Crypto Bridges Explained: Why They’re Powerful (and Dangerous)

Crypto bridges allow the seamless transfer of assets between different blockchain networks, making them powerful tools in the crypto space. These are also known as blockchain bridges, which enable interoperability between separate blockchain networks. However, their complexity also introduces significant security vulnerabilities, raising concerns about potential attack vectors and the need for robust safeguards. In this article, we will explain how crypto bridges work, “crypto bridges explained why they’re powerful and dangerous,” and what makes them dangerous.

Key Takeaways

- Cross-chain bridges enhance blockchain interoperability, allowing seamless asset and information transfer between different networks, which is vital for decentralized applications (DApps).

- There are two main types of cross-chain bridges: custodial, which pose security risks due to asset management, and non-custodial, which use smart contracts for better security but may be complex for users.

- While cross-chain bridges provide significant benefits such as liquidity and reduced transaction costs, they also carry vulnerabilities, including smart contract bugs and private key management issues that highlight the need for robust security measures.

The Role of Cross Chain Bridges in Crypto

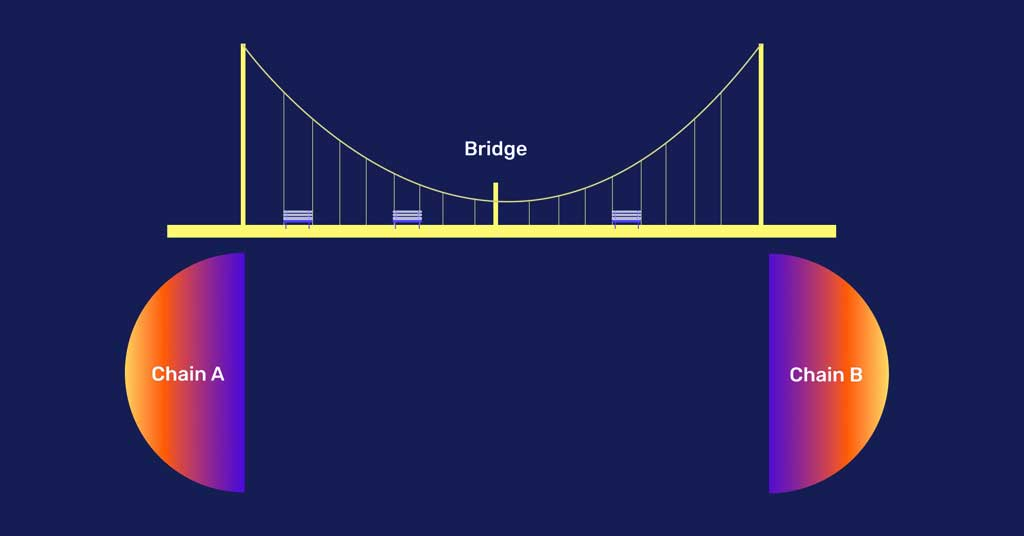

Cross-chain bridges are the connective tissue of the blockchain world, as they connect different blockchain networks, facilitating the transfer of assets and information and enabling communication and interaction between disparate blockchains. This interoperability is crucial for the development of decentralized applications (DApps) that need to operate across multiple blockchains, thereby enhancing their functionality and user reach. In essence, these bridges play a pivotal role in the broader blockchain ecosystem by enabling seamless communication and asset sharing among various blockchains, connecting blockchains, and serving as a blockchain bridge.

Users gain greater flexibility in choosing blockchains that align with their specific needs, whether it’s lower transaction costs or faster processing times. The ability to move assets across different platforms also opens up new avenues for participating in decentralized finance (DeFi) applications, significantly expanding the opportunities for lending, staking, and other financial activities.

Advancements in cross-chain technology promise a transition from isolated networks to a unified multi-chain infrastructure. This shift will enhance user experience across wallets and applications, making the crypto world more interconnected and efficient. The next generation of cross-chain architectures will enable seamless communication among decentralized applications, further facilitating interoperability within the blockchain ecosystem.

How Cross Chain Bridges Work

Understanding how cross-chain bridges work is essential for anyone looking to leverage their benefits. These bridges are protocols that lock assets on a source blockchain and mint equivalent tokens on a destination blockchain, thus facilitating interoperability between different blockchain networks. The process begins with sending an asset to a bridge contract on the source blockchain, where it is securely locked until the transfer is complete. Using these bridges, users can send tokens from one blockchain to another, but it’s important to note that this process carries certain risks, such as potential smart contract vulnerabilities or bridge failures.

The process works as follows:

- Once the asset is locked, a corresponding wrapped asset is created on the destination chain.

- This wrapped asset represents the original asset and can be used within the destination blockchain just like any native token.

- To reverse the transfer, the wrapped asset must be burned on the destination chain.

- After burning, the original asset can be unlocked on the source chain, facilitating the locking assets process.

This process ensures that the total supply of the asset remains consistent across both blockchains, with half of the value allocated to each.

What makes cross-chain bridges particularly powerful is their use of automated software for message verification. This eliminates the need for a centralized intermediary, making the process more secure and efficient. Grasping these mechanics allows users to appreciate the complexity and potential of cross-chain transactions.

Types of Cross Chain Bridges

Cross-chain bridges come in various forms, each with its own set of features and security considerations. For example, custodial bridges:

- Operate by holding user assets during transfers, similar to how a bank manages funds.

- Have a well-known example in Wrapped Bitcoin (wBTC), which converts Bitcoin for use on the Ethereum network.

- Can be convenient but pose security risks by creating a single point of failure for asset custody.

On the other hand, non-custodial bridges use smart contracts for asset management, offering greater transparency and security. These bridges often rely on a group of trusted entities, such as validators or guardians, to validate and secure cross-chain transactions, ensuring the protocol’s security and integrity through decentralized authority. The Polygon Portal is a prime example of a non-custodial bridge that connects Polygon and Ethereum using smart contracts for transactions. However, these bridges can present challenges for beginners due to their complexity.

Across, another non-custodial bridge, utilizes an Intents-based system to simplify the bridging process. The choice of cross-chain bridge depends on specific needs and risk tolerance, including different types of bridges. Custodial bridges may offer ease of use but come with higher security risks, while non-custodial bridges provide better security but require a deeper understanding of blockchain technology.

Benefits of Using Cross Chain Bridges

The benefits of using cross-chain bridges are manifold, including:

- Significant liquidity they bring to the table.

- Monthly transaction volumes in 2024 ranged from $1.5 billion to $3.2 billion, illustrating their substantial liquidity benefits.

- The ability for users to move large amounts of assets quickly and efficiently.

- Enabling more dynamic participation in the crypto market.

Cross-chain bridges provide users with:

- Access to a broader array of decentralized finance (DeFi) platforms.

- New opportunities for lending, staking, and other financial activities, allowing users to maximize their returns.

- Generally reduced transaction costs compared to traditional methods, making them an attractive option for cost-conscious users.

Enabling cross-chain transactions enhances the overall flexibility and usability of blockchain technology. Users can choose the best blockchain for their needs, moving assets as required to take advantage of lower fees, faster transactions, or specific platform features.

Common Use Cases for Bridges

Cross chain bridges are essential infrastructure in the crypto world, enabling interoperability and efficient asset transfers between different blockchains. One of the most popular use cases for a cross chain bridge is allowing users to move assets from one network to another to take advantage of unique features or lower transaction fees on a target chain. For example, a user might transfer USDT from the Ethereum blockchain to the BNB Chain using a cross chain bridge, benefiting from the lower fees and faster transactions available on the destination network.

Another significant use case is facilitating cross chain transactions between different DeFi ecosystems. By using cross chain bridges, users can transfer assets between networks like Ethereum and Solana, unlocking access to a wider range of DeFi protocols and projects. This not only increases the liquidity and usability of assets but also allows users to participate in new markets and take advantage of diverse investment opportunities across various blockchains.

Cross chain bridges also play a pivotal role in connecting blockchains with different consensus mechanisms. For instance, a bridge can link a proof-of-work blockchain such as Bitcoin with a proof-of-stake network like Ethereum. This connection enables users to transfer assets between these chains, combining the security and decentralization of one network with the smart contract capabilities of another. As a result, users can leverage the strengths of multiple blockchains without being limited to a single ecosystem.

Additionally, cross chain bridges make it possible to transfer assets from smaller or emerging blockchains to more established networks, increasing the visibility and liquidity of those assets. This can be particularly valuable for projects looking to expand their reach and for users seeking to access new opportunities in the rapidly evolving crypto landscape.

However, while cross chain bridges unlock powerful new possibilities, they also introduce security risks. Issues such as smart contract bugs, private key compromise, and bridge exploits—like the high-profile Ronin bridge incident—highlight the importance of implementing robust security measures. Careful attention to security features and ongoing audits are essential to ensure the safe transfer of assets between different blockchains.

As blockchain technology continues to advance, the role of cross chain bridges in connecting blockchains and enabling seamless asset transfers will only grow. By understanding the common use cases and associated risks, users can make more informed decisions and fully leverage the benefits of cross chain transactions in the crypto world.

Common Vulnerabilities in Cross Chain Bridges

Despite their benefits, cross-chain bridges come with their own set of vulnerabilities. Smart contracts, which are crucial for the operation of these bridges, can have smart contract bugs that, if exploited, can lead to significant losses. The Wormhole Bridge exploit is a prime example, where a flaw in the smart contract allowed unauthorized minting without collateral, leading to vast losses. The security of the network relies on the majority of honest nodes following the protocol, as honest nodes help prevent malicious actors from compromising the system.

Private key management is another critical area of concern regarding security issues. Improper handling can allow unauthorized access, as seen in the Harmony Bridge incident where two keys were exploited. The 2024 Orbit Chain hack further highlighted this vulnerability, where seven out of ten private key compromise were compromised, resulting in substantial financial losses for users. Additionally, the security of these chains is paramount to prevent future incidents. If the protocol is properly implemented, certain types of attacks—such as altering messages or submitting invalid proofs—should be impossible.

Other vulnerabilities include inadequate monitoring of transactions, which can delay the detection of exploits and heighten security risks. The absence of rate limiting on transactions can also facilitate rapid exploitation, allowing attackers to extract large values quickly. Attackers can exploit these weaknesses to steal assets from users. These vulnerabilities underscore the importance of robust security measures in the design and operation of cross-chain bridges.

High-Profile Bridge Exploits

High-profile bridge exploits serve as stark reminders of the vulnerabilities inherent in cross-chain bridges. These bridges rely on complex architectures and are attractive targets for hackers because they store large amounts of locked tokens. More than half of all DeFi hacks are attributed to cross-chain bridge exploits, highlighting how the attacker exploited their susceptibility to attacks.

Significant exploits have occurred in various cross-chain bridges, including:

- Wormhole

- Qubit Finance, which led to a total financial loss of $80 million

- Ronin network, which experienced a staggering loss of $625 million due to a bridge exploit

- Alex Lab compromise, resulting in a financial loss of $4.3 million

These incidents often involve specific attack vectors like validator key compromises and BGP hijacking. In the Ronin bridge incident, the exploitation occurred through a validator key compromise, while BGP hijacking can lead to theft of funds by redirecting assets to a malicious smart contract instead of the legitimate one. Understanding these attack vectors is crucial for developing more secure cross-chain bridges, especially in the face of potential attacker threats.

Security Measures for Safe Use

Several measures can mitigate the security risks associated with cross-chain bridges. Regular audits by experienced firms are crucial for ensuring the reliability of the smart contracts used in these bridges. Decentralization also enhances security by reducing the risk of single points of failure.

Multi-layer security models, including consensus mechanisms, monitoring systems, and validator decentralization, can further bolster the network security of cross-chain bridges. Validator sets should have proof of operational security experience to effectively manage the infrastructure, and using hardware security modules for private key management significantly enhances operational security.

Active monitoring of transactions helps in detecting abnormal activities in real-time, which can prevent potential hacks. Implementation of rate limits can serve as a protective measure against exploitation by capping the transfer amount within specific timeframes. Incorporating timelock contracts also allows users to review code changes before they are executed, enhancing upgradability security.

Future Developments in Cross Chain Technology

The future of cross-chain technology is promising, with emerging programmable messaging systems poised to revolutionize the space. These projects will allow smart contracts to automatically process cross-chain data, significantly increasing efficiency and enabling more complex interactions to communicate between different blockchains.

This evolution will likely see a transition from isolated networks to a unified multi-chain infrastructure, improving the user experience across wallets and applications. The next generation of cross-chain architectures will be enabling interoperability among decentralized applications, facilitating interoperability within the blockchain ecosystem, including one network, the bnb chain, and a specific chain.

The continued development of cross-chain technology will further enhance the capabilities of DeFi ecosystems and blockchain platforms. By enabling more efficient and secure asset transfers, these innovations will play a critical role in the future of the crypto world.

Summary

In summary, cross-chain bridges are a powerful yet complex tool in the crypto world, offering significant benefits in terms of liquidity, flexibility, and access to a broader array of DeFi platforms. However, they also come with inherent vulnerabilities that require careful management and robust security measures.

As we look to the future, advancements in cross-chain technology promise to enhance interoperability and efficiency across various blockchains. By understanding the mechanics, benefits, risks, and future developments of cross-chain bridges, users can better navigate their complexities and harness their full potential.

Frequently Asked Questions

What makes crypto so dangerous?

Cryptocurrency is dangerous due to its high price volatility and lack of regulation, which can lead to significant financial losses for investors. It’s essential to only invest money you can afford to lose.

What are cross-chain bridges?

Cross-chain bridges are essential protocols that enable the seamless transfer of assets and information between various blockchain networks, significantly improving interoperability. They play a crucial role in connecting disparate blockchain ecosystems.

How do cross-chain bridges work?

Cross-chain bridges function by locking assets on one blockchain and minting equivalent tokens on another, utilizing automated software to verify messages. This mechanism facilitates interoperability between different blockchain networks.

What are the benefits of using cross-chain bridges?

Using cross-chain bridges enhances liquidity, facilitates access to diverse DeFi platforms, and lowers transaction costs. This ultimately leads to a more efficient and connected blockchain ecosystem.

What are some common vulnerabilities in cross-chain bridges?

Cross-chain bridges often face vulnerabilities such as smart contract bugs, private key management issues, and inadequate monitoring. Addressing these concerns is crucial for ensuring the security and reliability of these systems.