How Stablecoins Are Quietly Taking Over Global Payments

While the financial world debates the future of digital currencies, stablecoins have already begun their quiet conquest of global payments. A $250 billion market that didn’t exist a decade ago is now processing more monthly volume than many traditional payment networks, fundamentally changing how money moves across borders.

Unlike volatile digital assets like Bitcoin, stablecoins maintain stable value by pegging to traditional fiat currencies like the US dollar. This price stability has unlocked their potential as practical payment instruments, enabling businesses and individuals to harness blockchain technology’s speed and efficiency without exposure to wild price swings.

The transformation is happening across every major payment sector, from freelance payouts to corporate treasury operations. Traditional financial systems that once dominated cross border payments are watching their market share erode as stablecoin payments offer superior speed, lower costs, and 24/7 availability. Card networks, as part of the traditional payment infrastructure, contribute to the fees, delays, and opacity that have long plagued cross-border transactions.

Introduction to Stablecoins

Stablecoins are a category of digital currency engineered to maintain a stable value, most commonly by pegging their worth to established fiat currencies like the US dollar. This stability is achieved through mechanisms such as holding reserve assets ranging from cash and government bonds to other secure securities, that back each token in circulation. Operating on blockchain technology, stablecoins enable rapid, secure, and transparent transactions across borders, making them an increasingly attractive alternative to traditional financial systems.

Their ability to offer a stable value has made stablecoins especially valuable for cross border payments, where volatility and high fees have long been pain points. In regions with unstable economies, stablecoins provide individuals and businesses with a reliable way to store and transfer value, bypassing the risks associated with local currency fluctuations. As a result, stablecoins are not only facilitating more efficient global commerce but are also empowering users in markets underserved by conventional banking infrastructure.

The Silent Revolution: Stablecoins Transform Money Movement

The numbers tell a remarkable story of exponential growth. Stablecoins have reached $305 billion in circulation as of September 2025, up from just $5 billion five years earlier, a 61-fold increase that dwarfs traditional payment infrastructure expansion rates. This isn’t speculative trading driving growth; it’s real payment demand.

Monthly stablecoin payment volume has surged to unprecedented levels, with total blockchain transaction volumes exceeding $32 trillion in 2024. More importantly, payment-specific stablecoin volumes reached approximately $5.7 trillion according to Visa data, representing genuine cross border payments rather than crypto trading or arbitrage activities.

Over 10% of U.S.–Mexico remittances now use stablecoins, demonstrating real-world adoption beyond crypto speculation. This corridor alone processes billions in annual remittance volume, making it a significant test case for stablecoin viability. Major payment processors like Stripe report 30% monthly growth in stablecoin payment volume, indicating accelerating mainstream adoption.

Perhaps most striking, 26% of US adults used stablecoins for remittances abroad in the past year according to February 2025 surveys. This represents millions of Americans who’ve moved beyond traditional banking infrastructure to access faster, cheaper international money movement.

The speed advantage is transformative. Traditional Swift transfers between many markets take 3-5 days, while blockchain settlements using stablecoins complete in under 3 minutes. With stablecoins, users can send money quickly and efficiently across borders, bypassing traditional banking delays. This isn’t marginal improvement, it’s a fundamental reimagining of how quickly money can move globally.

Current stablecoin daily payment volumes range from $20 billion to $30 billion, split between remittances and business settlements. While this represents less than 1% of global daily money transfer volume, the trajectory suggests rapid scaling ahead. Industry analysts project stablecoins could reach 20% of global cross border payments by 2030, compared to approximately 3% today.

Real-World Adoption Across Key Payment Sectors

Freelancers and Digital Creators Breaking Free from Banking Delays

The gig economy has embraced stablecoins as liberation from traditional banking constraints. Visa Direct pilot programs and PayPal’s PYUSD enable fast cross-border payouts in dollar stablecoins, eliminating the week-long delays freelancers previously endured waiting for international wire transfers to clear.

Stripe’s stablecoin payment support has proven particularly valuable for businesses with recurring payouts to global contractors. Creators receive predictable dollar amounts in USDC, PYUSD, or USDT, completely avoiding foreign exchange risk that previously made international client relationships financially unpredictable.

This evolution has moved far beyond niche crypto deals to official payment flows with proper tax reporting and compliance tools. Payment platforms now offer seamless integration where clients pay in traditional currency while contractors receive stablecoins instantly, combining familiar fiat interfaces with blockchain settlement speed.

Consider a graphic designer in Eastern Europe working for US clients. Previously, a $2,000 invoice might take 5-7 business days to settle via international wire transfer, with $25-50 in fees plus unfavorable exchange rates. Today, the same payment settles in minutes as USDC with under $5 total cost, a massive improvement in both cash flow and economics.

Digital content creators on platforms integrating stablecoin payments report significant improvements in working capital management. Instead of batching payments monthly due to wire transfer costs, they can receive instant payouts for individual projects, fundamentally changing their financial planning capabilities. Additionally, freelancers and creators can now use stablecoins to pay bills directly from their digital wallets, making it practical to settle everyday expenses such as rent or purchases with stablecoins.

Cross-Border Business Payments and Emerging Markets

African fintech companies like Yellow Card demonstrate stablecoins’ transformative potential in emerging markets. By using USDT and USDC for cross border transfers, they’ve cut foreign exchange costs by up to 70% while reducing transfer delays from days to minutes.

Traditional cross-border payments cost an average of $6.08 for $200 transfers from UAE to Philippines, according to World Bank data. Comparable stablecoin transfers cost $1 or less, representing fundamental cost structure advantages that compound for businesses processing regular international payments.

PayPal, Stripe, and Conduit are rapidly adopting stablecoin rails for B2B cross border payments, recognizing that their enterprise clients demand better alternatives to correspondent banking networks. Local banks remain important as on/off-ramps while stablecoin payments run on cheaper, faster blockchain rails between endpoints.

The impact is particularly pronounced in unstable economies where businesses struggle with currency volatility and banking access. A manufacturing company in Latin America can now receive payment from European customers in USDC, maintaining dollar-denominated value throughout the settlement process while avoiding local currency devaluation risks.

Supply chain finance has emerged as another key adoption area. Companies use stablecoins to pay suppliers instantly upon delivery confirmation, improving supplier relationships while capturing early payment discounts. The programmable nature of smart contracts enables programmable payments, allowing automatic payment triggers based on shipping confirmations or quality inspections, which increases automation and efficiency.

Corporate treasury teams report significant improvements in cash flow predictability when using stablecoin payments. International subsidiary funding that previously required complex correspondent banking arrangements now happens instantly through blockchain networks, enabling more dynamic global liquidity management.

Remittances and Person-to-Person Transfers

Global remittances totaled $904 billion last year, representing one of the world’s largest payment flows and a natural fit for stablecoin infrastructure. Traditional remittance services like Western Union face intense pressure from stablecoin-based alternatives offering superior economics and speed.

MoneyGram and Crossmint have launched USDC corridors enabling near-instant transfers from US to Latin America, bypassing Swift rails and correspondent banks entirely. Recipients access funds within minutes rather than days, fundamentally changing the remittance experience for families depending on overseas income.

Western Union is responding by developing its own stablecoin USDPT to reduce costs and speed up transfers, acknowledging that traditional remittance infrastructure cannot compete with blockchain-based alternatives. This represents a major strategic shift for the world’s largest money transfer operator.

Active stablecoin wallets increased 53% in one year, primarily driven by payment usage rather than investment activity. This suggests genuine utility adoption as global users discover stablecoins’ practical advantages for moving money internationally.

The user experience improvement is dramatic. Instead of visiting physical remittance locations with cash, senders can now transfer value instantly from their smartphones. For recipients, stablecoins function as digital cash, providing a convenient and accessible way for families to receive and use funds instantly. Recipients access funds through local exchanges or crypto-friendly banks, often receiving better exchange rates than traditional remittance services offered.

Money market funds denominated in stablecoins are emerging as hybrid solutions, allowing remittance recipients to earn yield while maintaining dollar exposure. This evolution positions stablecoins not just as payment rails but as access points to the broader digital economy.

Central Bank Digital Currencies: The Parallel Evolution

Central Bank Digital Currencies (CBDCs) represent a new frontier in digital currencies, issued and regulated directly by national central banks. Unlike stablecoins, which are typically managed by private entities and backed by reserve assets, CBDCs are a direct liability of the central bank and carry the full backing of the government. The primary goal of CBDCs is to modernize the financial system by providing a secure, stable, and efficient digital alternative to cash and traditional payment methods.

Around the world, central banks are launching pilot programs and exploring the integration of CBDCs into the broader global financial infrastructure. These initiatives aim to enhance the efficiency of payments, reduce costs, and increase financial inclusion. As CBDCs and stablecoins evolve in parallel, there is growing potential for these digital currencies to work together, leveraging stablecoin infrastructure to create a more interconnected and resilient financial system. This dual-track development is shaping the future of digital payments and reinforcing the importance of robust, scalable payment rails in the digital economy.

Regulatory Embrace: From Resistance to Integration

United States: The GENIUS Act Legitimizes Stablecoin Payments

The GENIUS Act of 2025 represents a watershed moment in US stablecoin regulation, providing clear regulatory framework for payment stablecoins while tasking Treasury with licensing requirements. This legislation shifts the regulatory approach from exclusion to regulated integration within existing payment infrastructure.

US banks are now exploring issuing their own settlement tokens following this framework, recognizing stablecoins as legitimate tools for improving payment efficiency rather than threats to financial stability. The regulatory framework focuses on anti-money laundering, consumer protection, and reserve requirements rather than outright prohibition.

Key provisions require stablecoin issuers to back tokens with safe, liquid assets like Treasury bills and maintain transparent reserve reporting. Circle’s USDC has become the compliance template, demonstrating how properly managed stablecoins can operate within traditional financial regulations.

The genius act specifically defines payment stablecoins as distinct from other digital assets, creating regulatory certainty that enables broader institutional adoption. Banks can now offer stablecoin services to business customers without regulatory ambiguity, accelerating enterprise integration.

This regulatory clarity has unleashed innovation in traditional finance. JPMorgan and other major banks are launching stablecoin payment initiatives for wholesale settlement, viewing blockchain infrastructure as natural evolution of existing payment networks rather than disruptive competition.

Europe: MiCA Framework and Bank-Issued Euro Stablecoins

Nine major European banks formed a joint venture to issue MiCA-compliant euro stablecoins, creating regulated European alternatives to dollar-denominated USDT and USDC. This strategic initiative aims to establish European monetary sovereignty in digital payments while meeting strict regulatory requirements.

The european central bank supports a dual model combining strict MiCA rules with bank-issued euro stablecoins, ensuring European businesses can access blockchain payment advantages without relying on dollar-based infrastructure. This approach positions Europe as a leader in regulated stablecoin adoption.

MiCA’s framework emphasizes transparent, regulated settlement instruments embedded in European law, providing legal certainty that enables broader business adoption. European businesses can now integrate euro stablecoins into payment infrastructure with full regulatory compliance assurance.

The contrast between European and US approaches highlights different strategic priorities. While the US focuses on maintaining dollar dominance through regulated USD stablecoins, Europe emphasizes monetary sovereignty and reduced dependence on dollar-based payment systems.

European payment processors are rapidly integrating MiCA-compliant stablecoins into their platforms, recognizing growing demand from businesses seeking faster, cheaper cross border transfers within European economic zones and globally.

Asia-Pacific: Strategic Stablecoin Initiatives

Hong Kong’s Stablecoins Ordinance of 2025 requires licenses for fiat-pegged stablecoin issuers, establishing the territory as a regulated hub for Asian stablecoin innovation. This regulatory framework attracts major financial institutions seeking compliant stablecoin operations in Asia.

South Korea’s Toss bank plans won-pegged stablecoin issuance pending final legal frameworks, demonstrating how Asian financial institutions view stablecoins as strategic tools for regional expansion. Standard Chartered and Ant Group are pursuing licensed stablecoin issuance across multiple Asian jurisdictions.

Asian countries increasingly view stablecoins as competitive advantages in developing their financial hubs. Singapore, Hong Kong, and UAE offer regulatory sandboxes enabling stablecoin experimentation while maintaining appropriate oversight of systemic risks.

The regional approach emphasizes stablecoins as infrastructure for connecting Asian economies with global markets. Cross border trade finance using Asian-issued stablecoins could reduce dependence on dollar-based correspondent banking while maintaining stable value references.

China’s digital yuan represents a different approach—central bank digital currencies rather than private stablecoins—but the overall trend toward digital payment infrastructure is consistent across the region. Asian economies recognize digital transformation as essential for maintaining financial competitiveness.

Corporate Treasury and Stablecoins: A New Era for Enterprise Finance

The adoption of stablecoins is ushering in a new era for corporate treasury operations, fundamentally changing how businesses manage cross border payments, liquidity, and foreign exchange exposure. By leveraging digital currencies, companies can streamline payment processes, reduce reliance on traditional payment rails, and minimize FX costs associated with international transactions. Stablecoins enable treasury teams to move funds instantly across borders, improving cash flow visibility and allowing for more agile financial decision-making.

For multinational corporations, stablecoins simplify the complexity of managing treasury operations across multiple jurisdictions. Payments to suppliers and receipts from customers can be settled in real time, eliminating the delays and unpredictability of legacy banking systems. This increased efficiency not only reduces operational costs but also empowers treasury teams to manage liquidity more proactively, optimizing working capital and supporting global business growth. As more enterprises recognize the strategic advantages of digital currencies, stablecoin adoption in corporate treasury is poised for significant expansion.

Enterprise Integration: From Pilots to Production

Major corporations like Ferrari and SpaceX have moved beyond pilot programs to production stablecoin usage for treasury operations and international payments. These implementations demonstrate that enterprise-scale stablecoin adoption is not just possible but advantageous for improving operational efficiency.

J.P. Morgan and other major banks are launching stablecoin payment initiatives specifically for wholesale settlement, recognizing that institutional clients demand faster, cheaper alternatives to traditional correspondent banking. These initiatives target large corporate clients with significant cross border payment volumes.

Companies are using stablecoins for instant fund transfers between subsidiaries, eliminating Swift delays that previously created working capital inefficiencies. A multinational corporation can now move millions between European and Asian subsidiaries in minutes rather than days, dramatically improving global cash management.

Stablecoin-based payroll solutions from companies like AllScale and Rise are reducing payment times from weeks to minutes for businesses with global workforces. Increasingly, businesses are leveraging digital dollars to streamline payroll and international payments, making transactions more efficient and boosting employee satisfaction. International contractors receive payments instantly rather than waiting for complex international wire transfers, improving employee satisfaction and retention.

The treasury operations impact extends beyond speed improvements. Corporate treasury teams can now manage liquidity dynamically across global subsidiaries, responding to opportunities and challenges in real-time rather than planning around multi-day settlement delays.

Enterprise adoption often follows a hybrid model where companies maintain traditional banking relationships while using stablecoins for specific use cases where speed and cost advantages are most pronounced. This approach reduces implementation risk while capturing immediate benefits.

Stablecoins and Money Market Funds: Bridging Traditional and Digital Finance

The intersection of stablecoins and money market funds is creating innovative pathways that bridge traditional finance with the emerging world of digital assets. Money market funds, known for their low-risk, short-term investments and liquidity, are now being integrated with stablecoins to offer investors a stable, yield-generating store of value. This combination allows users to benefit from the security and regulatory oversight of traditional finance while enjoying the speed, transparency, and accessibility of digital finance.

By utilizing stablecoins within money market funds, investors can achieve faster settlement times and greater flexibility in managing their assets. This synergy is particularly appealing in a low-yield environment, where the search for efficient, higher-return solutions is driving market growth. As stablecoin-based money market funds gain traction, they are paving the way for new financial products that cater to both institutional and retail investors, further accelerating the convergence of digital and traditional financial systems.

The Infrastructure Ecosystem Supporting the Takeover

Payment infrastructure providers like Bridge, MoonPay, and Ramp Network have built sophisticated systems enabling easy stablecoin integration for businesses without blockchain expertise. These platforms abstract away technical complexity while providing enterprise-grade reliability and compliance tools.

Compliance tools from Chainalysis and TRM Labs provide anti-fraud monitoring and regulatory reporting capabilities that make stablecoin payments suitable for regulated financial institutions. This compliance infrastructure was essential for mainstream adoption beyond crypto-native businesses.

Crypto platforms act as key intermediaries, facilitating seamless integration between traditional financial systems and digital assets. Three primary integration models have emerged: on-ramp/off-ramp services that convert between fiat and stablecoins, brokerage-based solutions that handle blockchain complexity for clients, and direct on-chain integration for businesses wanting maximum control and efficiency.

Tokenized money market funds from Franklin Templeton, Circle, and BlackRock are managing billions in assets, creating yield-generating alternatives to traditional cash management. These products combine stablecoin convenience with institutional-grade asset management, appealing to corporate treasuries seeking better returns on working capital. Stablecoins and related products may be backed not only by cash reserves but also by other assets such as government bonds or corporate securities, ensuring stability and trust in their value.

The infrastructure ecosystem has reached maturity levels enabling seamless business integration. Companies can now integrate stablecoin capabilities into existing payment systems without rebuilding core infrastructure, dramatically reducing implementation barriers.

Payment orchestration platforms are emerging that automatically route payments between stablecoin and traditional rails based on cost, speed, and reliability optimization. This automated intelligence enables businesses to capture stablecoin advantages without manual intervention for every transaction.

Risks and Challenges in the Stablecoin Revolution

Issuer and reserve risk remain fundamental concerns as stablecoins depend entirely on issuer reserves to maintain their 1:1 peg to underlying fiat currencies. Stablecoins maintain their value by being pegged to a reserve asset, most commonly the US dollar, and the quality of the reserve asset is crucial for ensuring stability. While major issuers like Circle maintain high-quality reserves in Treasury bills, the centralized nature creates single points of failure that traditional banking infrastructure distributes across multiple institutions.

Technical risks include potential depegs during market stress, protocol bugs in underlying blockchain networks, and security breaches that could compromise user funds. The May 2022 Terra USD collapse demonstrated how quickly stablecoins can lose their pegs when underlying mechanisms fail.

Regulatory and sanctions risks pose ongoing challenges as governments can block addresses or restrict stablecoin services for geopolitical reasons. Businesses using stablecoins for international payments must consider compliance requirements across all jurisdictions where they operate.

The need for financial hygiene and risk awareness becomes crucial when treating stablecoins as payment rails rather than investment vehicles. Businesses must implement proper treasury controls, custody procedures, and risk management frameworks when integrating stablecoins into payment operations.

Operational risks include key management challenges, as losing access to stablecoin wallets means permanently losing funds, unlike traditional bank accounts where institutions can help recover access. This requires businesses to implement robust backup and recovery procedures.

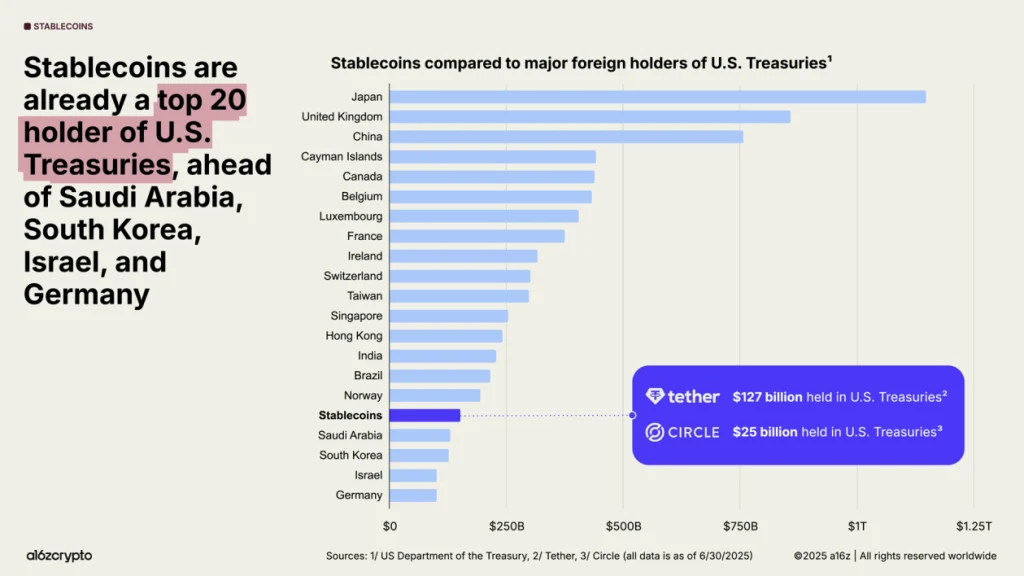

Market concentration represents another concern, as USD stablecoin issuers held about $155 billion in Treasury bills by October 2025, representing about 2.5% of total Treasury holdings. This concentration could create systemic risks if stablecoin adoption continues accelerating without diversification.

The Future: Dual-Rail Payment Systems and Programmable Money

The future of global payments will feature dual-rail systems that combine stablecoin and traditional payment rails dynamically, selecting optimal routes based on cost, speed, reliability, and regulatory requirements. This hybrid approach captures blockchain advantages while maintaining compatibility with existing financial infrastructure.

Orchestration layers will emerge that make payment routing decisions automatically, comparing traditional banking costs and speed against various stablecoin options in real-time. Businesses will specify parameters like maximum cost or required settlement time, and systems will execute payments using the most appropriate rails.

Payments will become network-agnostic and programmable, enabling sophisticated business logic around payment triggers, conditions, and settlements. Smart contracts will automate complex payment workflows that currently require manual intervention, from supplier payments triggered by delivery confirmations to automated revenue sharing based on performance metrics.

Integration of yield-generating strategies with stablecoin payment functionality will create new business models where companies can earn returns on payment floats while maintaining liquidity for operational needs. Treasury operations will become more dynamic and profitable through programmable money management.

The building blocks for this transformation are already emerging. Major payment processors are implementing stablecoin infrastructure, regulatory frameworks are providing clarity, and businesses are discovering practical advantages that justify adoption despite remaining risks and challenges.

Global financial infrastructure will likely evolve toward hybrid systems rather than complete replacement of traditional banking. Local banks will remain important for regulatory compliance and customer service, while stablecoin rails will handle the actual money movement for speed and cost advantages.

Mass adoption depends on continued infrastructure maturation, regulatory clarity, and user experience improvements that make stablecoin payments as simple as traditional digital payments. The foundation is in place; widespread adoption is now primarily a matter of time and continued execution by infrastructure providers and stablecoin issuers.

The stablecoin revolution isn’t coming—it’s already here, quietly transforming how money moves around the world. As traditional and blockchain payment rails converge, businesses that adapt early will gain significant competitive advantages in an increasingly connected digital economy.