Why SEI is Becoming the Go-to Chain For High-Frequency Trading Apps

In the world of high frequency trading, milliseconds translate directly into profits, and network congestion can mean the difference between a successful trade and a costly miss. Traditional blockchains like Ethereum, with their 15-minute finality times, limited throughput, and higher fees, simply weren’t designed for the demanding requirements of professional trading operations. This fundamental mismatch has created a massive opportunity for specialized blockchain technology that prioritizes speed, efficiency, low transaction costs, and trading-specific infrastructure.

Sei emerges as a purpose-built solution to this problem, positioning itself as the go to blockchain for high frequency trading applications through a combination of breakthrough performance metrics and native trading infrastructure. With sub-400ms finality, throughput exceeding 20,000 transactions per second, and built-in order matching capabilities, Sei offers what traditional blockchains cannot: institutional-grade performance tailored specifically for decentralized finance and trading applications. Sei is designed to enable fast and efficient transactions, which are crucial for high frequency trading and DeFi activity.

The numbers tell a compelling story. Since its mainnet launch in August 2023, the Sei ecosystem has attracted over $120 million in total value locked, with trading platforms processing more than $47 million in daily volume. The ecosystem is seeing an increasing number of DeFi projects building on Sei, further expanding its reach and adoption. Trading focused DeFi applications are a core use case, leveraging Sei’s speed and scalability. The Sei token plays a central role in network utility, governance, and validator incentives, while SEI tokens are essential for staking and network security. But beyond the impressive metrics, Sei’s architecture addresses the core challenges that have prevented widespread adoption of decentralized exchanges and high frequency trading applications on blockchain infrastructure.

Sei’s vision is to become the leading blockchain for decentralized exchanges and high-performance DeFi applications, emphasizing scalability, efficiency, and security to meet the evolving needs of traders and liquidity providers. As the market faces the growing demands of DeFi traders and decentralized exchanges, Sei is designed to meet these needs through its high-performance, scalable architecture.

Introduction to Sei

Sei is a high-performance, layer 1 blockchain purpose-built to power the next generation of trading-focused decentralized applications and decentralized finance (DeFi) protocols. As the backbone of the sei ecosystem, Sei leverages the Cosmos SDK to deliver unmatched speed, scalability, and interoperability for DeFi traders and developers. Its architecture is specifically optimized for high frequency trading, making it the ideal foundation for decentralized exchanges (DEXs), trading applications, and other frequency trading platforms that demand rapid execution and minimal transaction fees.

What sets Sei apart is its native order matching engine, which streamlines the trading process and eliminates the inefficiencies found in traditional blockchain-based DEXs. This allows decentralized applications to offer a seamless, high performance trading experience that rivals centralized platforms, while maintaining the transparency and security of decentralized finance. With its focus on low transaction fees and efficient transaction processing, Sei offers a compelling solution for DeFi traders seeking both speed and cost-effectiveness. As decentralized finance continues to evolve, Sei’s high frequency, trading-optimized infrastructure positions it as a leader in the layer 1 blockchain landscape.

Ultra-Fast Transaction Finality Meets HFT Demands

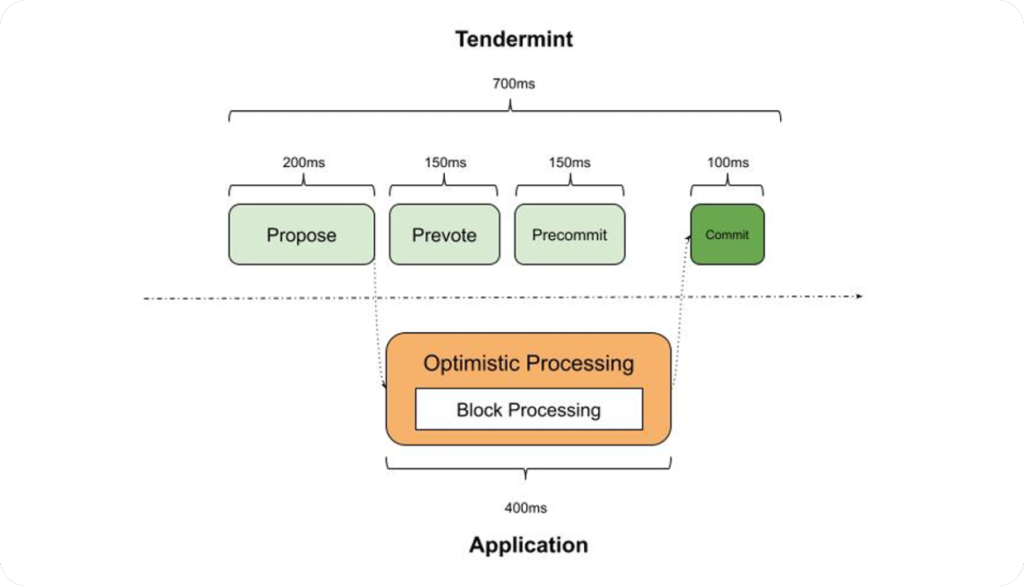

The foundation of Sei’s competitive advantage lies in its twin turbo consensus mechanism, which achieves sub second finality that makes the platform sei ideal for high frequency trading where every millisecond counts. Unlike traditional blockchain architectures that require multiple confirmation blocks, Sei’s twin turbo consensus mechanism enables single slot finality, meaning transactions become irreversible in approximately 380-400 milliseconds.

This represents a quantum leap in blockchain speed when compared to existing solutions. Ethereum’s proof-of-stake network requires roughly 15 minutes for true finality, while even high-performance chains like Solana need approximately 2.5 seconds. For high frequency trading applications, these delays create unacceptable execution risk and eliminate entire categories of trading strategies that depend on near-instantaneous settlement.

The twin turbo consensus achieves this breakthrough through two key innovations: smart block propagation and optimistic block processing. Smart block propagation optimizes how transaction data moves through the validator network, reducing the time validators spend waiting for complete block information. Meanwhile, optimistic block processing allows the network to finalize transactions before receiving full validator confirmation, dramatically reducing latency without compromising security.

Consider a practical scenario: an arbitrage opportunity between two decentralized exchanges that exists for only 500 milliseconds. On Ethereum, a trader would miss this opportunity entirely due to network latency. On Solana, the window would close before confirmation. But on sei, traders can execute, confirm, and settle such opportunities within the available timeframe, opening up high frequency trading strategies previously impossible on decentralized platforms.

The consensus mechanism’s efficiency extends beyond individual transaction speed. By processing transactions faster, Sei reduces the time that trading capital remains locked in pending states, improving capital efficiency for trading applications and enabling more sophisticated trading strategies that require rapid position adjustments.

Native Trading Infrastructure Built for Speed

What truly makes sei the go to chain for high frequency trading apps is its native order matching engine, which eliminates the infrastructure overhead that plagues other blockchain platforms. Rather than requiring developers to build order-matching logic in smart contracts—adding latency and computational complexity—Sei provides this functionality at the protocol level.

The native decentralized exchange framework includes a built-in Central Limit Order Book (CLOB) system that supports the advanced order types and execution models familiar to institutional traders. This includes limit orders, market orders, stop-loss orders, and other sophisticated trading instruments that form the backbone of professional trading operations. Unlike automated market maker (AMM) systems that dominate other blockchains, Sei’s CLOB provides precise price discovery and eliminates the slippage issues that make high frequency trading unprofitable on AMM-based platforms.

Frequent batch auctioning creates a fairer trading environment by grouping orders and executing them simultaneously, reducing the advantages of latency-based strategies and front-running. This mechanism protects smaller traders while maintaining the efficiency that high frequency trading applications require. The system processes these batches within single blocks, ensuring that order placement and execution can occur within the same 400-millisecond finality window.

MEV (Miner Extractable Value) resistance forms another crucial component of Sei’s trading infrastructure. Traditional blockchains allow validators or miners to reorder transactions for profit, creating an unfair environment where sophisticated actors can extract value from other traders. Sei’s architecture includes specific protections against these practices, creating more predictable execution costs and fairer outcomes for all participants.

Real-world examples demonstrate these advantages in action. SeiSwap, one of the primary decentralized exchanges built on Sei, processes trades with execution speeds that rival centralized exchange performance while maintaining the transparency and non-custodial benefits of decentralized finance. Other trading platforms like Astroport and White Whale have already migrated or expanded to Sei specifically to leverage these native trading capabilities.

Massive Throughput Scaling with Parallel Execution

Sei’s approach to transaction processing represents a fundamental architectural innovation that enables throughput scaling impossible on traditional sequential blockchains. The current network capacity exceeds 20,000 transactions per second, with the upcoming Sei Giga upgrade targeting 200,000 TPS by 2025—performance levels that approach institutional-grade trading infrastructure requirements.

Parallel transaction processing forms the core of this scalability breakthrough. While most blockchains process transactions one at a time, sei aims to execute multiple non-conflicting transactions simultaneously across different validator cores. This approach recognizes that many trading activities—such as trades involving different asset pairs—have no logical dependencies and can safely occur in parallel without compromising consistency.

| Blockchain | Current TPS | Finality Time | Trading Optimization |

| Ethereum | ~15 | 15 minutes | None |

| Solana | ~65,000 | 2.5 seconds | Limited |

| Sei | 20,000+ | 0.4 seconds | Native |

Optimistic parallelization handles the complex scenarios where transactions might conflict, such as two trades attempting to use the same input assets. The system tentatively executes transactions in parallel, then identifies and properly sequences any conflicts after the fact. This approach maximizes throughput while maintaining strict consistency guarantees required for financial applications.

The implications for high frequency trading applications are substantial. A trading platform built on Ethereum can process perhaps 10-15 trades per block, with 12-15 second block times creating significant execution delays. Solana improves throughput but lacks the trading-specific optimizations that reduce latency for financial operations. Sei combines high throughput with trading-optimized execution, enabling platforms to handle thousands of simultaneous trading operations without performance degradation.

The sei ecosystem benefits from this scalability in measurable ways. During peak trading periods, when network congestion typically causes transaction fees to spike and execution times to increase, Sei maintains consistent performance. This reliability becomes crucial for high frequency trading applications where performance predictability is often more important than peak performance.

The planned Sei Giga upgrade represents the next evolution in this scaling approach. By targeting 200,000 TPS while maintaining sub-second finality, the upgrade positions sei to handle institutional trading volumes that would overwhelm other blockchain platforms. This roadmap demonstrates Sei’s commitment to staying ahead of growing demand in the defi space.

Advanced Database Optimization for Trading Performance

SeiDB’s innovative two-layer architecture provides the data access performance that trading applications require, addressing a fundamental bottleneck that limits other blockchain platforms. Traditional blockchain databases weren’t designed for the rapid queries that trading applications need—checking balances, retrieving price histories, and updating order states in real-time.

The State Commitment Layer maintains the latest blockchain state optimized for instant access, while the database achieves 90% data size reduction through intelligent pruning of historical information that trading applications rarely need to access immediately. This design means that balance queries, order book updates, and transaction confirmations occur with minimal latency, even as the network scales to handle larger transaction volumes.

Efficient metadata storage enables trading platforms to provide instant balance and transaction history queries without the delays that plague other blockchain platforms. When a trader checks their portfolio balance or reviews recent transaction history, the response occurs in milliseconds rather than seconds, creating user experiences comparable to centralized exchange platforms.

The database optimization directly impacts trading app performance in several measurable ways. Order book updates occur in real-time as new orders arrive and existing orders execute, providing traders with accurate market information needed for decision-making. Price feed updates propagate instantly across all connected trading applications, ensuring that arbitrage opportunities and market movements are reflected consistently across the sei network.

For high frequency trading applications, these database optimizations eliminate a significant source of latency that accumulates in traditional blockchain architectures. While other platforms might require several database queries to execute a complex trade, Sei’s optimized architecture handles the same operations with minimal overhead, keeping total execution times within the critical sub-second thresholds that high frequency trading requires.

Cost-Effective Trading at Scale

Low transaction fees form a critical component of what makes sei attractive for high frequency trading applications, where transaction costs directly impact strategy profitability. Traditional high-frequency trading on centralized exchanges often involves thousands of transactions daily, making cost efficiency essential for maintaining profitable operations.

Sei’s fee structure remains economically viable even during high trading volumes, contrasting sharply with networks like Ethereum where gas fees can spike to hundreds of dollars during peak congestion periods. Gas optimization built into Sei’s architecture ensures that trading platforms can offer competitive fee structures to their users while maintaining sustainable economics for platform operators.

Cost comparison reveals the economic advantage clearly. During Ethereum’s peak congestion periods, simple token swaps might cost $50-100 in transaction fees, making high frequency trading strategies completely uneconomical. Even on more efficient networks, frequent trading quickly accumulates significant cost overhead that eliminates strategy profitability.

Sei addresses this challenge through multiple architectural decisions that keep costs low. Efficient consensus reduces the computational overhead required for transaction validation, while optimized database operations minimize the resources needed to maintain network state. Parallel processing enables higher throughput without proportionally increasing infrastructure costs, allowing the network to maintain low fees even as transaction volume grows.

The economic benefits extend beyond simple transaction costs. Faster finality reduces the capital costs associated with maintaining open positions during settlement delays, effectively lowering the total cost of capital for trading operations. Predictable fee structures enable trading platforms to offer transparent pricing to users, building trust and enabling more sophisticated trading strategies that require precise cost calculations.

Trading platforms built on sei report transaction costs that are 90% lower than comparable operations on Ethereum, with greater predictability that enables more sophisticated automated trading strategies. These economics make previously unprofitable trading strategies viable while improving the overall accessibility of decentralized finance for retail and institutional traders alike.

Comparison to Other Blockchains

Sei distinguishes itself from other blockchains through a combination of innovative features designed specifically for high frequency trading and decentralized finance. Its Twin-Turbo Consensus mechanism and parallel execution capabilities enable Sei to process transactions at speeds and volumes that far exceed those of general-purpose blockchains like Ethereum. While Ethereum struggles with high transaction fees and slower processing times, Sei offers a streamlined environment where high frequency trading applications can thrive without the bottlenecks of network congestion.

EVM compatibility further enhances Sei’s appeal, allowing developers to deploy Ethereum-based smart contracts on the platform with minimal adjustments. This seamless integration means that teams can leverage existing codebases and developer tools while benefiting from Sei’s superior trading infrastructure. Unlike other layer 1 blockchains that cater to a broad range of use cases, Sei’s focus on trading applications and DeFi protocols ensures that its consensus mechanism, transaction processing, and infrastructure are all optimized for the unique demands of frequency trading. This specialization makes Sei the go-to choice for projects seeking high performance and efficiency in the decentralized finance space.

Growing Ecosystem Adoption in Trading Sector

The sei ecosystem demonstrates measurable growth that validates its positioning as the preferred platform for trading applications. With over $120 million in total value locked and daily trading volumes exceeding $47 million, the network has achieved the critical mass necessary to support sophisticated trading operations while maintaining the liquidity that high frequency trading applications require.

More than 70 development teams are actively building trading-focused applications on sei, representing a concentration of specialized development talent that accelerates innovation and creates network effects beneficial to all platform participants. This developer interest stems not just from sei’s technical advantages but from the growing recognition that specialized blockchain infrastructure provides competitive advantages over general-purpose platforms.

SeiSwap has emerged as the flagship decentralized exchange, processing significant trading volumes while demonstrating the practical advantages of Sei’s native trading infrastructure. The platform offers order types and execution speeds that were previously impossible on decentralized platforms, bridging the gap between centralized exchange performance and decentralized platform benefits.

Major defi protocols have begun integrating with sei since the mainnet launch, recognizing the platform’s advantages for trading-intensive applications. These integrations include lending protocols that benefit from faster liquidation capabilities, yield farming platforms that require frequent rebalancing, and derivatives platforms that depend on precise execution timing.

The network’s growth trajectory shows signs of sustainable adoption rather than speculative activity. Daily active addresses have grown consistently, transaction counts maintain steady growth patterns, and new application launches continue at an accelerating pace. This organic growth pattern suggests that sei positions itself successfully as the infrastructure layer for the next generation of trading applications.

Partnership announcements and strategic alliances continue expanding sei’s reach into institutional trading markets. Traditional trading firms exploring defi infrastructure increasingly view sei as the platform capable of supporting their performance requirements while providing the operational benefits of blockchain-based settlement and transparency.

Sei’s Role in the Market

Sei plays a pivotal role in the decentralized finance market by providing a high-performance platform tailored for trading-focused applications. Its low-latency and high-throughput capabilities make it the preferred choice for decentralized exchanges, NFT marketplaces, and a diverse range of DeFi protocols that require efficient and reliable transaction processing. Sei aims to be the go-to blockchain for DeFi applications, offering a fairer trading environment where users benefit from low transaction fees and consistent network performance, even during periods of high demand.

By addressing persistent challenges such as network congestion and unpredictable transaction costs, Sei facilitates the growth of the DeFi ecosystem and empowers both developers and users. Its vision is to create a seamless, high performance infrastructure that supports the next wave of decentralized innovation, making it easier for projects to launch and scale trading applications. As the DeFi market continues to expand, Sei’s commitment to efficient transaction processing and a fairer trading environment positions it as a foundational layer for the future of decentralized finance.

Developer-Friendly Features for Trading App Development

EVM compatibility enables trading platforms built on Ethereum to migrate to sei with minimal code changes, reducing the friction that typically prevents developers from switching blockchain platforms. Support for the Ethereum Virtual Machine allows developers to deploy Ethereum smart contracts on Sei, enhancing cross-chain compatibility. This compatibility means that existing trading smart contracts, user interfaces, and operational processes can transfer to sei while immediately benefiting from improved performance characteristics.

CosmWasm support provides flexible smart contract development options for teams that want to build custom trading logic optimized specifically for Sei’s architecture. This dual approach—supporting both familiar Ethereum tooling and native Cosmos development—attracts developers with different backgrounds and preferences while enabling innovation that leverages Sei’s unique capabilities.

Pointer Contracts enable seamless token interoperability between EVM and CosmWasm environments, solving integration challenges that could otherwise fragment the sei ecosystem. These features facilitate communication between EVM and CosmWasm environments, streamlining cross-environment interactions. Trading platforms can use EVM-compatible interfaces for user interactions while implementing performance-critical trading logic in optimized CosmWasm contracts, combining familiarity with performance optimization.

Comprehensive developer tools accelerate development cycles for trading applications, providing the testing frameworks, monitoring capabilities, and deployment pipelines that sophisticated trading platforms require. Unlike general-purpose blockchain platforms where developers must build trading-specific tooling from scratch, sei offers pre-built solutions for common trading application requirements.

The development timeline advantages are measurable. Teams report reducing time-to-market for trading applications by 60% compared to building equivalent functionality on other blockchain platforms. This acceleration stems from both the availability of native trading infrastructure and the comprehensive development support that eliminates common implementation challenges.

Documentation and community support specifically address trading application development, providing tutorials, code examples, and best practices that help development teams avoid common pitfalls and leverage sei’s advantages effectively. This specialized support creates a learning curve advantage that helps teams maximize the benefits of Sei’s architecture.

Addressing Challenges

Sei’s innovative architecture is purpose-built to overcome the challenges that have historically limited the growth of DeFi applications. Through parallel transaction processing and optimistic parallelization, Sei achieves fast and efficient transaction throughput, significantly reducing latency and enabling high frequency trading at scale. The platform’s frequent batch auctioning and Twin-Turbo Consensus mechanism work together to minimize miner extractable value (MEV), ensuring a fairer trading environment for all participants.

By leveraging advanced blockchain technology and integrating with the broader Cosmos ecosystem, Sei provides a secure and decentralized alternative to centralized exchanges. Its consensus mechanism is designed to handle the demands of modern DeFi protocols, supporting rapid transaction processing and robust network security. These innovations not only address the technical limitations of previous platforms but also promote the growth of the DeFi space by making decentralized trading more accessible, efficient, and equitable.

Institutional-Grade Security and Reliability

Delegated Proof-of-Stake consensus with 39 validators provides the security guarantees that institutional trading applications require while maintaining the performance characteristics that make sei attractive for high frequency trading. The validator set includes established operators with proven track records in securing high-value blockchain networks, creating confidence for institutional capital deployment.

Built on the battle-tested Cosmos SDK and Tendermint consensus mechanisms, sei inherits years of production deployment experience and security hardening that provides operational reliability for mission-critical trading applications. This foundation contrasts with newer blockchain platforms that lack extensive real-world testing under adversarial conditions.

Slashing mechanisms protect against malicious validator behavior through economic penalties that make attacks financially irrational, creating strong incentives for honest operation that institutional users require for confident capital deployment. These mechanisms have been tested through multiple network stress scenarios without compromise to network security or stability.

Network uptime records since mainnet launch demonstrate operational reliability that supports 24/7 trading operations. High frequency trading applications cannot tolerate network outages or performance degradation during critical market conditions, making proven operational reliability a prerequisite for institutional adoption.

Security audits and penetration testing specifically focus on trading-related attack vectors, ensuring that sei’s native trading infrastructure maintains security standards appropriate for high-value financial operations. The consensus mechanism, order-matching engine, and database optimization features all undergo rigorous security evaluation by specialized blockchain security firms.

Risk management features built into the protocol level help trading platforms implement appropriate safeguards for user funds and system stability. These include configurable position limits, automatic liquidation mechanisms, and emergency pause functionality that enables rapid response to market anomalies or technical issues.

Short-Term Outlook

In the near future, Sei is poised for significant growth as it continues to expand its ecosystem and attract new projects. With its strong emphasis on decentralized finance and trading applications, Sei is well-positioned to meet the rising demand for high performance blockchain platforms. As more developers and traders seek out solutions that offer low fees, fast transactions, and high throughput, Sei’s unique capabilities are expected to drive increased adoption and ecosystem development.

The platform’s high performance blockchain infrastructure, combined with its focus on seamless user experiences and efficient transaction processing, makes Sei a leading contender in the evolving DeFi space. As the decentralized finance ecosystem matures, Sei’s ability to deliver reliable, cost-effective, and scalable trading solutions will be instrumental in shaping the future of decentralized applications and driving the next wave of innovation in the industry.

Future Roadmap Solidifies HFT Leadership

Multi-proposer architecture currently in development will further boost transaction throughput by enabling multiple validators to propose blocks simultaneously, removing bottlenecks that could limit scaling as the network grows. This approach addresses potential congestion points before they impact trading application performance, maintaining sei’s competitive advantages as adoption increases.

Enhanced EVM compatibility improvements aim to attract more Ethereum-based trading projects by reducing migration friction and enabling more sophisticated cross-chain functionality. These enhancements recognize that the defi ecosystem spans multiple blockchain platforms, and trading applications need seamless interoperability to access liquidity and functionality across networks.

Cross-chain interoperability through Cosmos IBC enables multi-chain trading strategies that can access liquidity and opportunities across the broader cosmos ecosystem and beyond. This connectivity creates arbitrage opportunities and capital efficiency improvements that benefit high frequency trading applications while expanding the total addressable market for trading platforms built on sei.

The $100 million ecosystem fund supporting trading-focused application development provides financial incentives for teams building innovative trading infrastructure and applications. This funding accelerates development timelines while attracting top-tier development talent to the sei ecosystem, creating a competitive advantage in developer mindshare and application innovation.

Specific roadmap milestones include performance targets that push transaction throughput toward 200,000 TPS while maintaining sub-second finality, establishing sei as the clear performance leader among trading-focused blockchain platforms. These targets reflect not just technical ambition but practical requirements for supporting institutional trading volumes and sophisticated trading strategies.

The roadmap also addresses emerging requirements in the defi space, including improved privacy features for institutional trading, enhanced compliance tooling for regulated markets, and integration capabilities with traditional financial infrastructure. These developments position sei to capture institutional trading volume as traditional finance increases its defi participation.

sei’s vision extends beyond current market requirements to anticipate the needs of next-generation trading applications, including AI-powered trading strategies, cross-chain derivatives markets, and real-time risk management systems that require performance characteristics unavailable on traditional blockchain platforms.

The Clear Choice for High-Frequency Trading Applications

The evidence overwhelmingly supports sei as the emerging go to blockchain for high frequency trading applications. Through its combination of sub-400ms finality, native trading infrastructure, massive parallel throughput, and developer-friendly features, sei addresses every major limitation that has prevented widespread adoption of blockchain technology in professional trading operations.

The growing sei community of developers, traders, and institutional participants creates network effects that strengthen the platform’s competitive position. As more trading applications launch on sei, liquidity concentrates on the platform, attracting additional applications and users in a self-reinforcing cycle that establishes sei as the central hub for decentralized trading activities.

For trading platforms considering blockchain infrastructure decisions, sei offers a unique combination of performance, functionality, and ecosystem support that simply isn’t available elsewhere. The platform’s specialization in trading use cases provides advantages that general-purpose blockchains cannot match, while its roadmap ensures these advantages will expand as the market evolves.

The numbers speak for themselves: institutions and developers are choosing sei for trading applications because it delivers the performance and reliability that high frequency trading demands. With continued ecosystem growth, technological advancement, and institutional adoption, sei is rapidly becoming the definitive platform for the future of decentralized trading.

Whether you’re building the next generation of trading applications or evaluating blockchain infrastructure for your trading operations, sei offers the specialized performance and features that make it the go to chain for high frequency trading apps in the evolving defi landscape.