Memecoins: Dumb Gamble or the Smartest Trade of the Cycle? Decide for Yourself!

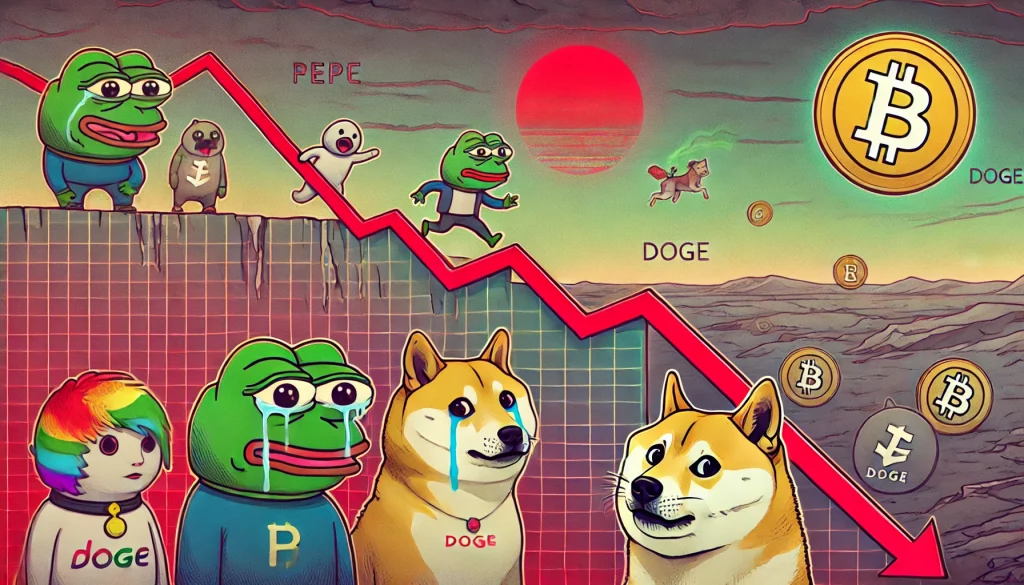

Are memecoins a dumb gamble or the smartest trade of the cycle? As internet meme-based cryptocurrencies make waves, investors debate their value. This article will explore whether memecoins—dumb gamble or the smartest trade of the cycle—offer huge rewards or if they’re just risky bets, guiding you to make an informed decision.

Key Takeaways

- Memecoins combine humor and investment potential, attracting speculators with the chance of high profits, but they also come with significant risks due to their volatile nature.

- Community engagement plays a crucial role in the value of memecoins, with successful projects often driven by active supporters and viral trends on social media.

- Investors should conduct thorough research before diving in, focusing on factors like community involvement, transparency, and tokenomics to assess a memecoin’s long-term potential beyond just hype.

Introduction to Meme Coins

Meme coins have exploded onto the scene, shaking up the world of finance and crypto with their blend of internet humor and speculative investing. Born from viral memes and online jokes, these coins have captured the imagination—and wallets—of millions. With market caps soaring into the billions, meme coins are no longer just a passing fad; they’re a major force in the crypto market.

For most people, investing in meme coins is a high-stakes gamble. Their value is often driven more by hype and community interest than by any underlying utility or technology. Yet, the allure is undeniable: the chance to turn a small investment into a life-changing sum is what keeps traders coming back for more. In a world where finance and memes collide, meme coins offer both risk and reward in equal measure. Whether you see them as a joke or a serious investment, there’s no denying their impact on the market—and the interest they continue to generate.

Understanding Memecoins

At their core, memecoins—also known as meme coins—are cryptocurrency tokens created more for fun and speculation than for any real-world utility. These coins often spring from a viral meme or internet joke, quickly gaining traction as communities rally around the idea. The goal? To create buzz, drive up the price, and maybe even make a few people rich along the way.

But here’s the catch: most meme coins lack intrinsic value or a clear use case. Their market cap can skyrocket on the back of a trending meme, only to crash just as quickly when the hype fades. This makes them especially vulnerable to rug pulls, where developers or insiders cash out, leaving unsuspecting investors holding the bag. The world of meme coins thrives on speculation, community-driven interest, and the power of a good story—but it’s also a space where fortunes can be made or lost in an instant. If you’re thinking about investing, make sure you understand the risks, the community dynamics, and the ever-present possibility that today’s hot token could be tomorrow’s punchline.

The Allure of Memecoins

Memecoins have captivated both investors and internet users. These digital assets, inspired by popular memes, blend humor with financial potential. The thrill of trading memecoins lies in their volatility and the chance for quick, substantial profits. Platforms like Pump.fun have simplified the process of launching these tokens, adding to a saturated yet exhilarating market.

A bunch of enthusiasts and community members are drawn to memecoins, driving their popularity and momentum as they rally around shared interests and viral trends.

Active community participation fosters loyalty and sustained interest, transforming memecoins into cultural phenomena. Shiba Inu, for instance, owes much of its popularity to dedicated communities that continually create engagement and hype through the creation of innovative content.

The allure of potentially turning a small investment into a fortune attracts many speculators. Beyond financial gains, it’s about being part of a movement, a joke, and a meme that resonates with the zeitgeist. In a world dominated by internet culture, memecoins blend financial aspirations with the fun, capital, and frivolity of online money life. This idea captures the essence of modern investing and speculation, where the chance to win is a driving force.

Historical Success Stories

The history of memecoins is filled with immense success stories, turning ordinary people into crypto millionaires overnight. Dogecoin, for example, started as a joke but quickly became a major player in the crypto world, reaching a market cap of approximately $90 billion in 2021. This meteoric rise was fueled by community engagement and high-profile endorsements, most notably from Tesla CEO Elon Musk. The influence of a single person, especially someone as prominent as Musk, can dramatically impact a memecoin’s success and credibility.

Shiba Inu is another standout. Launched as a “Dogecoin killer,” Shiba Inu achieved an extraordinary annual return of 45,278,000% in 2021. Early investors who took the plunge found themselves sitting on generational wealth, thanks to strategic listings on major exchanges and viral social media trends. Community and influencer endorsements significantly elevate a memecoin’s visibility and market interest.

These story examples are how memecoins, with the right mix of community support, strategic marketing, and some luck, can yield remarkable financial returns. They serve as a reminder that in the unpredictable world of crypto, rich fortunes and riches can be made and lost in the blink of an eye, and these experiences are happening to shape the lives of many investors through their words.

Popular Options: The Hottest Memecoins Right Now

The meme coin market is a fast-moving playground, with new tokens popping up almost daily. Still, a few names have managed to rise above the noise and capture the world’s attention. Dogecoin (DOGE) remains the OG of meme coins, its Shiba Inu mascot now a symbol of crypto’s playful side. Shiba Inu (SHIB) followed in its paw prints, building a massive community and a market cap that rivals some of the biggest names in crypto.

Pepe (PEPE) is another popular crypto meme coin, riding the wave of internet culture and trading memecoins hype. Other contenders like Pudgy Penguins (PENGU), Bonk (BONK), and Official Trump (TRUMP) each bring their own unique story and community-driven energy to the market. These tokens have become more than just coins—they’re cultural phenomena, with communities that create memes, drive interest, and fuel price surges.

If you’re considering trading memecoins, staying up-to-date with the latest trends and news is essential. Each token’s story, community, and market cap can shift rapidly, so thorough research is your best friend. In the world of meme coins, today’s joke could be tomorrow’s generational wealth—or just another forgotten punchline.

The Risks Involved

While the success stories of Dogecoin and Shiba Inu are alluring, the inherent risks of investing in memecoins must be recognized. These assets are highly speculative, and their values can plummet just as quickly as they rise. Both Dogecoin and Shiba Inu experienced drastic declines of over 90% in value after their peak highs in 2021.

Price volatility is a hallmark of the memecoin market, with values fluctuating wildly based on hype, public sentiment, and trending topics. This makes investing in memecoins akin to gambling, where fortunes can be made or lost on a whim. The lack of stringent regulations also makes the market susceptible to scams and fraudulent activities, compromising investor security. Additionally, the broader crypto industry is still developing comprehensive security standards, which contributes to the overall risk profile of memecoins.

One significant risk is the potential for rug pulls, where developers inflate a token’s value and then withdraw funds, leaving investors with worthless assets. Many memecoins lack meaningful applications, making their value purely speculative. Market oversaturation means that many of these tokens fail shortly after launch. Therefore, approach memecoin investments with caution and a clear understanding of the risks involved.

Market Volatility: Riding the Rollercoaster

If there’s one thing you can count on in the memecoin market, it’s volatility. Prices can skyrocket on a viral tweet or plummet just as fast when the hype dies down. This rollercoaster ride is what makes investing in meme coins both thrilling and nerve-wracking. For those who know how to play the game, the wild swings can mean big profits—but for the unprepared, it can also mean losing your entire investment in the blink of an eye.

Smart investors approach the memecoin market with a clear strategy, using tools and platforms designed to protect their capital and manage risk. Understanding the market cycle, setting stop-losses, and staying focused on research are all crucial for success. As one crypto platform CEO put it, “The key to winning in the memecoin market is to stay focused, keep learning, and never let hype cloud your judgment.” In this world, fortunes are made and lost on the back of memes, market sentiment, and timing—so invest wisely, protect your account, and remember: only risk what you can afford to lose.

Factors to Consider Before Investing in Memecoins

Before investing in memecoins, consider several relevant factors to make informed decisions. In this section, key concepts and strategies for evaluating memecoins are explained to help readers make informed choices. Active and engaged communities can indicate an interesting memecoin’s viability and potential for sustained interest.

Transparency of the development team plays a significant role in building investor confidence. Knowing who is behind the project and their track record can provide insights into its legitimacy and long-term potential. Additionally, analyzing tokenomics, including supply mechanisms and distribution plans, is crucial for assessing a token memecoin’s potential.

To maximize your investment in memecoins, consider the following strategies:

- Conduct thorough research on each memecoin to identify potential risks and opportunities.

- Regularly analyze market trends to identify the right moments to buy or sell.

- Diversify investments across various memecoins to reduce overall portfolio risk.

Strategies for Trading Memecoins

Trading memecoins requires a strategic approach to navigate their volatility effectively. Using futures contracts allows traders to profit from declining prices in low-utility meme coins, which can be particularly useful in a market where values can drop as quickly as they rise. Memecoins are traded across various markets, including spot and derivatives markets, each offering different trading opportunities, levels of liquidity, and volatility for traders.

Identifying optimal entry and exit points is crucial for maximizing profits. This involves:

- Monitoring market trends.

- Analyzing supply and demand zones on monthly charts.

- Recognizing market pullbacks as ideal entry points, offering lower prices and higher potential returns.

- Setting profit targets or trailing stops to determine the best times to exit investments.

Focusing on higher timeframes for analysis can lead to more accurate trading setups and reduce market noise. This course approach helps traders make informed decisions based on long-term trends rather than short-term fluctuations, leading to more successful trades.

Community Influence on Memecoin Value

The value of memecoins is heavily influenced by community engagement and social media trends. Community-driven narratives and humorous content sustain interest in these tokens. Memecoins thrive on cultural relevance and visibility, often gaining value through collective enthusiasm and viral moments.

Monitoring social media trends and community sentiment provides valuable insights for trading memecoins. FOMO (Fear of Missing Out) plays a significant role in driving participation, as investors rush to join the latest hype. For instance, Dogecoin’s community drives campaigns and memes on social media platforms like Twitter, continuously boosting its visibility and value.

Examples like PEPE, whose value depends primarily on community sentiment and viral momentum, illustrate the critical role of community influence in the memecoin market. Understanding these dynamics helps traders make more informed decisions and capitalize on emerging trends.

Timing is Everything

In the world of memecoins, timing is crucial. Identifying key supply and demand zones on monthly charts can help determine ideal entry and exit point for trades. Optimal entry points often coincide with market pullbacks in the fall, so it’s important to wait for lower prices and higher potential returns.

Focusing on higher timeframes for analysis can lead to more accurate trading setups and reduce market noise. This approach allows traders to make informed decisions based on long-term trends rather than short-term fluctuations. Setting profit targets or trailing stops can help determine the best times to exit investments, maximizing returns. These ideas can enhance overall trading strategies.

Strategic timing plays a crucial role in maximizing returns on memecoin investments. By understanding market cycle and staying attuned to supply and demand dynamics, traders can make smarter, more profitable trades.

Beyond the Hype: Utility and Future Potential

While the hype surrounding memecoins is undeniable, their long-term potential often hinges on utility and innovation. New entrants like Angry Pepe are introducing mechanics like staking rewards and GambleFi to enhance user retention. These features add a layer of utility, making the tokens more than just speculative assets.

Projects like FLOKI are transitioning into ecosystems featuring DeFi products and metaverse integrations, further enhancing their value proposition. Sustainability-focused projects like SUNDOG are redefining the purpose of memecoins by supporting eco-friendly initiatives. These efforts highlight the potential for memecoins to balance humor with supposed meaningful applications.

Investors should evaluate the potential for long-term value in memecoins. While many lack intrinsic investment worth, those that leverage existing memes and community-driven initiatives often perform better due to their viral appeal. The future of memecoins will be determined by their ability to innovate and provide tangible value beyond the initial hype.

Popular Platforms to Trade Memecoins

Trading memecoins requires access to reliable platforms that offer security and ease of use. Kraken, for instance, allows trading of popular memecoins like DOGE, SHIB, and FLOKI, and provides robust security features including proof-of-reserves and mandatory two-factor authentication. Binance, known for listing trending memecoins quickly, ensures security with SAFU insurance funds and advanced monitoring practices.

Bybit is another popular choice among traders for its quick onboarding process and beginner-friendly app layout. It also implements proof-of-reserves and cold storage as part of its security measures. For those looking to start trading with minimal investment, Kraken allows users to begin with as little as $10, making it accessible for new participants.

Platforms like MEXC and KuCoin also offer competitive trading fees and strong security measures, providing traders with multiple options. Whether you’re a seasoned trader or a newcomer, selecting the right platform is crucial for a successful trading experience.

Tips for Managing Your Memecoin Portfolio

Managing a memecoin portfolio requires a strategic approach to mitigate risks and maximize returns. Setting stop-loss orders can limit potential losses during market downturns, especially in the highly volatile memecoin market, where prices can fluctuate rapidly and cause investors to lose money.

Regularly assessing your smart risk tolerance is crucial for making informed invest decisions in finance. As market conditions change, so should your investment strategy. Using tracking tools and technology can help monitor price movements and portfolio performance in real-time, allowing for timely adjustments to your account and reducing any worry about potential losses.

Diversification is another key strategy for managing risk. By spreading investments across various memecoins, you can reduce the impact of any single token’s poor performance on your overall portfolio. This balanced approach helps navigate the unpredictable nature of the memecoin market.

Summary

In the thrilling world of memecoins, the potential for remarkable gains comes with significant risks. From understanding the allure and historical success stories to recognizing the inherent risks and strategic trading, navigating this market requires both due diligence and a bit of daring. Memecoins thrive on community engagement and viral trends, but their long-term value often hinges on innovative utility and sustainability.

Ultimately, whether memecoins are a dumb gamble or the smartest trade of the cycle depends on your approach and risk tolerance. By staying informed, conducting thorough research, and employing strategic trading and portfolio management techniques, you can make informed decisions that align with your financial goals.

Frequently Asked Questions

What makes memecoins appealing to investors?

Memecoins are super appealing because they promise quick profits and foster strong community engagement, all while tapping into the fun and viral nature of memes. It’s that thrill and camaraderie that draws many investors in!

Are there any historical examples of successful memecoins?

Absolutely! Dogecoin and Shiba Inu are prime examples, with Dogecoin hitting a market cap of $90 billion and Shiba Inu boasting a jaw-dropping return of 45,278,000% in 2021.

What are the main risks of investing in memecoins?

Investing in memecoins is risky due to their extreme price volatility, the high potential for scams, and their speculative nature. It’s crucial to be aware of these dangers before diving in.

What factors should I consider before investing in memecoins?

Before investing in memecoins, pay attention to community engagement, the transparency of the development team, tokenomics, and current market trends. Diversifying your investments can also help manage risk.

How can I manage my memecoin portfolio effectively?

To effectively manage your memecoin portfolio, set stop-loss orders, regularly assess your risk tolerance, use tracking tools, and diversify your investments. These strategies will help you stay on top of your portfolio and make informed decisions.