The Essential Guide to Link Crypto: Chainlink Reserve (LINK)

e projects and enterprises recognize the value of interoperable, secure, and automated systems. As the blockchain industry grows, Chainlink’s cross-chain solutions will remain a cornerstone of iLINK crypto powers Chainlink, connecting blockchains with real-world data. Sergey Nazarov, the co-founder of Chainlink, has played a key role in establishing the project’s leadership and expertise in the blockchain industry. This guide will explain why LINK is critical for blockchain.

Key Takeaways

- LINK tokens are essential for the Chainlink Network, serving as both a stake for node operators and a means of compensation for data delivery, thereby ensuring integrity and reliability.

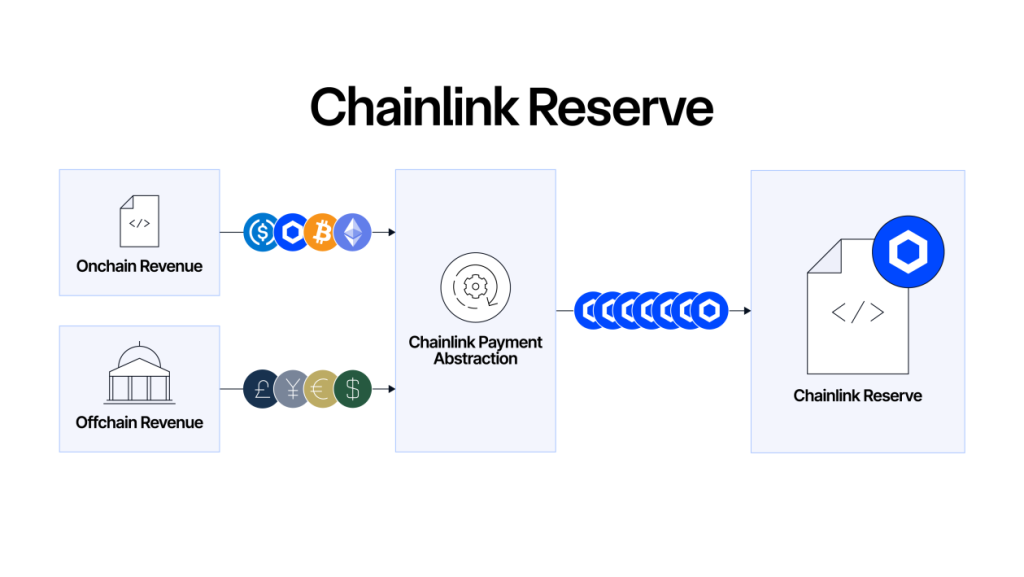

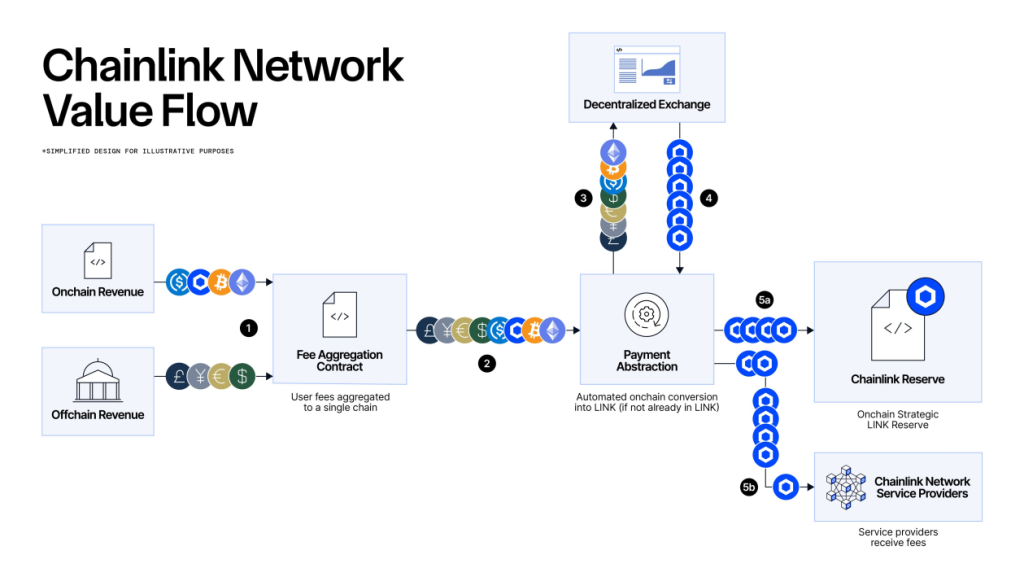

- The Chainlink Reserve is a strategic initiative designed to accumulate LINK tokens for long-term sustainability and growth, converting both on-chain and off-chain revenues into LINK to support the network’s objectives.

- Chainlink has created hundreds of millions of dollars in revenue, driven by adoption from the world’s largest banking institutions and enterprises, highlighting the scale and financial impact of its ecosystem.

- Chainlink plays a pivotal role in the blockchain ecosystem by providing secure and reliable data feeds, enhancing the functionality of decentralized finance applications and facilitating the integration of traditional financial systems.

Introduction to Chainlink Labs

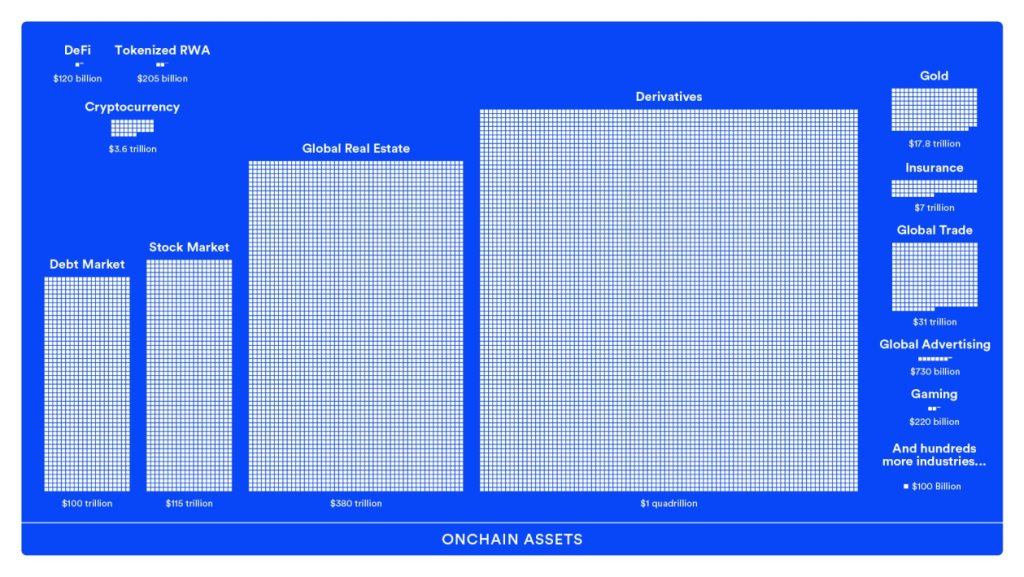

Chainlink Labs stands at the forefront of blockchain innovation, serving as the primary developer and architect behind the Chainlink platform. As a pioneer in the integration of off-chain data with blockchain technology, Chainlink Labs has established the Chainlink Network as a decentralized network of oracles that securely connect real-world data to smart contracts. This breakthrough has enabled the creation of advanced onchain applications, transforming how data is accessed and utilized across the blockchain industry.

The mission of Chainlink Labs extends beyond technical development; it is dedicated to advancing the entire Chainlink ecosystem. This includes not only the Chainlink Network itself but also a comprehensive suite of Chainlink Services and the strategic management of the Chainlink Reserve. By fostering a robust and sustainable ecosystem, Chainlink Labs ensures that the Chainlink platform remains the global standard for secure data delivery and decentralized automation.

Through continuous innovation and a commitment to long-term growth, Chainlink Labs empowers developers, enterprises, and capital markets institutions to build reliable, data-driven solutions. Its leadership in the blockchain industry is evident in the widespread adoption of Chainlink’s decentralized network, which underpins the security and reliability of countless smart contracts and onchain finance applications worldwide.

Understanding LINK

At the heart of the Chainlink Network lies the LINK blockchain token, the primary currency that fuels its decentralized oracle ecosystem. LINK tokens are pivotal for node operators in the following ways:

- Node operators must stake LINK tokens to participate in the network, ensuring a commitment to providing accurate and reliable data.

- The staking mechanism incentivizes node operators.

- Compensation for node operators is directly tied to their performance and reliability.

This approach maintains the integrity and functionality of Chainlink’s decentralized oracle networks and protocol.

In the Chainlink ecosystem, LINK tokens serve multiple purposes. They are used to compensate operators for managing off-chain data and delivering it to smart contracts on the blockchain. This dual role of LINK as both a currency and a stake ensures that the ecosystem operates smoothly and that data accuracy is maintained. The use of LINK tokens is a testament to the innovative approach Chainlink takes to solve the complexities of integrating real-world data with blockchain technology.

The importance of LINK tokens extends beyond mere transactions. Linking compensation to performance fosters a reliable and efficient network within Chainlink. The proper utilization of LINK within the Chainlink ecosystem is crucial for maintaining the trust and efficacy of decentralized oracle networks.

As we delve deeper into the Chainlink Network, you will see how these tokens play a vital role in supporting the broader blockchain industry.

The circulating supply of LINK tokens is publicly available through analytics dashboards, providing transparency and valuable insight into the token’s liquidity and overall market dynamics.

The Chainlink Network and Its Impact on Blockchain Technology

The Chainlink Network is a revolutionary platform that bridges the gap between blockchain technology and real-world data. Utilizing decentralized oracles allows Chainlink to enable smart contracts to interact with off-chain data, vastly enhancing their functionality. This integration is crucial for the blockchain industry, as it addresses the significant issue of data reliability faced by decentralized applications.

One of the standout features of the Chainlink platform is its ability to aggregate data from multiple sources. This approach mitigates the risks associated with relying on a single data provider, ensuring more trustworthy data delivery. The Chainlink network is not just about data aggregation; it serves as a critical infrastructure that supports secure, scalable, and interoperable financial applications across various blockchain networks. This interoperability is essential for the future growth of blockchain technology, as it enhances cross-chain communication and expands the capabilities of smart contracts.

Node operators play an essential role in the Chainlink Network by maintaining the oracle infrastructure that connects smart contracts to off-chain data and onchain service usage. The network includes a reputation system to ensure the reliable performance of its oracle nodes, further solidifying its position as a leader in the blockchain industry.

As technological advancements continue, Chainlink’s offerings, such as its interoperability with multiple blockchains, will be critical for its future growth. This continuous innovation significantly expands the scope and functionalities of smart contracts, and chainlink’s unique capabilities increases the potential for future innovations in the blockchain ecosystem. Chainlink’s unique capabilities increase the network’s value and drive increasing demand from enterprises and institutions, further supporting the ecosystem’s long-term growth and adoption.

The Strategic LINK Reserve: A Game Changer

Introducing the Chainlink Reserve is a strategic move aimed at bolstering the long-term sustainability and growth of the Chainlink Network. This reserve is designed to accumulate LINK tokens from both off-chain revenue generated by enterprises and on-chain service fees. The reserve accumulates both offchain and onchain revenue, which are converted into LINK tokens to support the network. By doing so, it creates a stable foundation for the network’s future, ensuring that it can continue to innovate and expand.

The Chainlink Reserve is expected to grow over time as the demand for Chainlink services increases. Onchain revenue and more revenue from enterprise integrations further strengthen the reserve’s growth. This strategic on-chain reserve is not just a financial buffer; it represents a commitment to the network’s sustainability and long-term vision. With the growing utilization of Chainlink services, the reserve will play a crucial role in supporting the network’s objectives.

One of the key aspects of the Chainlink Reserve is its focus on long-term growth. This is not a temporary measure but a well-thought-out strategy to ensure that the Chainlink network remains robust and resilient. The next sections will delve into how Payment Abstraction supports this reserve and the importance of accumulating LINK tokens for sustainable growth.

How Payment Abstraction Supports the Chainlink Reserve

Payment Abstraction is a groundbreaking feature that significantly enhances the efficiency and growth of the Chainlink Reserve. By convert offchain and on-chain revenue into LINK tokens, Payment Abstraction ensures that payments are smooth and seamless. This process is crucial for the sustainability of the reserve, as it transforms various forms of revenue, including offchain revenue, into a unified currency – LINK, paid offchain. Payment Abstraction is an upgrade centered on improving revenue conversion and network sustainability.

The role of Payment Abstraction goes beyond mere conversion. It supports the growth of the Chainlink Reserve by enabling enhanced revenue streams from enterprise usage. Facilitating these conversions, Payment Abstraction contributes to a steady accumulation of LINK tokens, essential for the reserve’s long-term objectives.

This innovative approach underscores the importance of integrating advanced features to support the network’s financial human co ecosystem with a new upgrade and automation.

Accumulating LINK Tokens for Long-Term Growth

The Chainlink Reserve is meticulously designed to accumulate LINK tokens over time, ensuring a stable foundation for the network’s continued growth. This strategy is not about quick gains but about gradual and sustainable expansion. The reserve is expected to grow significantly, with no anticipated withdrawals for several years.

This long-term growth strategy is pivotal for maintaining the network’s stability and resilience over multiple years. Gradually grow the reserve ensures Chainlink can support its ecosystem through various market conditions. This approach reflects a commitment to building a robust and sustainable network that can withstand the test of time.

Global Standard for Data Delivery

Chainlink has set the benchmark as the global standard for data delivery in the blockchain industry. By providing a secure, decentralized network of oracles, Chainlink ensures that smart contracts can access accurate, tamper-proof data from a wide array of off-chain sources. This capability is essential for the operation of top DeFi protocols, decentralized exchange infrastructure, and onchain finance platforms that require real-time, reliable market data.

The Chainlink platform’s reputation for security and reliability has made it the preferred choice for developers and enterprises seeking to automate complex processes and enable new financial products. Its decentralized approach eliminates single points of failure, ensuring that data delivered to smart contracts is both trustworthy and resilient against manipulation.

As the blockchain industry continues to evolve, Chainlink’s role as the global standard for data delivery becomes increasingly vital. Its infrastructure supports the growing demand for secure, scalable, and interoperable services, enabling the next generation of digital assets and decentralized applications to thrive. By maintaining this standard, Chainlink not only supports current industry needs but also paves the way for future innovations in onchain and offchain revenue models, payment abstraction, and cross-chain solutions.

Leveraging LINK for Onchain Finance

Chainlink is at the forefront of providing the infrastructure necessary for secure and scalable on-chain finance applications. Its innovations have facilitated the wider adoption of decentralized finance (DeFi) applications, ensuring that these applications have access to secure, institutional-grade data. This is crucial for the blockchain industry, as reliable data delivery is the backbone of any financial application, a mission supported by Chainlink Labs.

One of the key features of Chainlink’s services is the provision of high-frequency market data and secure on-chain data feeds. These services are essential for DeFi applications, enabling automated compliance and secure data streams that enhance next-generation DeFi applications. The growing adoption of Chainlink services in DeFi is likely to drive future price appreciation of LINK tokens, reflecting the increasing value of this infrastructure.

Moreover, Chainlink’s infrastructure supports institutional adoption by enabling seamless settlements across traditional and tokenized markets. This capability is crucial for the integration of traditional financial systems with the emerging blockchain ecosystem. Leveraging LINK for on-chain finance ensures Chainlink remains a key player in the future of decentralized finance and the broader blockchain industry.

Cross-Chain Interoperability

One of Chainlink’s most transformative contributions to the blockchain ecosystem is its robust support for cross-chain interoperability. As decentralized networks and digital assets proliferate across multiple blockchains, the need for seamless communication and value transfer between these systems has become paramount. Chainlink addresses this challenge by providing the infrastructure necessary for secure, reliable cross-chain data and asset movement.

Through its advanced oracle networks and decentralized exchange infrastructure, Chainlink enables smart contracts to interact with data and assets across different blockchains. This interoperability is crucial for capital markets institutions, DeFi protocols, and large enterprises seeking to leverage blockchain technology without being confined to a single chain. It also supports the development of next-generation applications that require access to diverse data sources and liquidity pools.

By facilitating cross-chain connectivity, Chainlink empowers developers to build more versatile and powerful decentralized applications. This capability not only enhances the utility of the Chainlink platform but also drives industry-wide adoption, as mornnovation, supporting the integration of traditional finance with onchain and offchain systems for a truly interconnected digital economy.

Key Features of Chainlink Services

Chainlink offers a suite of advanced features that make it a cornerstone of the blockchain industry. Its ability to provide secure data, cross-chain interoperability, and decentralized computing capabilities facilitates the creation of advanced on-chain applications. These features are essential for the seamless transfer of data and value across different blockchain platforms, enhancing cross-chain communication and adhering to the chainlink standard.

The secure lending and borrowing processes in decentralized finance are supported by Chainlink’s services, which include:

- An automated compliance engine that ensures digital assets remain compliant, crucial for institutional adoption.

- Infrastructure designed to ensure high reliability and accuracy, making it indispensable for financial applications.

- A decentralized network of Chainlink nodes that aggregate data, eliminating single points of failure and enhancing reliability.

Moreover, Chainlink’s infrastructure supports transparency by enabling the seamless integration of data streams necessary for maintaining asset transparency. Smart contracts can be automated through decentralized triggers, streamlining operational processes and contributing to the overall efficiency of blockchain applications. These key features underscore Chainlink’s role in advancing the blockchain industry and supporting innovative decentralized applications.

The Role of Node Operators in the Chainlink Ecosystem

Node operators are the backbone of the Chainlink Network, playing a critical role in fetching external data from APIs and delivering it to smart contracts on the blockchain. This process ensures that smart contracts have access to accurate and timely data, which is essential for their proper functioning. Node operators can customize their nodes with external adapters, expanding their ability to fetch a wider range of data types.

The flexibility of node operators in selling data to smart contracts either through standard API models or by running their own nodes to deliver signed data is a testament to Chainlink’s innovative approach. This flexibility enhances the network’s ability to provide diverse and reliable data sources. The accuracy and timeliness of data delivery by node operators are crucial for maintaining the integrity of the Chainlink Network.

The role of node operators extends beyond data delivery. They are integral to the network’s overall performance and reliability. Ensuring accurate and timely data is fetched and delivered contributes to the stability and trustworthiness of the Chainlink ecosystem. This essential role underscores the importance of incentivizing and supporting node operators within the Chainlink Network.

Chainlink Economics: Ensuring Sustainability

The sustainability of the Chainlink Network is underpinned by its robust economic model, which focuses on user fee growth and operating cost reductions. The Chainlink Reserve, having accumulated over $1 million worth of LINK from its early stage launch phase, plays a pivotal role in this economic model. This reserve is expected to grow over time, providing a stable financial foundation for the network.

The payment structures on the Chainlink platform are designed to evolve based on the architecture and user needs. This flexibility ensures that the network can adapt to changing market conditions and user requirements. The strategic onchain reserve of LINK tokens supports the network’s long-term sustainability by creating a financial buffer that can be utilized to support various initiatives.

As the demand for Chainlink services grows, so does the potential for increased user fees. This growth in user fees, coupled with cost reductions, ensures that the Chainlink Network remains financially sustainable. The Chainlink Reserve is a testament to the network’s commitment to long-term growth and stability, ensuring that it can continue to innovate and expand.

Real-World Applications and Partnerships

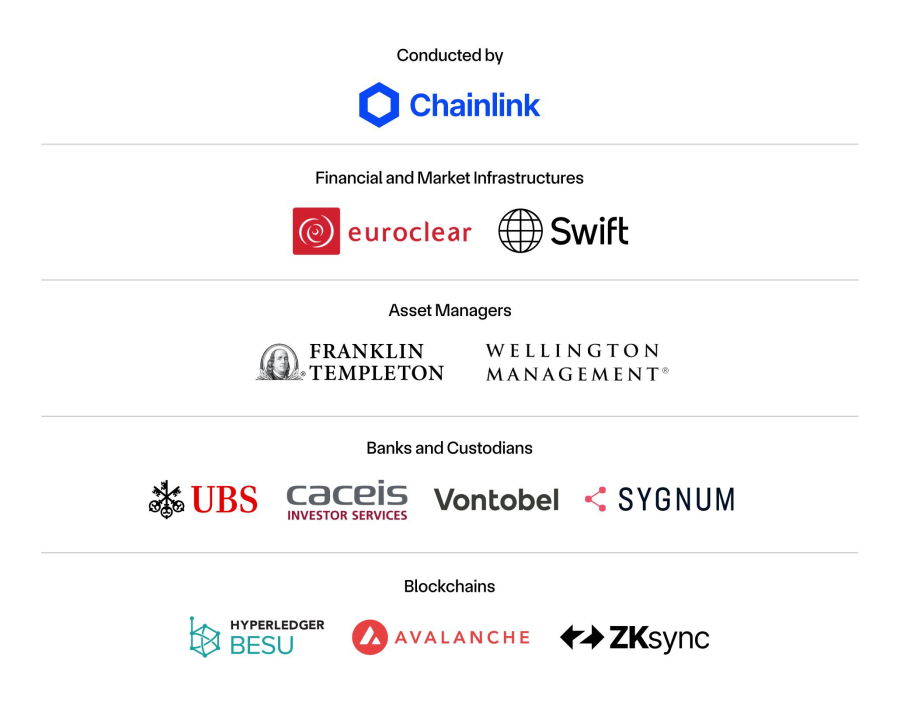

Chainlink’s platform has been instrumental in enabling transactions valued in tens of trillions across tokenized assets and DeFi markets. Capital markets institutions can utilize Chainlink to automate the delivery of essential financial data in a compliant manner, ensuring that they meet regulatory requirements. This capability is crucial for the integration of traditional financial systems with the emerging blockchain ecosystem.

Key partnerships with large enterprises such as Mastercard and J.P. Morgan illustrate the significant real-world applications of Chainlink. For instance, Mastercard and Chainlink have collaborated to enable nearly 3 billion cardholders to purchase cryptocurrency on-chain. J.P. Morgan’s Kinexys project, powered by Chainlink, demonstrates a scalable method for cross-chain, atomic settlement of tokenized assets.

These partnerships not only enhance Chainlink’s market presence but also drive service demand. The pilot project involving Swift, UBS Asset Management, and Chainlink demonstrated the potential to bridge tokenized assets with existing payment systems. As the industry grows, these strategic partnerships will play a crucial role in Chainlink’s continued success and adoption.

Future Prospects for LINK Crypto

The future prospects for LINK tokens are promising, with experts forecasting significant price appreciation in bullish market conditions. If the overall cryptocurrency market cap reaches $10 trillion, LINK could potentially rise to $97.97. However, in a bearish market, LINK might struggle, with price predictions dropping to about $14.89 under a $3 trillion market cap.

Despite market fluctuations, the revenue model for Chainlink is expected to grow as industry demand increases. Experts predict that by the end of 2025, LINK’s price could range from $30.69 to $38.26, with a potential high of over $200 by 2030. This growth is driven by the increasing adoption of Chainlink services and the strategic accumulation of LINK tokens in the Chainlink Reserve.

The Chainlink ecosystem’s continuous innovation and the establishment of strategic reserves ensure that LINK remains a valuable asset in the blockchain industry. As we look towards the future, the potential for LINK to achieve new heights is evident, making it an exciting prospect for investors and stakeholders alike.

Summary

In summary, Chainlink’s innovative approach, particularly the Strategic LINK Reserve, positions it as a leader in the blockchain industry. The use of LINK tokens, the robust Chainlink Network, and the strategic accumulation of reserves ensure long-term sustainability and growth. As we witness the continuous adoption of decentralized finance and the integration of traditional financial systems with blockchain technology, Chainlink’s role becomes increasingly vital. Let us embrace the potential of Chainlink and its transformative impact on the future of finance and technology.

Frequently Asked Questions

How much LINK has the Chainlink Reserve accumulated so far?

The Chainlink Reserve has accumulated over $1 million worth of LINK during its early stage launch phase.

What is the expected growth trend for the Chainlink Reserve?

The Chainlink Reserve is anticipated to grow steadily as revenue is increasingly converted into LINK and added to the Reserve, with no withdrawals projected for several years.

What is the role of Payment Abstraction in Chainlink services?

Payment Abstraction enables users to pay for Chainlink services using their preferred payment methods, which are then automatically converted to LINK tokens. This enhances flexibility and convenience for users in utilizing Chainlink services.

What is the purpose of the analytics dashboard created for the Chainlink Reserve?

The analytics dashboard serves to enhance community visibility into the Chainlink Reserve, ensuring stakeholders have access to important information. This transparency is essential for informed decision-making and trust within the community.

What is the main goal of the Chainlink Reserve?

The main goal of the Chainlink Reserve is to establish a sustainable oracle economy through the expansion of Payment Abstraction, which aims to enhance the strategic on-chain reserve of LINK by diversifying revenue sources.