Halving 2028 Sounds Far Away But Markets Are Already Pricing It In: What Investors Need to Know

Even though 2028 sounds far away, markets are already pricing in the Bitcoin halving. This anticipation stems from investors seeking to benefit from the expected supply shock that typically boosts Bitcoin’s price. This article will unpack why this early reaction is happening, its impact on Bitcoin’s price and value, and strategies you can consider to navigate this evolving landscape.

The halving is a scheduled event embedded in Bitcoin’s protocol, ensuring predictable supply changes that markets can anticipate.

Key Takeaways

- The 2028 Bitcoin halving, scheduled for March, is already influencing market dynamics as investors anticipate supply shocks and potential price increases.

- Historically, Bitcoin halvings have led to significant price increases post-event due to reduced supply, heightened market sentiment, and investor speculation.

- Institutional investors are increasingly impacting Bitcoin’s market stability and demand, especially ahead of the 2028 halving, which may enhance the cryptocurrency’s appeal as a reserve asset amid inflation concerns.

- Each subsequent halving may result in diminishing returns for investors, as the supply impact lessens over time.

Why the 2028 Bitcoin Halving Matters Now

A Bitcoin halving, scheduled for March 2028, will cut the block reward for miners by 50%. Although this date seems distant, the market is already factoring in its effects. Investors see these halvings, including the most recent halving, as critical events that can significantly impact Bitcoin’s market value.

Historically, Bitcoin halvings have led to bullish outcomes by creating a supply shock, driving up prices. These events are also key inflection points in bitcoin’s broader market cycles, helping investors anticipate price movements. The perception of scarcity and anticipated future price hikes prompt investors to act in advance, and the halving is designed to raise demand by reducing the rate of new bitcoin entering the market, leading to early market activity and pricing adjustments.

These events are crucial for those looking to capitalize on the next Bitcoin halving. Investors are positioning themselves years in advance to maximize potential gains, highlighting the importance of staying informed and prepared about the halving event and the bitcoin halving event as a stock advisor would recommend, including insights from the analyst team.

Understanding the Halving Cycle

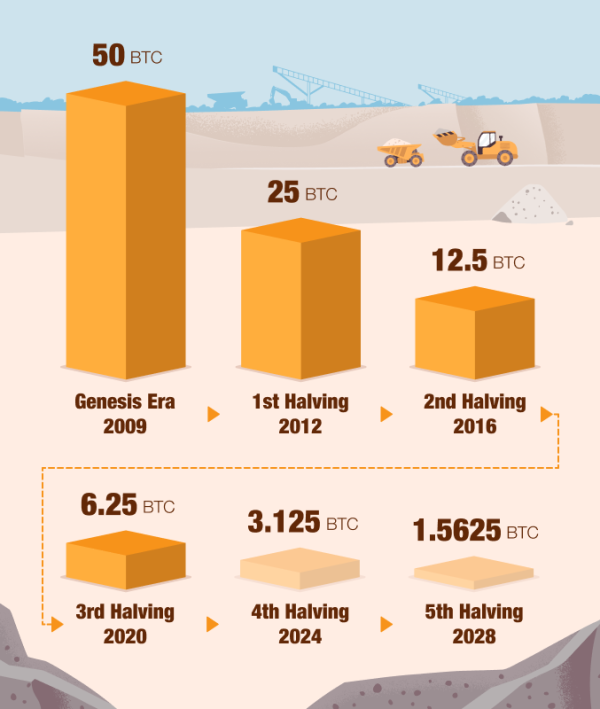

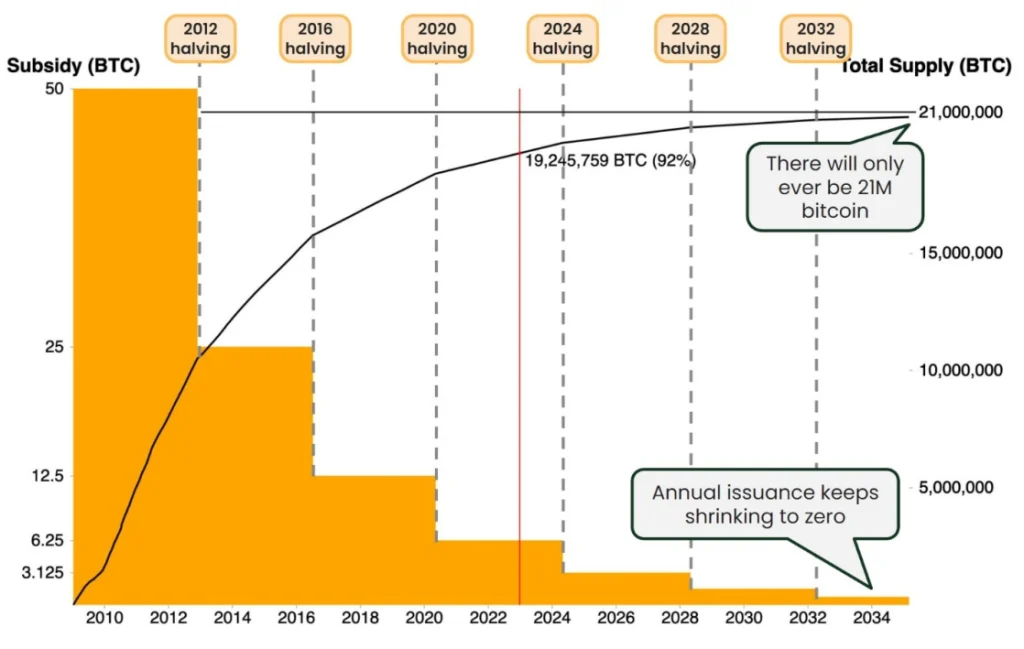

The Bitcoin halving cycle is a fundamental part of the cryptocurrency’s design, occurring roughly every four years. During each halving, the block reward that Bitcoin miners receive for validating transactions and mining new blocks is cut in half. This means that with every cycle, the number of new coins entering the market is reduced, tightening the supply of new Bitcoins. Currently, miners earn 3.125 BTC for each block they validate, but the next bitcoin halving will reduce this reward to 1.5625 BTC.

This predictable reduction in block rewards is built into Bitcoin’s protocol to ensure a controlled and finite supply, ultimately capped at 21 million coins. As the next halving approaches, both miners and investors are closely monitoring the potential impact on the market. A lower supply of new coins can lead to increased scarcity, especially if demand remains steady or grows, which often results in upward pressure on Bitcoin’s price. The halving cycle not only incentivizes miners to continue validating transactions but also reinforces Bitcoin’s reputation as “digital gold” by making new coins increasingly rare.

Market Sentiment and Early Pricing

As the 2028 halving approaches, market dynamics are already starting to shift. Market sentiment regarding a Bitcoin halving can influence prices well in advance. Investors speculate and accumulate Bitcoin, anticipating value increases driven by the scarcity created by the halving.

Broader economic factors, such as changes in interest rates, can also influence investor sentiment and early pricing dynamics around the halving.

Media coverage during halving hype amplifies investor interest and speculation, enhancing overall market sentiment. This creates a feedback loop involving:

- Increased media attention leading to more buying

- More buying driving prices higher

- Speculative fervor causing significant market volatility

- Traders rushing to position themselves for the expected price surge

Large buy orders below the market price can create a psychological barrier, helping stabilize prices before a halving. This behavior shows how market sentiment and psychological factors shape early priced dynamics, with investors betting on human nature around scarcity, a historically consistent pattern.

Historical Patterns of Bitcoin Halvings

Analyzing past Bitcoin halvings offers insights into what to expect in 2028. Historically, bitcoin’s price has soared for 12 to 18 months post-halving before often crashing. For example:

- After the first halving in 2012, bitcoin’s price increased by 7,000% within a year.

- The second halving in 2016 saw bitcoin’s price rise by 294%.

- The third halving in 2020 experienced a 541% increase in bitcoin’s price over the same period.

In each case, bitcoin’s price surged following the halving event due to the supply shock created by the reduction in new coins entering the market.

Halving events impact Bitcoin’s market in several ways:

- They create supply shocks by reducing the block reward to miners.

- This reduction leads to long-term price increases due to decreased coin supply.

- When combined with steady or increased demand, it typically results in upward pressure on bitcoin’s price.

- The anticipation of this supply shock often leads to bullish sentiment among investors even before the halving occurs.

Each halving reduces how many tokens (bitcoins) miners receive as a reward. For example, before the first halving, miners earned 50 bitcoins per block, which dropped to 25 after the first halving, then to 12.5 after the second, and 6.25 after the third, highlighting the increasing scarcity with each event.

As halvings approach, Bitcoin’s exchange balances typically decline as miners hoard inventory, signaling bullish sentiment. This strategic move aims to capitalize on the expected post-halving price increase. Rapid bitcoin adoption following a halving can further amplify price appreciation, while a stall in adoption can lead to market downturns. Recognizing these patterns can help investors make informed buying and selling decisions.

The impact of previous cycles and halvings on Bitcoin’s protocol and market dynamics underscores their importance. Each halving has influenced price and shaped Bitcoin’s evolution as a financial asset. As we approach the 2028 halving, these historical trends offer a roadmap for what might lie ahead.

Institutional Investors and Bitcoin Halving

As the Bitcoin market matures, institutional investors play a significant role in determining its price. Their involvement means the price effects of halvings are less immediate compared to Bitcoin’s early days, but their participation adds stability and legitimacy to the markets.

The 2028 halving is expected to further constrain Bitcoin’s supply, enhancing its appeal to institutional investors. Regulatory clarity surrounding Bitcoin ETFs has made it easier for institutional players like pension funds and sovereign wealth funds to invest, providing the confidence needed for significant capital to enter the market. Unlike the inflation targets set by central banks, Bitcoin’s predictable halving schedule enforces scarcity through a decentralized monetary policy.

Bitcoin’s integration into institutional portfolios is driven by its emerging status as a reserve asset and hedge against inflation. Similar to precious metals such as gold, Bitcoin’s scarcity makes it attractive as ‘digital gold’ for institutional portfolios seeking security and inflation protection. As institutions recognize Bitcoin’s potential to diversify and protect portfolios, their demand around halving events is likely to increase, further influencing market dynamics.

Factors Affecting the Halving Event

The outcome of any bitcoin halving event is shaped by a variety of factors beyond just the reduction in block reward. Market sentiment plays a crucial role—if investors believe the halving will lead to a supply shock, anticipation alone can drive up prices ahead of the event. Adoption rates also matter; as more individuals and institutions buy bitcoin and integrate it into their portfolios, demand for new coins can rise, amplifying the effects of the halving.

Macroeconomic conditions, such as inflation rates and global financial stability, further influence how the market reacts. The recent halving in April 2024, which reduced the block reward to 3.125 BTC, highlighted the growing influence of institutional investors and long-term holders. Their strategic moves can set the tone for the entire market, as they often accumulate bitcoin in anticipation of a price increase. The bitcoin algorithm’s design ensures that each halving event reduces the supply of new coins, reinforcing Bitcoin’s deflationary nature and its appeal as a hedge against traditional financial risks. As the next halving approaches, these factors will continue to shape market dynamics and investor strategies.

Bitcoin Supply Shock and Price Dynamics

The 2028 halving will lower the mining reward to 1.5625 BTC, further enhancing Bitcoin’s scarcity. This block reward reduction is part of the bitcoin algorithm designed to combat inflation by decreasing the Bitcoin supply rate over time, which has halved and been mined since the last halving and the recent halving, ultimately impacting the bitcoin reward and block rewards, including new blocks.

A decrease in Bitcoin supply often results in:

- Increased buying pressure, leading to potential price escalations.

- Fewer new coins reaching exchanges.

- Increased buyer demand, which typically causes Bitcoin’s price to rise post-halving.

- If demand remains steady or increases, Bitcoin usually experiences significant price increases in the following months.

The approval of Bitcoin ETFs in April 2024 has introduced substantial institutional demand, significantly influencing halving dynamics. This interest is expected to create additional buying pressure, further elevating Bitcoin’s price.

Bitcoin’s protocol ensures that only 21 million BTC will ever exist, with each halving reducing the inflation rate. This mechanism guarantees long-term scarcity, making Bitcoin an attractive asset for those seeking a hedge against traditional market dynamics and macroeconomic conditions.

Strategies for Investing Before the 2028 Halving

One effective pre-2028 halving strategy is dollar-cost averaging (DCA), which involves regularly buying small amounts of Bitcoin over time. This approach smooths out Bitcoin’s price peaks and valleys, offering a balanced investment strategy.

Buying Bitcoin before March 2028 is advisable as the price is likely to trend higher over the long term. This preemptive approach allows investors to capitalize on the anticipated post-halving price surge. Various trading options are available, including speculating on BTC spot or futures prices, investing in ETFs, or buying bitcoin coins outright. Investors can also buy stock in companies with significant Bitcoin exposure or in Bitcoin ETFs as an alternative way to gain exposure to Bitcoin’s price movements.

Dollar-cost averaging mitigates market volatility, providing a steady accumulation of Bitcoin regardless of short-term price fluctuations. This strategy suits both new and experienced investors aiming to build a robust dollar cost average Bitcoin portfolio. Historically, well-timed investment strategies around halving events have produced monster returns for savvy investors.

Investing in the Stock Market: Implications of the Bitcoin Halving

The bitcoin halving event doesn’t just impact cryptocurrency enthusiasts—it also has important implications for stock market investors. The Motley Fool’s Stock Advisor analyst team, while not currently recommending Bitcoin as a top stock to buy, acknowledges the cryptocurrency’s potential for market crushing outperformance compared to traditional equities. Historically, bitcoin’s price has surged following halving events, sometimes outpacing the returns of even the best-performing stocks.

For investors looking to diversify their portfolios, dollar cost averaging into Bitcoin can be a prudent strategy. By investing a fixed amount at regular intervals, investors can reduce the risk of buying at market peaks and benefit from price fluctuations over time. This approach, recommended by many stock advisor experts, helps smooth out the average cost basis and can lead to more consistent long-term results. As the next halving approaches, considering how Bitcoin fits into your broader investment strategy could help you capture potential upside while managing risk.

Potential Risks and Volatility

Investing in Bitcoin is high-risk, with the potential for total capital loss. Market dynamics can lead to unpredictable price swings before and after the halving, creating significant volatility. Investors should be cautious of market sentiment shifts causing sudden price changes.

External factors like regulatory changes can significantly influence Bitcoin’s market behavior. The timing and extent of Bitcoin’s price movements can vary greatly, often influenced by broader market conditions. Investors must stay informed and be prepared for potential market disruptions.

While high returns are alluring, it is crucial to weigh the risks and volatility of Bitcoin investments. A well-considered investment strategy can mitigate some risks, but caution and vigilance remain paramount.

Navigating Market Fluctuations

Market volatility is an inherent feature of the bitcoin market, especially around a halving event. The reduction in new supply often triggers a feedback loop: as the supply of new coins drops, demand can rise, pushing prices higher and attracting even more interest from investors. However, this post halving period can also bring sharp corrections and increased market volatility, as traders react to shifting market sentiment and new supply dynamics.

To navigate these fluctuations, it’s essential for investors to stay informed about the halving cycle and its impact on the market. Monitoring market sentiment, adoption trends, and macroeconomic developments can help you anticipate potential price movements. By understanding how the halving event influences supply and demand, investors can make more informed decisions and avoid common pitfalls, such as panic selling during downturns or overextending during price surges. Ultimately, a disciplined approach—grounded in research and a clear investment strategy—can help you weather the ups and downs of the bitcoin market and position yourself for long-term success.

Post-Halving Price Projections

Analysts predict Bitcoin’s price could average around $399,294 in 2028, with a minimum estimated price of approximately $388,085. Based on historical trends and current market dynamics, these projections suggest a substantial price increase post-halving. When compared to historical stock advisor returns, the projected gains for Bitcoin could potentially outpace the average returns seen from top-performing stock advisor services, which have historically outperformed benchmarks like the S&P 500.

By 2029, Bitcoin’s price is expected to range between $552,951 and $675,534. By 2030, the average price is estimated to be around $826,664. These projections highlight the potential for significant long-term growth, driven by diminishing new Bitcoin supply and increasing demand.

Bitcoin’s value is expected to fluctuate significantly, with projections suggesting it could reach up to $1,358,045 by 2031. This potential for substantial bitcoin’s price increases underscores the importance of strategic investment planning and staying informed about market trends and bitcoin concerns. Recently, a bitcoin strategy has become essential as bitcoin hit new highs, further emphasizing the volatility of bitcoin’s value, including instances where investors have seen returns of 3.125 btc. Notably, bitcoin’s price surged, highlighting the dynamic nature of the market. Such price surges have the potential to deliver monster returns for investors who position themselves ahead of the halving.

Summary

The 2028 Bitcoin halving is a pivotal event that is already influencing market sentiment and pricing. Understanding the historical patterns, the role of institutional investors, and the dynamics of supply shocks can provide valuable insights for investors. Strategic investment approaches, such as dollar-cost averaging, can help mitigate risks and capitalize on the anticipated price surge.

Staying informed and prepared is crucial for navigating the pre- and post-halving landscape. As Bitcoin continues to evolve and integrate into institutional portfolios, its potential as a hedge against inflation and a store of value remains strong. Investors should approach this opportunity with a balanced strategy, mindful of the potential risks and rewards.

Frequently Asked Questions

What if you put $1000 in Bitcoin 5 years ago?

A $1,000 investment in Bitcoin made five years ago would now be worth over $9,680 to $10,620, reflecting substantial growth despite some volatility during that period. Thus, investing in Bitcoin five years ago has proven to be highly profitable.

Does crypto price go up after halving?

Halving events generally lead to a reduction in the supply of new bitcoins, which, combined with stable demand, typically results in an increase in price. Historically, both the periods leading up to and following halving have shown bullish trends in Bitcoin’s market value.

What is a Bitcoin halving?

A Bitcoin halving is a significant event that occurs approximately every four years, halving the mining reward and thus slowing the creation of new Bitcoins. This mechanism helps control inflation and is pivotal in maintaining Bitcoin’s scarcity.

Why is the 2028 Bitcoin halving important now?

The 2028 Bitcoin halving is crucial now as it is shaping market sentiment and pricing, with investors expecting a supply shock that may lead to significant price increases. This anticipation highlights the event’s potential impact on the cryptocurrency market.

How do institutional investors affect Bitcoin halving events?

Institutional investors enhance the stability and legitimacy of Bitcoin during halving events by increasing market participation and boosting investor confidence through regulatory clarity and the introduction of Bitcoin ETFs. Their involvement can lead to greater price resilience and potential upward momentum in the market.