating AI into DeFi is essential for creating responsive financial systems that can optimize user returns while minimizing risks. AI algorithms in DeFi play a crucial role in analyzing risk and forecasting returns. Additionally, they automate portfolio strategies and detect suspicious activity.

By 2025, AI will significantly impact DeFi by:

- Automating trading

- Enhancing risk assessment

- Forecasting yield opportunities

- Identifying fraud

AI trading agents enable real-time portfolio management, allowing users to track market changes promptly through automation.

The combination of AI and blockchain offers a unique advantage by providing access to transparent and verifiable datasets for AI training.

The Decline of Ineffective Models

As the DeFi ecosystem matures, several models are losing relevance:

- Algorithmic stablecoins

- Over-leveraged yield schemes

- Token models that do not provide any utility These models are particularly losing their appeal in the DeFi landscape.

However, FRAX is an exception among the failing models, demonstrating continued relevance. This decline highlights the critical need for innovation and the creation of models that provide real value in the story of market dynamics.

Future Outlook: Beyond 2025

Decentralized finance holds immense promise and potential for reshaping the finance industry. DeFi is expected to become a real alternative to traditional banking, evolving into comprehensive financial services. Key factors such as technological advancements and regulatory adaptations will shape the future of decentralized finance.

Investors have various ways to participate in DeFi protocols:

- Stake

- Lend

- Yield farm

- Purchase tokens from decentralized exchanges (DEXs)

Looking ahead, there is growing anticipation for a new ‘DeFi summer’ in 2025, which could be marked by a surge in innovation and user adoption, similar to previous periods of rapid growth in the space.

As DeFi continues to grow, new opportunities will emerge, offering innovative ways to listen and engage with the financial system at night.

The future of DeFi is bright, with endless possibilities for those interested in exploring and investing in this evolving landscape.

Chain Abstraction and Aggregators

Key concepts in DeFi include:

- Chain abstraction: Enables users to interact with DeFi without needing to understand the underlying blockchain, greatly simplifying the user experience.

- Wallet abstraction: Improves onboarding by removing the need for seed phrases or gas tokens, enhancing accessibility.

- Aggregators: Route intents, transactions, and liquidity across multiple chains and applications, streamlining operations for users.

Projects like Particle Network and Near are developing solutions that:

- Integrate multiple chains under a single account for enhanced user experience.

- Allow developers to easily create applications that operate across various blockchains due to reduced complexity in coding.

- Further improve transaction efficiency.

In the future, most users won’t need to know or care which blockchain they’re using, highlighting the transition to an intuitive DeFi experience.

Summary

The landscape of decentralized finance in 2025 is dynamic and full of potential. Core technologies like blockchain and smart contracts continue to drive DeFi forward, while trends such as asset tokenization and enhanced mobile-first apps are reshaping the ecosystem. Security and risk management remain paramount, with AI playing a crucial role in automation and fraud detection.

As we look beyond 2025, DeFi is poised to become a real alternative to traditional banking, offering comprehensive financial services. The future holds immense promise, with new opportunities emerging for investors and users alike. Embrace the possibilities and stay informed as decentralized finance continues to evolve and redefine the financial landscape.

Frequently Asked Questions

What was the Specials hit in 1981?

The Specials hit in 1981 was “Ghost Town,” which topped the UK Singles Chart for three weeks and remained in the top 40 for 10 weeks. This iconic track is emblematic of the British two-tone music genre that fuses ska and punk influences.

Will crypto be big in 2025?

Crypto is expected to thrive in 2025, with the market cap surpassing $4 trillion and a significant increase in mobile wallet users. This indicates strong growth and widespread adoption in the industry.

What makes DeFi popular in 2025?

DeFi’s popularity in 2025 is driven by higher interest rates for lending and borrowing, greater inclusivity for underbanked populations, and the allure of high returns. These factors collectively enhance its appeal in the financial landscape.

How does blockchain technology drive DeFi forward?

Blockchain technology drives DeFi forward by ensuring transparency and security through its decentralized, immutable ledger, while smart contracts enhance efficiency by automating financial processes.

What are the major trends shaping DeFi in 2025?

The major trends shaping DeFi in 2025 include asset tokenization and fractional ownership, enhanced mobile-first applications, and the increasing focus on regulatory compliance for better investor protection. These developments are likely to drive greater adoption and safety in the decentralized financial landscape.