Solana vs Ethereum in 2025 Throughput: Which Blockchain Delivers More Speed?

Which will have better throughput in 2025, Solana or Ethereum? This article offers a comprehensive comparison of their projected transaction speeds and efficiency, particularly focusing on “solana vs ethereum in 2025 throughput,” while considering their different technologies and upgrades.

Key Takeaways

- Solana significantly outperforms Ethereum in transaction speed and cost efficiency, handling up to 4,709 transactions per second compared to Ethereum’s lower throughput.

- Ethereum’s multi-layered architecture focuses on security and decentralization, while Solana’s monolithic design prioritizes speed and efficiency, impacting their respective use cases.

- Both blockchains are implementing ongoing upgrades to enhance their throughput capabilities, ensuring their competitiveness in a multi-chain ecosystem.

Throughput Overview in 2025

Transaction throughput measures how many transactions a blockchain can execute in a specified time, impacting its overall efficiency. As blockchain technology evolves, the demand for systems handling high transaction volumes with speed and reliability has surged. This need for high throughput drives innovations in blockchain protocols to support an expanding user base and diverse applications.

Quicker transaction confirmations and user satisfaction hinge on enhancing throughput. Efficient consensus algorithms and architectural designs are crucial for boosting speed and overall network performance. Slow blockchain performance can lead to frustrating user experiences and hinder new application development.

Consequently, the future performance and adoption of blockchain platforms like Solana and Ethereum depend on delivering high throughput and efficient transaction processing.

Technical Foundations of Throughput

To grasp why Solana and Ethereum perform differently, understanding the technical foundations of throughput is crucial. Consensus mechanisms and architectural design significantly influence transaction throughput.

Ethereum and Solana adopt distinct approaches in these areas, which shape their performance metrics, security, and scalability. Ethereum’s base layer is focused on security and decentralization, but it has throughput limitations, typically processing around 15-30 transactions per second (TPS). The Ethereum Virtual Machine (EVM) serves as the foundational technology that enables smart contracts and provides interoperability across different blockchain networks. Let’s explore the consensus mechanisms and architectural designs of these two blockchains in detail.

Consensus Mechanisms

Consensus mechanisms determine the performance and scalability of blockchain networks. Ethereum transitioned to a Proof of Stake (PoS) mechanism in 2022, separating consensus from execution to focus on sustainability and decentralization. This security-first approach ensures Ethereum remains a robust and reliable network, though with more conservative throughput compared to Solana.

Solana uses a unique combination of Proof of History (PoH) and Proof of Stake (PoS) to enhance throughput:

- PoH enables efficient timestamping of transactions, allowing parallel execution and significantly boosting speeds.

- This innovative approach prioritizes raw performance.

- It enables Solana to achieve higher throughput and lower latency compared to Ethereum.

Architectural Design

Architectural design plays a crucial role in a blockchain’s transaction throughput and scalability. Solana’s monolithic Layer-1 architecture is designed for high transaction speeds. Parallel processing of transactions allows Solana to drastically improve throughput, making it suitable for high-frequency applications.

Ethereum, in contrast, uses a multi-layered design with a rollup-centric scaling approach. This modular architecture enhances security and decentralization, though at the cost of lower raw performance compared to Solana. Additionally, ethereum relies on this innovative structure to optimize its capabilities vs ethereum.

These architectural key differences shape the throughput capabilities of Solana and Ethereum, impacting their suitability for various applications.

Transaction Speed and Finality

Transaction speed and finality are critical metrics impacting user experience and operational capabilities. Key comparisons between Solana and Ethereum include:

- Solana significantly outperforms Ethereum in transaction speed.

- Under peak conditions, Solana can handle around 870.6 TPS, with peaks up to 4,709 TPS.

- The average block time for Solana is about 0.39 seconds.

- This block time is much quicker than Ethereum’s average block time.

Solana also excels in transaction finality, achieving approximately 6.4 seconds compared to Ethereum’s 12 to 15 minutes. This speed advantage makes Solana more suitable for applications requiring low latency and frequent transactions, such as crypto trading and real-time gaming.

Real-World Performance Metrics

In real-world conditions:

- Solana processes about 35.99 million daily solana transactions, significantly more than Ethereum’s 1.13 million.

- This stark difference highlights Solana’s ability to handle a much larger volume efficiently.

- Solana’s average transaction cost is very low, at approximately $0.00025, making it a low cost solution ideal for high-volume and microtransaction applications.

Ethereum processes between 15 to 30 transactions per second during typical usage. Its transaction finality is slower, with block times averaging around 12 seconds. These significant differences imply varying efficiencies and scalability potential for decentralized applications on both networks, including:

- Throughput differences

- Speed differences

- Impact on efficiency

- Scalability potential

Cost Efficiency and Transaction Costs

Cost efficiency and transaction costs significantly influence user adoption and overall network efficiency. Key points include:

- Solana offers much lower transaction costs, averaging about $0.00025.

- Ethereum’s gas fees are variable and can reach up to $30 during peak times.

- Solana’s low fees make it particularly suitable for frequent and small transactions.

- This cost advantage enhances user engagement and satisfaction.

High and variable transaction costs on Ethereum can discourage user engagement, especially during network congestion. This unpredictability can be a significant barrier for users and developers. In contrast, Solana’s low transaction fees make it attractive for a wide range of applications, including NFT trading and microtransactions.

Scalability Solutions and Upgrades

Scalability solutions and ongoing upgrades are crucial for maintaining high throughput and network performance. Both Ethereum and Solana are pursuing strategic upgrades to enhance scalability and efficiency. Ethereum focuses on Layer-2 solutions and modular scaling to balance efficiency with security. In contrast, Solana aims to boost throughput through core upgrades like Firedancer and Alpenglow.

Next, we will delve into the specific scalability solutions and upgrades for both blockchains.

Ethereum Layer-2 Solutions

Ethereum primarily scales its blockchain through Layer-2 networks (rollups) and data sharding. Adoption of Layer-2 solutions like Arbitrum and Optimism has significantly enhanced Ethereum’s scalability, enabling it to handle as much or more traffic than Solana. These solutions reduce transaction fees and enhance validator efficiency, making the network more cost-effective and scalable.

Recent upgrades to Ethereum, such as proto-danksharding, have further cut Layer-2 fees and opened up new opportunities for crypto investment. These ongoing improvements can positively impact investment returns for Ethereum users by increasing network efficiency and reducing costs. These ongoing improvements ensure that Ethereum remains a competitive and attractive option in the evolving crypto market.

Solana’s Core Upgrades

Solana’s core upgrades aim to enhance throughput and maintain high performance. The Firedancer upgrade boosts network throughput while ensuring performance integrity. Alpenglow, another significant upgrade, represents a major consensus overhaul that will further optimize Solana’s capabilities.

Techniques like sharding allow Solana to considerably increase the number of transactions it handles simultaneously. These ongoing upgrades are crucial for maintaining Solana’s high throughput and ensuring it remains a top contender in the blockchain space.

Risk Factors and Key Features

When comparing Solana vs Ethereum in the evolving crypto market, it’s essential to weigh both the risk factors and key features that define each blockchain platform. These considerations are crucial for investors, developers, and users seeking to understand which network best aligns with their needs in terms of transaction throughput, cost efficiency, and ecosystem growth.

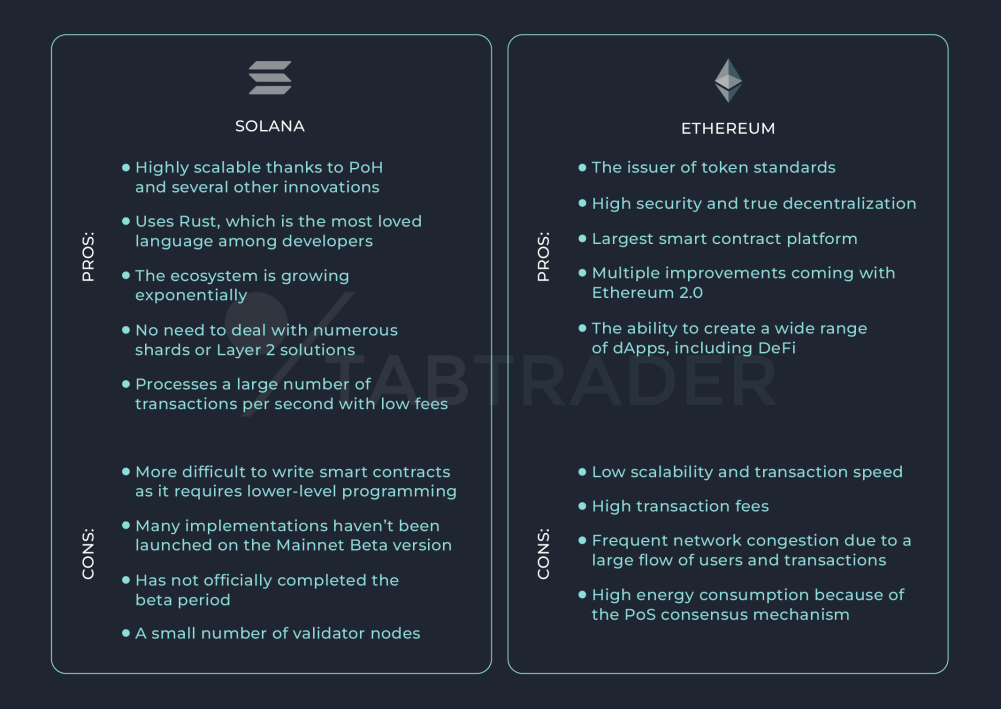

Solana stands out for its high performance, delivering exceptional transaction speed and low average transaction cost—around $0.00025 per transaction. This makes Solana particularly attractive for decentralized finance (DeFi) protocols, decentralized exchanges, and high frequency trading, as well as real time gaming and other high frequency applications. Solana’s ability to process thousands of transactions per second supports a wide range of use cases that demand low latency and frequent transactions.

However, Solana’s ecosystem is still evolving quickly, and the platform has experienced network outages in the past. These outages can impact investor sentiment and raise concerns about network security and reliability. Additionally, Solana’s reliance on a single client implementation and a relatively smaller validator set introduces potential centralization risks, which are important risk factors to consider as the network scales.

Ethereum, by contrast, remains the established smart contract platform with the largest developer ecosystem in the blockchain space. Its base layer prioritizes security and decentralization, making it a preferred choice for high value DeFi protocols, NFT marketplaces, and enterprise blockchain solutions. While Ethereum’s transaction costs are higher and its transaction throughput is lower compared to Solana, ongoing upgrades and a modular scaling approach—such as Layer-2 solutions—are designed to improve performance metrics and cost efficiency without compromising network security.

Ethereum’s mature ecosystem, higher staking yields, and broad institutional adoption contribute to its stability and long-term viability. Its larger market cap and proven track record in the smart contract space provide additional confidence for institutional investors and those seeking established blockchain technology.

Use Cases and Ecosystem Impact

Throughput is vital for the growth and adoption of blockchain ecosystems. Solana’s high throughput and low transaction costs make it ideal for applications like gaming, social apps, and payments. The rapid growth and diversity of the Solana ecosystem, along with Solana’s ecosystem’s focus on DeFi and NFTs, have led to a variety of innovative projects and tools. In contrast, the maturity and extensive developer support of the Ethereum ecosystem, as well as Ethereum’s ecosystem’s dominance in DeFi and NFT projects, make it particularly suited for high-value DeFi protocols and complex financial applications. Ethereum supports a wide range of NFT projects, benefiting from its established infrastructure and network effects.

Many DeFi protocols are deployed across both networks, leveraging their respective strengths in security, speed, and user experience.

Next, we will explore the impact of throughput on defi interactions, DeFi protocols, and NFT marketplaces.

DeFi Protocols

Solana’s key features and applications include:

- High performance, low latency, and cost efficiency, which are crucial for its DeFi capabilities.

- Support for over 8,400 smart contracts, facilitating a diverse range of DeFi projects.

- Suitability for various applications, including gaming, microfinance, and social tokens.

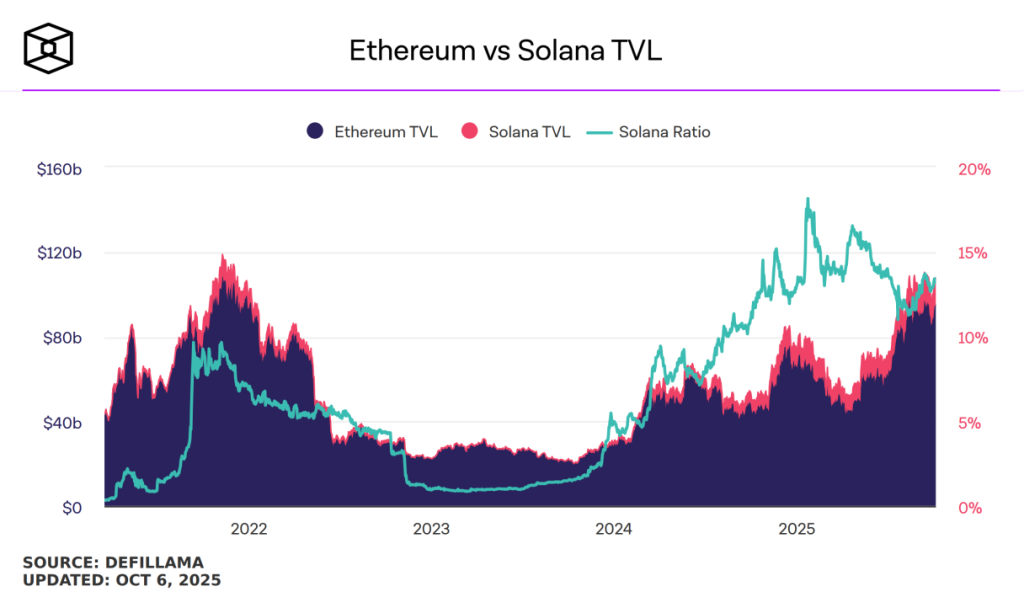

Ethereum remains the dominant established smart contract platform in the DeFi space due to its security and liquidity. It has the highest Total Value Locked (TVL) in DeFi, underscoring its dominance in the sector.

Both Solana and Ethereum offer unique advantages in the DeFi space, reflecting the trend towards a multi-chain future.

NFT Marketplaces

NFT marketplaces are crucial for the blockchain ecosystem, allowing users to buy, sell, and trade digital assets. Throughput impacts transaction efficiency and speed within NFT marketplaces, directly affecting user experience. Solana’s NFT marketplaces have demonstrated faster transaction speeds and lower fees compared to Ethereum’s, attracting more users and creators.

As both ecosystems evolve, ongoing improvements in throughput for Solana and Ethereum will likely bolster ecosystem growth and innovation within their respective NFT marketplaces, including Solana’s ecosystem and market dynamics. This ensures that both platforms remain competitive and attractive to users and developers, contributing to the largest developer ecosystem while evolving quickly.

Institutional Adoption and Investor Sentiment

Institutional adoption and investor sentiment are crucial indicators of a blockchain’s future success. Ethereum remains attractive to institutional investors due to its established market presence and ongoing technological improvements. Reliability is a key factor, making Ethereum’s robust network a preferred choice, highlighting the ethereum benefits for institutional investors. As the market evolves, it is clear that ethereum leads in the race for institutional adoption.

Solana is gaining traction among institutions through initiatives related to tokenized real-world assets and decentralized finance (DeFi). Despite higher staking yields, conducting your own research on Solana vs other platforms presents new opportunities for investors seeking high-performance alternatives.

When considering these opportunities, both institutional and retail investors must assess their risk tolerance, as it plays a significant role in platform selection and investment timing. Understanding the performance differences between Ethereum and Solana is critical for making informed trading decisions in the crypto market for crypto traders. To effectively navigate this landscape, it is essential to compare Solana and Ethereum.

Future Outlook for Throughput

Looking ahead, future developments in blockchain technology are expected to focus on enhancing efficiency, reducing energy consumption, and improving interoperability between networks. Solana’s upcoming Firedancer upgrade aims to achieve a transaction throughput of up to 1 million transactions per second, rivaling centralized systems in speed.

Ongoing improvements in consensus algorithms and blockchain architecture are anticipated to boost transaction speeds and overall network scalability. As the blockchain space rapidly evolves, both Solana and Ethereum are poised to make significant strides in their throughput capabilities and overall performance.

This ongoing progress is a central topic in the ethereum debate, which focuses on understanding the unique strengths and niches of each blockchain platform rather than declaring a clear winner.

Comparing Solana and Ethereum: Key Takeaways

Both Solana and Ethereum are expected to coexist in a multi-chain ecosystem, fulfilling distinct roles within ethereum’s ecosystem. Solana excels in speed and cost-efficiency, making it ideal for consumer applications requiring high throughput and low costs. Ethereum, on the other hand, is renowned for its security, liquidity, and maturity, making it suitable for high-value DeFi protocols and complex applications. In the ongoing discussion of solana vs ethereum, both platforms have their unique advantages.

Ethereum is implementing upgrades like danksharding to enhance its transaction capabilities while maintaining a focus on security and decentralization. Solana processes over 50% of the global decentralized exchange volume, highlighting its growing significance as a decentralized exchange platform in the DeFi space. The distinct strengths of both blockchains underscore the importance of a multi-chain future.

Summary

In summary, the comparison between Solana and Ethereum in terms of transaction throughput reveals significant differences in their technical foundations, performance metrics, and cost efficiency. Solana’s high throughput and low transaction costs make it ideal for applications requiring speed and frequent transactions. In contrast, Ethereum’s established ecosystem and focus on security make it a preferred choice for high-value DeFi protocols and complex financial applications.

Both blockchains are continuously evolving, with ongoing upgrades and scalability solutions enhancing their performance and capabilities. As we look to the future, the coexistence of Solana and Ethereum in a multi-chain ecosystem will play a crucial role in the growth and adoption of blockchain technology. The distinct strengths of each blockchain will cater to different use cases, ensuring a versatile and dynamic blockchain landscape.

Frequently Asked Questions

What is transaction throughput, and why is it important?

Transaction throughput refers to the number of transactions a blockchain can process in a given timeframe, making it crucial for the efficiency of the system and user satisfaction. High throughput is essential for applications that demand large volumes of transactions to function effectively.

How do Solana and Ethereum differ in their consensus mechanisms?

Solana differs from Ethereum by utilizing a combination of Proof of History (PoH) and Proof of Stake (PoS) to improve transaction throughput and parallel execution, whereas Ethereum solely employs a Proof of Stake (PoS) mechanism aimed at sustainability and decentralization.

What are the transaction speeds and finality times for Solana and Ethereum?

Solana offers significantly faster transaction speeds of approximately 870.6 TPS, reaching peaks of 4,709 TPS, with a finality time of about 6.4 seconds. In comparison, Ethereum processes only 15 to 30 TPS, with finality times of 12 to 15 minutes.

How do transaction costs on Solana compare to those on Ethereum?

Transaction costs on Solana are significantly lower, averaging around $0.00025 per transaction, while Ethereum’s costs can fluctuate dramatically, sometimes reaching up to $30 during peak times. Consequently, Solana presents a more cost-effective option for frequent transactions.

What are the future upgrades planned for Solana and Ethereum to enhance throughput?

Both Solana and Ethereum are taking significant steps to enhance throughput, with Solana set to implement Firedancer and Alpenglow, while Ethereum is prioritizing Layer-2 solutions and danksharding. These upgrades are intended to significantly improve scalability and efficiency within their networks.